Keep some powder dry and look to take advantage of stocks on a dip in the first quarter. That's one of the conclusions from looking at the latest results of MSC Industrial Direct (MSM -0.01%). The metalworking and maintenance, repair, and operations (MRO) products and services distributor's sales are a key barometer of the North American industrial sector. Its latest results contained a mix of warnings and opportunities for investors. Here's the lowdown.

Prepare yourself for profit warnings

I previously discussed the possibility for a spate of profit warnings in the coming earnings season, and MSC Industrial's earnings support that idea. It's one of three stocks to watch closely in January for a clue on current conditions in the economy.

Unfortunately, the report wasn't good. The company's fiscal first quarter of 2024 ended Dec. 2, 2023, and includes sales in September, October, and November. Back in the fourth quarter of 2023 earnings presentation in October, management told investors its average daily sales (ADS) grew 1.3% year over year in September and would be 1% to 2% in October.

As the table below demonstrates, ADS didn't grow in October, in fact, they declined 1.7%.

|

Metric |

September |

October |

November |

December |

|---|---|---|---|---|

|

Average daily sales growth (YOY) |

1.3% |

(1.7%) |

(1.2%) |

(2.5%) |

Data source: MSC Industrial presentations. YOY = year over year.

Given that MSC's management gave the October ADS guidance in late October, it's fair to say demand deteriorated a lot more than expected in the second half of the month. Indeed, CEO Erik Gershwind acknowledged this point on the recent earnings call, saying, "We ended the month down over 1%, which demonstrates just how soft demand was in the back half of October versus our expectation." He continued, "That softness carried into November, and as you can see on the op[erating] stats into December as well."

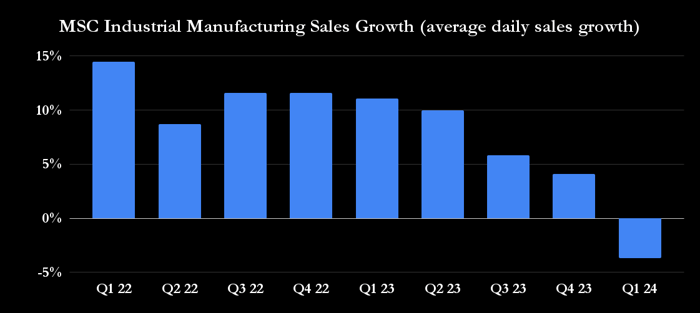

The table above shows the dynamics. In addition, zeroing in on MSC Industrial's manufacturing sales in particular, it's clear that there's a slowdown taking place.

Data source: MSC Industrial presentations. Chart by author.

Why sales were weaker than expected

Discussing just why sales weakened so much over the last few months, Gershwind put it down to a combination of "belt-tightening and inventory burn down heading into the holidays." There was also a slower-than-expected recovery from the negative impact of the United Auto Workers (UAW) strike in 2023.

While all of these can be dismissed as temporary, the fact is they all reveal a bias among customers to be cautious about spending over the near term. That sort of behavior manifests in a weak end market. Let's put it this way: If its customers saw their sales soaring, they would hurry to build inventory rather than run it down.

As such, it makes sense for investors in the industrial sector to be cautious over the upcoming earnings season.

Image source: Getty Images.

A second-half recovery is coming

That said, this year was always going to be a story of a second-half recovery, hopefully driven by a lower interest rate environment now that inflation is moderating. Indeed, management maintained its full-year guidance for ADS growth of 0% to 5% in fiscal 2024. However, Gershwind acknowledged, "If you look at our framework for the back half of the year, certainly, it's back-end loaded now given the way, the slow start, we came out of the gate."

In support of the argument that the trading environment will improve in the second half of its financial year, Gershwind talked of confidence "building among our customer base" due to the improved outlook for interest rates.

What it means to investors

Putting it all together, it's clear that the near-term deterioration in the industrial sector means there's significant potential for many industrial companies to miss expectations in the coming quarter. In MSC Industrial's case, given that it just reported a weak first quarter of earnings, it's understandable if investors nudged down their earnings expectations.

Reading across to other industrial companies, merely meeting their fourth-quarter guidance will be a positive, and they may give wide ranges in their full-year guidance to reflect the uncertain growth conditions.

That said, the likelihood of a second-half recovery means investors should look to initiate long-term positions by buying into any significant weakness in companies that looked like a good value going into earnings. If MSC Industrial's earnings are a guide then there will be plenty of opportunity to do so in the coming weeks.