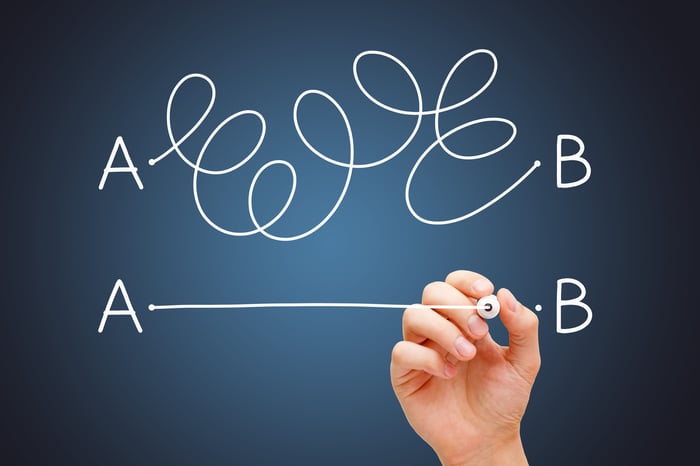

Investing is as simple as buying low and selling high -- but in reality, that's easier said than done. But to disregard valuation when buying a stock would be a big mistake. That's why so many investors use the price-to-earnings ratio as a valuation tool.

That's a good start, but it shouldn't be the only tool in your valuation toolkit. An excellent addition to the P/E ratio is the price-to-sales ratio. Here's why.

A logical choice

Investors are always watching earnings per share, which makes sense. As a stockholder, you are part owner of the company, so earnings per share is, technically speaking, your share of the profits. It is totally logical to ask how much you are paying per unit of earnings. That is basically what the price-to-earnings ratio tells you.

Image source: Getty Images.

Just to lay it out completely, you get P/E by dividing the price of the stock by the earnings per share. Higher numbers indicate that investors are paying more per unit of earnings. In other words, the higher the P/E, the richer the valuation. Most investors will prefer lower P/E ratios, as they indicate that a stock is trading relatively cheaply.

However, there are a few problems with P/E that investors need to wrap their heads around. First, what earnings figure do you use? There are generally accepted accounting principle (GAAP) earnings. Then there's basic versus diluted earnings, the latter of which assumes that any security that could be converted into shares is converted into shares. Another option is company-favorite adjusted earnings, which takes out items that management deems one-time in nature -- even though some companies seem to have "non-recurring" items on a highly regular basis. Which earnings figure you pick can materially change the math on the P/E.

Then there's another subtle problem: Earnings tend to be one of the more volatile company statistics. It isn't at all uncommon for a company to go through a brief rough patch, which could lead to a massive decline in earnings. Or, conversely, some companies experience brief demand spikes that are unlikely to last, resulting in a short-term boost to earnings. Both turn P/E into a less valuable valuation tool.

An addition to consider

That's where sales come in. Sales represent the so-called top line of the income statement (earnings are the bottom line) and tend to be fairly consistent over time. Part of the reason for this is that sales aren't impacted by all the operating costs that come out before earnings. Basically, sales are relatively pure and empirical since they aren't easily manipulated or engineered by other factors in the business.

A good example of the issue is Procter & Gamble (PG -0.38%). This consumer staples company sells a lot of low-cost items that consumers need and use on a daily basis. Its brands, which include names like Bounty, Crest, and Tide, tend to have loyal followings. Generally speaking, the company has pretty good pricing power. And, like every other company, it has gone through difficult periods where costs rose and earnings fell even though sales remained fairly strong. Examine the graphic below and you'll see the odd period where the P/E ratio spiked.

PG PS Ratio data by YCharts.

The stable line near the bottom of the above chart (colored purple) is the price-to-sales ratio. The math on that is to divide the stock price by the company's sales per share. While P&G's earnings went a little haywire for a few quarters, sales remained fairly consistent. And, thus, the P/S ratio provided a far more accurate view of the company's valuation. This isn't unique to P&G. Take a look at the graph below for Coca-Cola (KO 0.40%).

KO PS Ratio data by YCharts.

This consumer staples icon has a lot of similarities to P&G, including that odd spike in the P/E ratio that would have presented a distorted view of the drink maker's valuation. While you could dig into what was going on with P&G and Coca-Cola during those P/E spikes, it almost doesn't matter. Using P/E simply wasn't helpful.

This isn't meant to suggest that P/E is a useless measure. That's not true, at least not most of the time. However, there are situations when that metric needs to be taken with a grain of salt. Adding the P/S ratio to the mix can help you sort through those odd times when the P/E ratio makes little sense. (Note that a company that is losing money will have a meaningless P/E ratio, which would make P/S a highly useful alternative in such circumstances.)

One more tool

If you are like most investors, you want to make sure you don't overpay for a stock. Indeed, to paraphrase Benjamin Graham, the man who taught the likes of Warren Buffett, even a great company can be a bad investment if you pay too much for it. But you really shouldn't use P/E as your only valuation tool. It has notable flaws and sometimes provides spurious information. That's why you need to add price-to-sales into your valuation toolkit. When P/E is letting you down, the P/S ratio can help guide the way.