DraftKings (DKNG 4.96%) has been one of the hottest growth stocks to own this year. The sports betting industry is expanding, and DraftKings has already become a big name in the business. With the stock having already tripled in value this year, though, investors may be concerned that it has become too expensive. After all, it's trading at over 20 times its book value.

But the company isn't running out of growth opportunities anytime soon, not by a long shot. Here are four charts that help to demonstrate why this fast-growing stock still looks like a good buy.

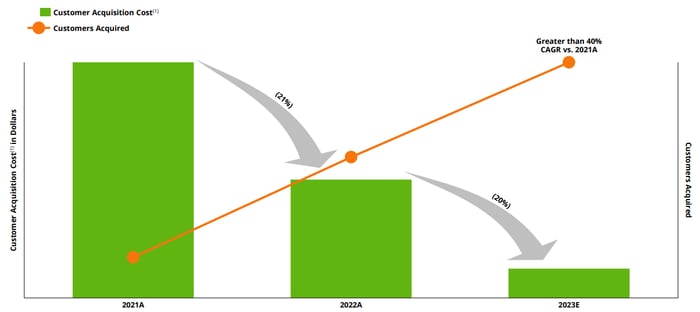

1. Customer acquisition costs are decreasing

DraftKings is experiencing significant growth as more states legalize sports betting, resulting in more people using the platform. What's encouraging for the business is that not only is DraftKings growing at a fast rate, but its customer acquisition costs are also falling sharply. This year the company projects they will decline by 20%, building off an already-strong 21% decline a year ago.

Image source: DraftKings Investor Day presentation.

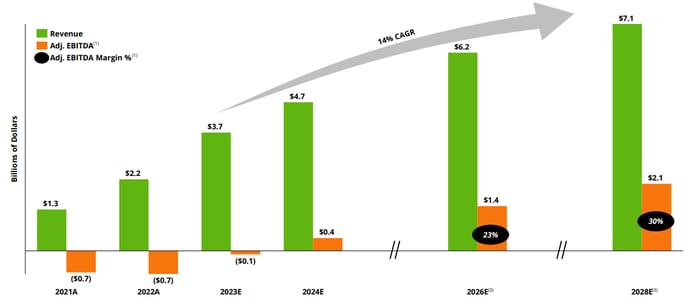

2. The bottom line will continue to improve

It is not surprising that as the company's customer-related costs benefit from economies of scale, DraftKings expects its earnings numbers to also look a whole lot better. The company still projects a loss based on adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) this year, but as early as next year that trend will change.

As the business grows, the company anticipates that both its bottom and top lines will improve. Although adjusted EBITDA is not the same as net income, it's a positive sign that the company's financials are moving in the right direction.

Image source: DraftKings Investor Day presentation.

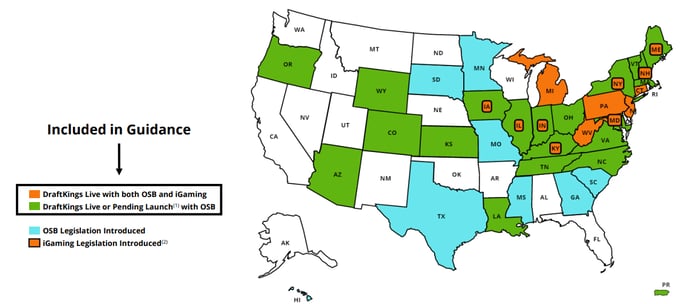

3. More states could legalize betting soon

A strong bull case for DraftKings can be made simply by looking at the following map, which shows how many states still haven't legalized online sports betting (OSB) and iGaming (online casino).

Image source: DraftKings Investor Day presentation.

DraftKings has also been fairly conservative with respect to its guidance, only including states where operations are live. That's a good sign that the business isn't putting too much optimism into its projections. And as more states legalize online sports betting and gambling, that means more guidance raises to come for DraftKings. It also means more customers.

4. It has seen a significant uptick in customers

The number of unique customers using DraftKings' platform has more than tripled since the start of 2020. As more states enact sports betting and online gambling legislation, these figures could climb even faster.

Image source: DraftKings Investor Day presentation.

Revenue growth has also coincided with a sharp increase in customer count. From 2019 through to 2022, DraftKings' revenue has jumped from just $323 million to more than $2.2 billion. And this year it projects its top line to hit $3.7 billion. For 2024, DraftKings is expecting sales to reach between $4.5 billion and $4.8 billion.

It isn't too late to buy DraftKings stock

The online gaming and sports betting industry is in its early growth stages, but DraftKings has already established itself as a top name. This year it has been a red-hot buy, with its shares up more than 220%. While that might have some investors thinking that the stock may be out of room to rise higher, the charts above should paint a different picture.

With more growth opportunities still out there and the company's bottom line improving as well, there could still be a lot more bullishness driving the growth stock higher in the years ahead.