Undoubtedly, artificial intelligence (AI) is the hot topic of 2023. Indeed, according to FactSet, the number of S&P 500 companies that mentioned AI in their first-quarter earnings calls hit an all-time high of 110, compared to 61 a year ago.

But with so many companies eager to talk about AI, which ones actually have the most potential to profit from it? Let's dig into three stocks well positioned to benefit from AI for years to come: Advanced Micro Devices (AMD 2.37%), Duolingo (DUOL 3.64%), and Tesla (TSLA -1.11%).

Image source: Getty Images.

Advanced Micro Devices

While fellow chipmaker Nvidia clearly stole the AI limelight in 2023, AMD shouldn't be overlooked. The company boasts diverse business segments that supply semiconductors for data centers, gaming consoles, personal computers, and automakers, among others.

What's more, AMD's new MI300X chip, which will begin delivery in the fall, gives the company a solid foothold in the battle for AI chip dominance. Nvidia has long been seen as the top dog in AI chips. However, with Nvidia's top H100 chip often costing over $40,000, there's an opportunity for AMD to compete in this lucrative business.

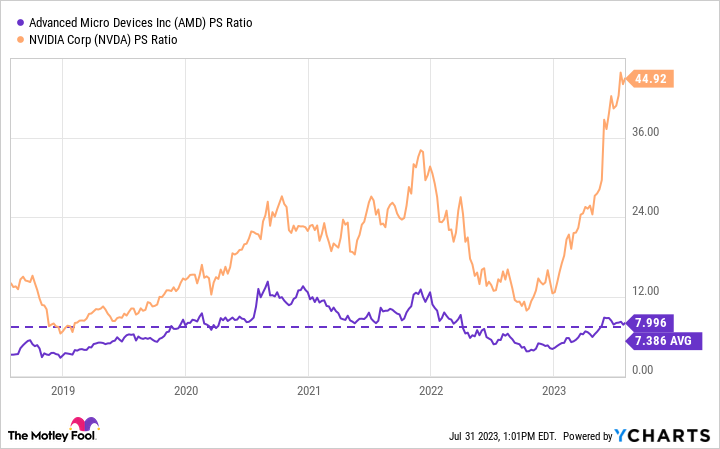

In addition, AMD's stock remains attractively priced. It trades at a price-to-sales (P/S) multiple of 8 -- only slightly above its five-year ratio of 7. Contrast that with Nvidia, which now sells at an astronomical PS ratio of 45.

AMD PS Ratio data by YCharts

Duolingo

If you've never heard of Duolingo, you're not alone. However, if you're a growth-oriented investor, it's a name you should know. In a nutshell, Duolingo runs a language-learning app that helps people learn a foreign language. The company uses a gaming-style app designed to keep the teaching fun, interactive, and addictive.

Duolingo was an early adopter of AI technology. For years it worked with OpenAI, the company behind ChatGPT. Duolingo relies on AI to write its course content, personalize its course structure, and score its language assessment exams.

Indeed, Duolingo was built from the ground up using AI. And in that way, it might be a glimpse of the future. AI is likely to revolutionize how companies operate, as AI is cheaper and more efficient than human workers -- sorry, fellow humans.

That said, Duolingo isn't for every investor. This is a mid-cap stock with a market cap of around $6 billion. However, for those looking for an under-the-radar AI stock that could hit the big time -- consider Duolingo.

Tesla

Let's face it: Tesla is an electric vehicle (EV) company. The company's massive success -- its market cap has grown from $32 billion to $850 billion in less than five years -- is built on the ability to produce and sell EVs.

However, the EV market is changing. Competition is increasing; prices are falling. As a result, Tesla's margins have decreased. So for its next act, Tesla must give the public something new and exciting. And that something is AI-powered full self driving.

In a nutshell, if Tesla can be the first to develop full self driving, it would mark the second time the company would have revolutionized vehicle transportation. It took decades before Tesla could mass produce EVs and sell them for a profit. Similarly, self-driving vehicles have been long in the making, but the only place to see them in action has been in science fiction movies.

If Tesla can master the technology, it will change everything about how people and materials get from place to place -- and it would provide Tesla with a mouth-watering asset ready to license to rival automakers.

Moreover, it would make Tesla a colossal player in the AI field. Full self driving requires vast computing power and dynamic calculations to get a vehicle safely from point A to point B. If Tesla can figure it out, it will be thanks to numerous AI-led innovations -- innovations that could send Tesla stock soaring in a parabolic fashion.