Wall Street is a wacky place. Just a few months ago, analysts were telling us to batten down the hatches for a recession. Now, all anyone wants to talk about is artificial intelligence (AI) and how we could avoid recession altogether. I have my doubts about the latter, but luckily, companies like CrowdStrike (CRWD 2.03%) were AI juggernauts before it was cool, have secular growth paths, and are recession-resistant.

That doesn't mean the stock can't fall if the market retreats, of course. However, it does mean that CrowdStrike has several characteristics of a company that could outperform the market for years.

CrowdStrike stock has gained nearly 40% year to date (YTD), yet it is still 50% off its all-time high. Shown below, it trades near its lowest price-to-sales (P/S) ratio ever despite being a much stronger company now than at any point in its history. The rapid rise in revenue is just one indicator of its strength.

CRWD PS Ratio data by YCharts. PS Ratio = price-to-sales ratio. TTM = trailing 12 months.

What does CrowdStrike do?

CrowdStrike offers a host of security solutions on its AI-powered Falcone security cloud, including threat intelligence, security ops, and cloud security. But the company's bread and butter is endpoint security.

Endpoints are anything that connects to a computer network, like laptops, desktops, phones, and Internet-of-Things devices. The more things that connect to the internet, the higher the demand for endpoint security; for example, the evolution of work-from-anywhere and connected devices.

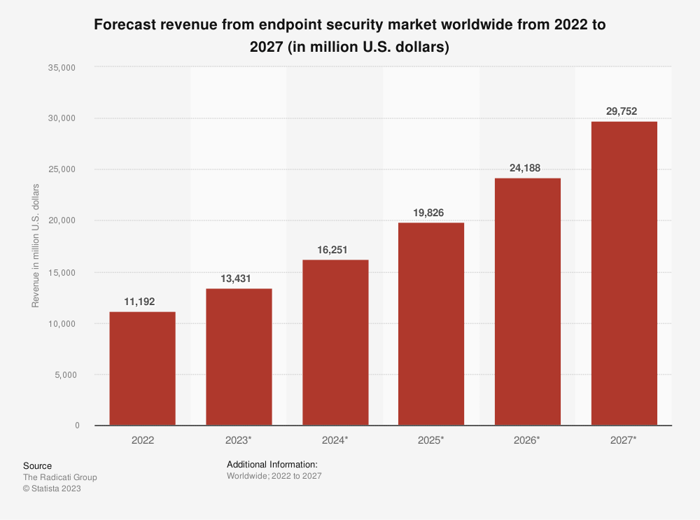

The technology is incredible, but there is a problem. IBM reports that 90% of successful cyber attacks and 70% of breaches exploit endpoints. This is why Statista estimates that the market for endpoint security alone will more than double from $13 billion this year to nearly $30 billion in 2027, as depicted below.

Source: Statista.

This puts CrowdStrike in an enviable position as the global modern endpoint security market leader at 17.7% (compared to Microsoft's 16.4% share), according to a recent IDC report. The software has won numerous rewards and has IL5 security clearance, which allows it to protect assets for the U.S. Department of Defense. All of this points to a continued steep growth path for CrowdStrike.

Is CrowdStrike a good stock to buy?

CrowdStrike is an all-around growth story. Its customer count, revenue, cash flow, and the security marketplace are all moving up and to the right on the graph. We have already seen the market expansion in the chart above, so let's talk about the rest.

CrowdStrike's annual recurring revenue reached $2.7 billion on 42% year-over-year growth last quarter. This increase in the face of businesses curbing technology spending shows the recession resistance of the cybersecurity industry. Cybersecurity is not a luxury; it's a necessity. With revenue growth comes cash flow, and CrowdStrike produced $677 million in fiscal 2023 (up from $442 million a year earlier) and $227 million in the first quarter of fiscal 2024 on 44% year-over-year growth.

As a result, CrowdStrike has amassed a war chest of $3 billion in cash and investments versus just $740 million in long-term debt. This means the company has the resources to continue investing in expansion.

Those are terrific results, but the metric I follow closest is the growth in CrowdStrike's subscription customers. Why? Because once customers sign up, they do two things:

- They don't leave. CrowdStrike has retained more than 97% of its customers each quarter since 2019.

- They spend more over time. The dollar-based net retention rate (a measurement of how much customers increase spending from a year earlier) for CrowdStrike has been over 120%, also since 2019.

As shown below, CrowdStrike's customer acquisition is prolific as it surpassed 23,000 in fiscal 2023 and directly correlates to rising revenue.

Data source: CrowdStrike. Chart by author.

Since CrowdStrike is a pure growth stock, it isn't profitable yet, so it is most appropriate for long-term investors with at least moderate risk tolerance. That said, the company's operating leverage has vastly improved in recent periods, pointing to profitability at scale.

CrowdStrike stock has made huge gains this year, but the growth story is just getting started. Cybersecurity is a terrific area to invest in, and CrowdStrike is one of the most exciting companies leveraging AI in the industry.