Warren Buffett has proved long-term investing works. He's stayed with companies he believes in during market ups and downs, and as a result, as chairman of Berkshire Hathaway, he's delivered a compounded annual gain of more than 19% over the past 57 years. That's compared to a 9.9% increase for the S&P 500. What does "long term" mean? Holding onto a stock for at least five years. But in Buffett's case, he's held onto many for decades, and I wouldn't be surprised if he kept certain favorites forever. (Here, I'm thinking top Buffett stock, Coca-Cola (KO -0.52%).)

Considering Buffett's success over time, it's no surprise investors look to follow his lead. This doesn't mean you have to buy every stock he owns -- after all, it's important to personalize your portfolio according to your investment strategy, knowledge, and comfort with risk. But a few Buffett favorites could make valuable additions to any portfolio. Here are two you could buy and hold forever.

1. Coca-Cola

"Always Coca-Cola" isn't just one of the company's former slogans. It also may describe Buffett's feelings about the world's biggest non-alcoholic beverage maker. The billionaire investor started buying the shares back in the late 1980s and has held on ever since.

And for good reason. Coca-Cola is a top dividend stock, having increased its payments for more than 50 consecutive years -- that puts it on the elite list of Dividend Kings. This sort of track record shows rewarding shareholders is important to the company, offering us evidence Coca-Cola probably will continue boosting dividends into the future. The beverage maker pays an annual dividend of $1.84 per share, at a yield of 3.35%, topping the S&P 500's yield of 1.5%.

Passive income is great because it means you'll benefit from owning Coca-Cola stock even if the market declines and even if Coca-Cola shares slip at one point or another.

This beverage giant also makes a strong buy for its earnings track record, and Coca-Cola's brand and distribution network represent a moat -- or advantages that should keep it ahead of rivals well into the future.

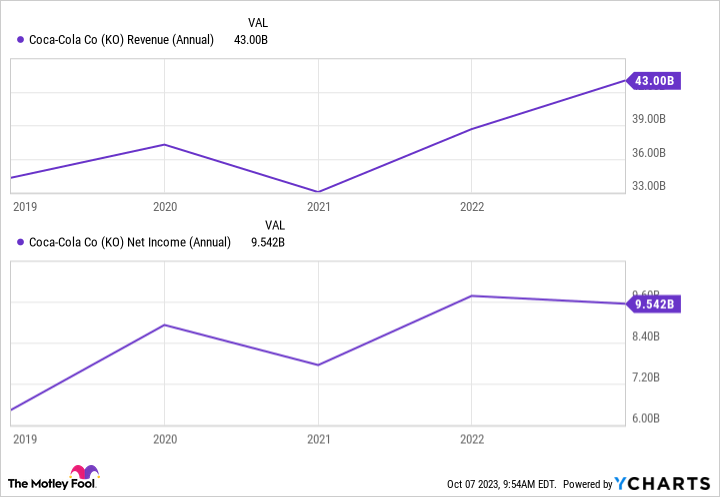

KO Revenue (Annual) data by YCharts

The most recent earnings report showed that, even in a tough economic environment, people still opt for Coca-Cola's eponymous drink and its other famous brands like Dasani water and Minute Maid juices. Coca-Cola reported increases in net revenue and earnings per share in the quarter.

Trading for only 20 times forward earnings estimates, Coca-Cola looks like an absolute steal, making now an excellent time to get in on this forever stock.

2. Amazon

Amazon (AMZN -0.96%) is a leader in two markets that are growing in the double digits this decade: e-commerce and cloud computing. Over the past several years, this leadership has helped the company grow earnings and its share price. In fact, Amazon's stock climbed so high that it completed a stock split last year to lower the price of each individual share -- and make it more accessible to a wide range of investors.

Of course, rising inflation has represented a headwind for the e-commerce business and cloud computing unit Amazon Web Services (AWS). But the good news is Amazon made lemonade out of the lemons: The company used the opportunity to improve its cost structure, a move that already is helping it out of the difficult times.

In the most recent quarter, Amazon reported gains in net sales and operating income -- and free cash flow shifted to an inflow from an outflow. The company also noted that AWS clients are beginning to deploy new projects again, a good sign for AWS sales moving forward. This is key because AWS generally has driven Amazon's profit.

Amazon's recovery efforts also should help the company excel in the future. For instance, the e-commerce giant has shifted to a regional from a national fulfillment model, which will result in shorter transport routes. This lowers Amazon's costs and speeds up delivery to customers. So, it's a win for the company and a win for shoppers.

Today, Amazon shares trade for about 58 times forward earnings estimates, which seems reasonable considering the company's leadership and prospects in two high-growth markets. And that's why, once you buy this Buffett stock, you may never want to sell it.