The last few years have been a miserable time to own AT&T (T 1.02%) stock. Thanks largely to its dividend income, AT&T investors earned a total return of just 13% over the last five years, a span when the S&P 500 drove total gains of nearly 110%. Additionally, the company faces considerable financial challenges because it has to spend heavily to remain competitive with Verizon Communications and T-Mobile.

Nonetheless, AT&T has reached a point where it has become too compelling to ignore, and one factor likely makes it a buy regardless of the apparent trials that might otherwise derail the stock.

The one reason to buy

The reason to buy AT&T stock is its compelling valuation. The stock currently sells at a P/E ratio of 7. This is a small fraction of the S&P 500's average P/E ratio of 26. Since numerous technology stocks experienced multiple significant expansions amid the AI-driven boom, such valuations are uncommonly low in today's tech industry.

On the surface, AT&T's dividend may bolster the appeal of the low valuation. Its $1.11 per share annual payout now offers a dividend yield of 6.7%. This is around 4.5 times the S&P 500's average dividend return, which has now fallen below 1.5%.

Still, investors should approach this dividend cautiously. AT&T slashed the payout in early 2022 after 35 straight years of payout hikes. And considering its $138 billion total debt, the dividend could fall victim to further cuts as the company looks for ways to reduce that obligation.

AT&T stock may not be cheap for a reason

However, even if such a dividend cut leads to selling in the short term, investors need to remember that AT&T is one of only three 5G providers in the U.S. Since the company spent around $17.5 billion in capital expenditures over the previous 12 months, AT&T's network should remain competitive from a quality standpoint.

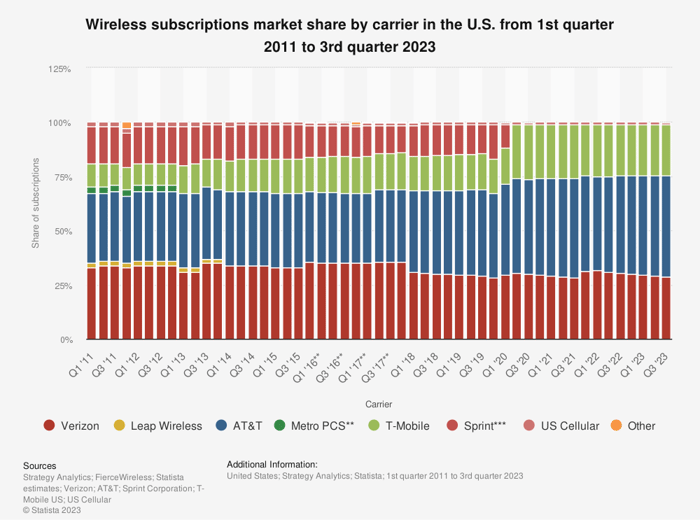

Indeed, AT&T is adding customers. In the third quarter of 2023, the company reported 468,000 postpaid phone net additions and a "historically low" churn rate, indicating it largely holds on to current customers. This has left AT&T with a 47% market share, the largest in its industry, and a gain of 2 percentage points over the last year.

Image source: Strategy Analytics, FierceWireless, Statista Estimates, AT&T, Verizon, T-Mobile, Sprint, and US Cellular.

Moreover, consumer broadband revenue rose 10% yearly while AT&T fiber grew revenue by 27%. This shows the growth is not just confined to its wireless business.

Additionally, the AI boom could supercharge AT&T's growth. Since many AI-related functions take place in the cloud, the technology will depend on 5G and fiber networks like the ones owned by AT&T to execute AI-driven workloads. Meeting that need will bode well for AT&T's top and bottom lines and should boost shareholder value over time.

Consider AT&T stock

Due to improving business conditions, the low valuation makes AT&T a compelling buy. Thanks to a rising market share and the AI-driven need for AT&T's networks, the company and its stock should move higher in the long term.

Admittedly, the massive debt is still a concern, and that could lead to another payout reduction or even the possible elimination of the dividend.

However, the improving financial conditions could lead to stock gains compensation for the lost dividend income. As AT&T solidifies its market leadership in an essential industry, it becomes increasingly likely that its valuation and stock price will begin to rise.