Everybody loves a good recovery story. You can get in on a promising company, with a potentially bright future ahead, but at a terrific price. And that means you could win big each time this player reports positive news and makes progress toward its goals. Of course, this is what we all would like to happen, but sometimes recovery doesn't go as planned. So, before betting on these sorts of stories, consider your appetite for risk. Even if you're OK with risk, make these recovery-story bets part of a diversified portfolio.

Now, let's get ready to do some recovery-story investing. Today, two recovery stories look particularly interesting, and if everything works out for these companies, their shares could deliver significant gains. I'm talking about Novavax (NVAX 3.54%) and Teladoc Health (TDOC -2.40%). The shares have dropped more than 90% from their peak in 2021. Which makes the better recovery-story buy right now? Let's find out.

Image source: Getty Images.

The case for Novavax

Novavax lost out on the biggest opportunity for COVID-19 vaccine revenue because its product reached the market well behind leaders Pfizer and Moderna. That left the company down, but not out. Novavax last year launched a plan to improve its cost base, and it's made progress, cutting current liabilities by $1 billion since September. The company reduced its workforce by 20% and aims to continue those cuts. Plus, Novavax is on track to reduce expenses by 55% this year compared with 2022.

As for potential products, the biotech player is working on a combined coronavirus/flu vaccine that it aims to launch in 2026. Today, demand for coronavirus shots has fallen. But the situation is different for flu vaccines, which generally attract about half of the U.S. population. And this group may readily opt for a combined shot, meaning such a product could represent growth for Novavax. This also means there may be enough room in the market for more than one player, and that's great news because Pfizer and Moderna also are working on combined candidates.

Of course, Novavax faces challenges, making it a risky stock. For example, it's involved in a dispute with Gavi, the vaccine alliance over the delivery of vaccine doses. If Novavax loses, it may have to return nearly $700 million in payments to Gavi. The dispute is under arbitration right now.

The case for Teladoc Health

Teladoc suffered in recent years as investors worried about its ability to transform growing revenue into profit. And when Teladoc reported billions of dollars in non-cash goodwill-impairment charges in 2022, that made matters worse.

But early last year, the telemedicine giant made a big move to turn things around. Teladoc launched a plan to bring costs in line with revenue opportunities, and put a balanced focus on revenue growth and the quest for profitability.

The efforts have been bearing fruit. Throughout last year, quarterly results have met or beat expectations, Teladoc has made gains in the key growth area of chronic care, and the company even has won some customers away from the competition thanks to its focus on "whole person" care and growing financial strength.

Teladoc now says investors can expect the company to deliver earnings before interest, taxes, depreciation, and amortization (EBITDA) and free-cash-flow growth that surpass revenue growth over the next few years, a key step on its path to profit.

On top of this, Teladoc recently launched a comprehensive operational review of its business to ensure optimal efficiency and investments only in areas that support whole person care. CEO Jason Gorevic says the stock's low valuation doesn't reflect the company's potential. Teladoc hopes this review will help maximize and reveal its strengths.

Novavax or Teladoc?

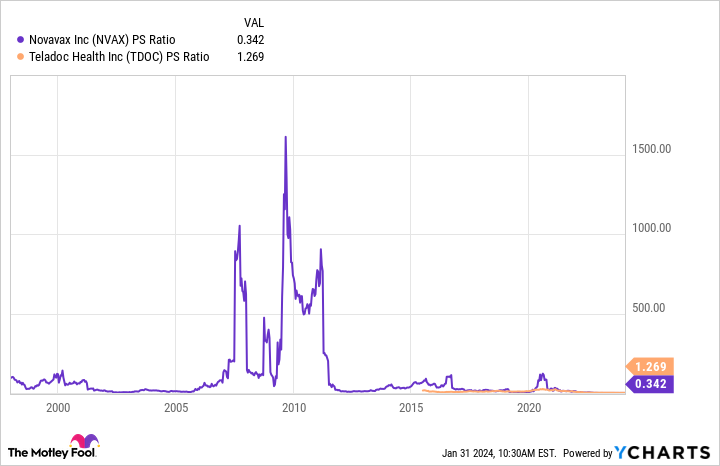

Both stocks look cheap if they successfully grow sales down the road. Today, they're trading around their lowest ever in relation to sales.

NVAX PS Ratio data by YCharts.

Novavax and Teladoc each carry some risk, and recent history shows they're far from being investors' favorite stocks to buy.

But I think risk is higher for Novavax than it is for Teladoc right now due to the Gavi uncertainty and the fact that Novavax depends on one product -- its coronavirus vaccine.

Teladoc has built a solid portfolio of customers, serving more than half of the Fortune 500, and is a leader in a high-growth market. If the company can manage its costs over time, optimize efficiency, and continue taking steps toward profitability, the shares should eventually take off. And that's why Teladoc looks like the better recovery-story buy right now.