Most investors dream of big returns: Doubling, tripling, even quadrupling their money. But actually pulling off such a feat isn't so easy.

However, let's examine a case where a simple $1,000 investment -- held until today -- would have blown the doors off even a four-fold return. It's the case of investing in The Trade Desk (TTD 1.67%) stock one month after its IPO in 2016.

Image source: Getty Images.

The digital ad market has exploded in size

First things first: The rapid growth of the digital ad market is an enormous factor in The Trade Desk's success as a public company. Consider this: It's estimated that the digital ad market has almost tripled from $243 billion in 2017 to $680 billion today. What's more, it's projected to grow to nearly $910 billion by 2027.

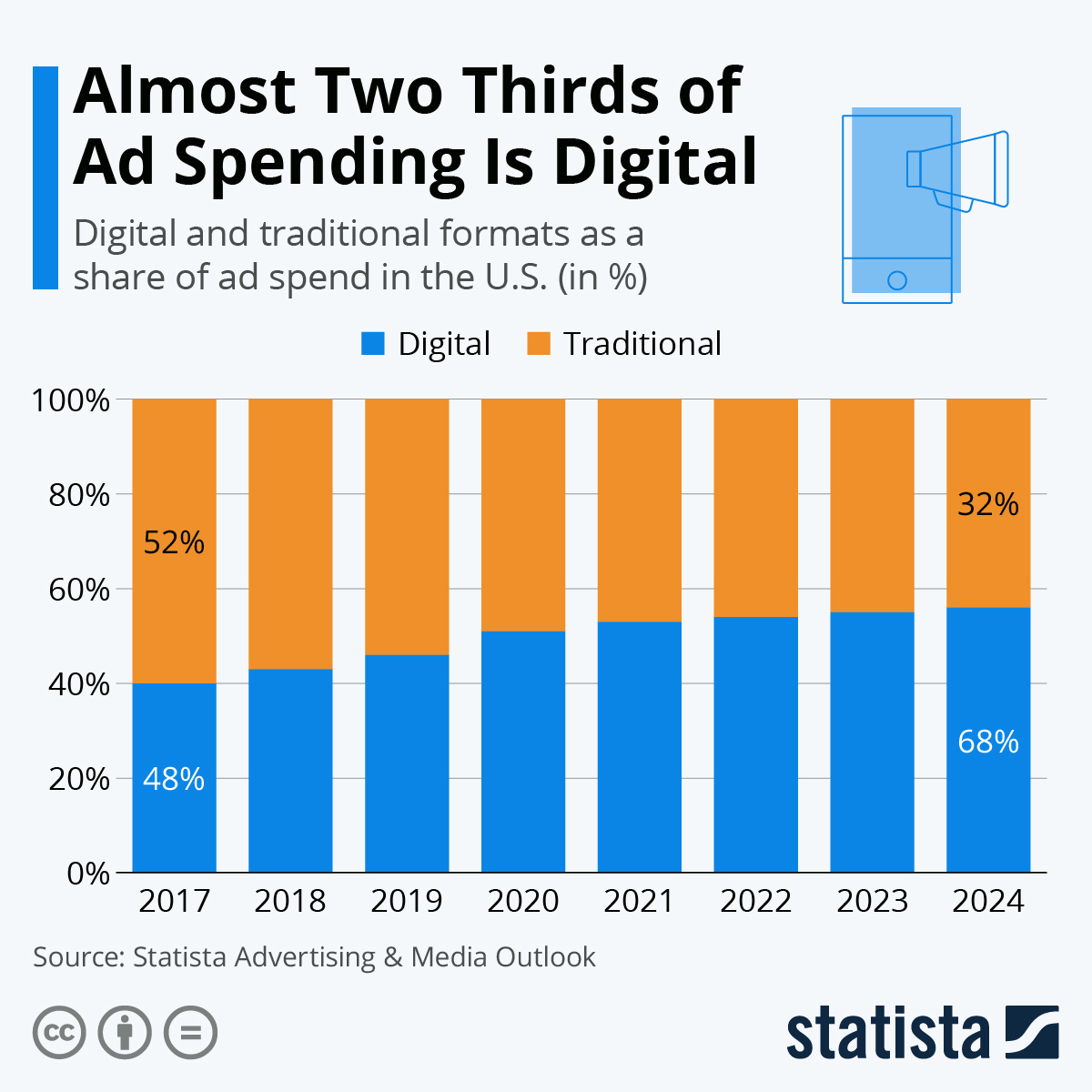

That's because advertisers have shifted away from traditional ad formats at a staggering rate. In the U.S. alone, estimates are that close to two-thirds of advertising is now digital, versus roughly half just six years ago.

You will find more infographics at Statista

At any rate, with so many digital ad dollars chasing potential customers, it's never been more critical for companies to get their money's worth. That's why The Trade Desk, which helps automate ad campaigns through programmatic advertising, has flourished.

The company's use of data-driven insights helps optimize its clients' ad campaigns through:

- Real-time bidding on ad auctions

- Audience targeting of interest groups or specific users that have visited a website

- Data analysis of ad performance

In short, The Trade Desk helps its customers increase their advertising return on investment (ROI).

A $1,000 investment in The Trade Desk in 2016 would now be worth over $23,000

Given the growth of the digital ad market, it's no surprise that The Trade Desk's stock has been a real winner. Perhaps its most stunning measure of success is its incredible revenue growth. Trailing 12-month revenue has skyrocketed from $173 million in 2016 to over $1.8 billion today. That translates to a staggering 43% average for quarterly revenue growth since 2016.

As a result, shares have surged. A $1,000 investment made in October 2016 would now be worth $23,290. A $25,000 investment would be worth almost $582,000. That's a 2,230% return, or a nearly 56% annualized return.

TTD Total Return Level data by YCharts

Compare that with the S&P 500, which has grown by 136% over the same period, meaning a $1,000 investment would have grown to $2,361.

Is The Trade Desk still a buy now?

So, is The Trade Desk still a buy today? From a valuation perspective, shares trade at a price-to-sales (P/S) ratio of 19x. While very high in absolute terms, that remains below the company's lifetime average of 21x.

Granted, hyper-growth stocks like The Trade Desk are not for every investor -- particularly those who are value-oriented. However, for investors willing to ride out the volatility that comes with owning this stock, The Trade Desk remains a company growing like a weed in a sector that will continue expanding for many years to come.