To say that artificial intelligence (AI) has dominated stock and technology talk would be a huge understatement. After the immediate success of OpenAI's ChatGPT in November 2022, AI went mainstream and was quickly crowned as the Next Big Thing.

On the heels of the AI hype, many AI-focused companies and companies dealing with AI in any capacity saw investors flock to their stock, skyrocketing values in a matter of months. One company that's been a huge beneficiary of this has been C3.ai (AI 3.02%), which is up roughly 150% year to date.

Rallies like we've seen with C3.ai usually come with skepticism as potential investors worry about having missed the train and invest at an inopportune time (like right before a huge price drop). While that's a fair thought, let's dive into whether it's truly too late to buy high-flying C3.ai stock.

Slowing growth is a slight cause for concern

Many growth stocks sacrifice profits early on to focus on growth, and C3.ai is no different. However, as an investor you always want to be confident that a company has a clear path to profitability. That's beginning to become a concern for C3.ai.

Image source: Getty Images.

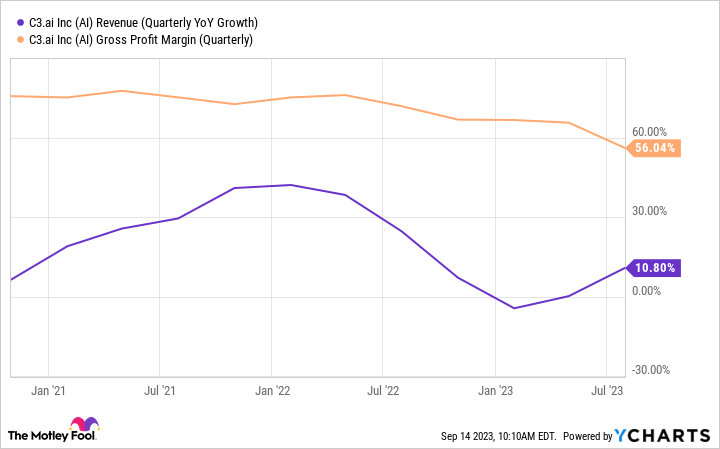

In its Q1 fiscal year (FY) 2024, C3.ai made $72.4 million in revenue, up 11% year over year (YoY). Its net income also increased close to 11% YoY, but it lost over $64 million. It's also worth noting that C3.ai's FY23 revenue was down, so the current YoY increases could be a bit misleading.

Maybe more concerning than the revenue and net income is the company's sharp drop in gross profit margins, from 72% to 56%.

AI Revenue (Quarterly YoY Growth) data by YCharts

The falling margins could be attributed to the company focusing on building out its generative AI ecosystem -- which isn't a bad long-term move -- but it's assuming that the current hype is, in fact, not hype and can sustain the company's growth.

C3.ai also switched to a usage-based billing model instead of a subscription model, so we'll have to see how that affects the company's margins going forward.

Investors should approach investing in C3.ai cautiously

To answer the main question regarding if it's too late to buy C3.ai's stock, it comes down to your time horizon. In the short term, the stock seems overvalued compared to its foreseeable growth chances.

C3.ai is currently valued at around $3.3 billion, which is more than 10 times the $295 million to $320 million in revenue it's projected to make in FY2024. A company's enterprise value-to-revenue ratio alone doesn't tell the whole story, but C3.ai's is high for a company only expected to grow revenue by 11% to 20%. I would avoid the stock if time isn't on your side.

For long-term investors with long time horizons who can stomach the inevitable volatility that'll come with investing in C3.ai, it's not too late to invest. However, investing a lump sum at once isn't recommended. The better approach would be to determine how much you want to invest in the company and then dollar-cost average your way into a stake over time.

The company has some hiccups it has to work through, but it's not time to completely write it off. Just increase caution.