NextEra Energy (NEE -1.36%) is not a cheap stock, sporting a price-to-earnings ratio of 37. That's a figure you'd expect from a technology start-up, not a utility. However, if you are looking for a utility with a fast-rising dividend, this company is probably among the best options around. Here's why dividend growth investors will definitely like the NextEra story.

A brief overview

NextEra is really two businesses in one. It operates one of the largest regulated utilities in the U.S. via its Florida Power & Light division, which has long benefited from in-migration to the Sunshine State. And it operates NextEra Energy Resources, which is the world's largest producer of wind and solar power.

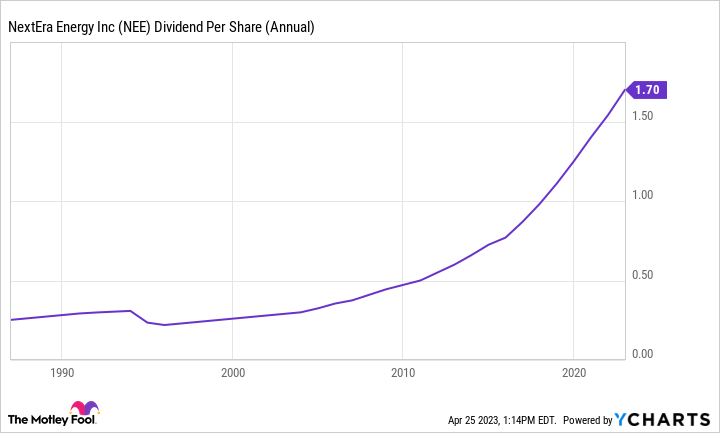

NEE Dividend Per Share (Annual) data by YCharts

The regulated utility is a solid and slow-growing foundation, and the renewable power business offers rapid growth. It is a fairly strong pairing that has rewarded dividend investors very well over time. The dividend has been increased annually for 29 consecutive years.

Rapid increases

It isn't just the length of the dividend streak that's so impressive. Indeed, there are utility stocks with even longer streaks. What sets NextEra apart is the magnitude of the increases. Over the past decade, the average annual increase was just shy of 11%. Now, every single year isn't that high, as the chart below shows, but 10%+ annual increases are very high for the utility sector, an area normally associated with slow and steady business growth.

NEE Dividend Per Share (Annual) data by YCharts

More to come

As all investors know, the past isn't a predictor of future performance. But NextEra's management has been very clear about its expectations for the future. And the big story is continued growth. While the regulated side of the business is likely to see slow and steady expansion, the clean energy business is going to grow at an impressive clip over the next few years.

As the table below shows, between 2023 and 2026 NextEra expects to develop between 32.7 gigawatts and 41.8 gigawatts of clean energy production. Today it has roughly 30 gigawatts of production. In other words, by 2026 NextEra Energy hopes to double the capacity in its NextEra Energy Resources business.

| Production (in megawatts) |

2023-2024 Expectations |

2025-2026 Expectations |

2023-2026 Expectations |

|---|---|---|---|

|

Wind |

4,000-4,800 |

8,000-9,800 |

12,000-14,600 |

|

Solar |

5,500-6,600 |

9,400-12,400 |

14,900-19,000 |

|

Energy storage |

2,500-2,800 |

2,600-4,000 |

5,100-6,800 |

|

Wind repowering |

100-400 |

600-1,000 |

700-1,400 |

|

Total |

12,100-14,600 |

20,600-27,200 |

32,700-41,800 |

Data source: NextEra Energy.

Given the history of success here, there's no reason to believe the company will miss this goal in any material fashion.

Earnings and dividend growth ahead

The rapid expansion of NextEra's clean energy business is going to be the driving force behind solid earnings and impressive dividend growth. At this point, management is calling for earnings to increase at a compound annual rate of between 6% and 8% through 2026 (see the table below). That is expected to support projected dividend growth of 10% at least through 2024.

|

Actual EPS |

Estimated EPS Guidance |

||||

|---|---|---|---|---|---|

|

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

|

$2.55 |

$2.90 |

$2.98-$3.13 |

$3.23-$3.43 |

$3.45-$3.70 |

$3.63-$4.00 |

Data source: NextEra Energy.

And, given the fairly consistent dividend growth over the past decade, it seems highly likely that rapid dividend growth will be the norm even after 2024 if the company hits the capacity projections highlighted above.

Premium priced

All of that said, investors are well aware of NextEra Energy's history of success. That's why the P/E ratio is so high. Investors are paying up for dividend growth here -- the dividend yield is a less than inspiring 2.3%. However, if you have a dividend growth portfolio and you'd like to add some diversification to the mix via a utility stock, NextEra Energy might be just what you are looking for.