One of the pioneers of e-commerce is PayPal (PYPL 2.90%). However, a number of new players emerging in digital payments have taken their toll on PayPal's business in recent years.

The company is currently at a crossroads as its core business continues to generate mundane results from quarter to quarter.

With the stock down nearly 80% in the last three years, it seems like investors have soured on PayPal and moved on. Even more concerning, management admitted to investors that 2024 may not bring a ton of growth.

However, a closer look into the business can provide investors with a clear idea of what PayPal's primary challenges are. More importantly, management has explained to investors what the company is working on in order to reinvent itself and return to accelerating growth.

Let's dig into PayPal, assess how the company plans to turn itself around, and determine if now is a good opportunity to buy the stock.

What is transaction margin, and why is it important?

PayPal generates the majority of its revenue from fees applied to transactions. However, the metric that investors really want to home in on is transaction margin. This figure provides you with a sense of how profitable PayPal's core business is.

| Category | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 |

|---|---|---|---|---|---|---|

| Transaction Margin | 51% | 49.7% | 47.1% | 45.9% | 45.4% | 45.8% |

Data source: PayPal Investor Relations

Over the last year, PayPal's transaction margin has been inconsistent and in decline. A combination of intensifying competition from other fintech businesses and even big tech companies such as Apple or Alphabet, along with uninspiring investments into innovative new products, has ultimately led to a noticeable problem for PayPal.

Image source: Getty Images.

How can PayPal improve transaction margin?

During the company's fourth-quarter earnings call, management told investors that in 2024, "We expect roughly flat transaction margin dollars."

There are a couple of important things to understand from this statement. First, management is speaking about transaction margin dollars -- not the actual margin percentage. However, the more important item at play here is breaking down why management is not forecasting growth in transaction margin dollars.

PayPal's CEO, Alex Chriss, addressed this topic head-on. Earlier this year, PayPal released a number of new products and features aimed at enhancing the overall shopping experience for merchants and consumers. Many of these services are aimed at better monetizing some of PayPal's acquired properties, such as Venmo, and using artificial intelligence (AI) to make it a more complete platform.

During the earnings call, Chriss told investors that PayPal's new services are still nascent, and so management is not expecting them to make major contributions in their first year of availability.

Another way that transaction margin can improve is by accelerating branded checkout functionality. PayPal's presence in e-commerce is huge -- but the company has admitted to under investing in certain areas, which has come back to haunt them. By creating a more streamlined online experience that also offers in-demand features such as buy now, pay later (BNPL) or earning cash back, PayPal has a greenfield opportunity to reinvent itself.

Should you invest in PayPal stock?

Although offering merchants and consumers a more prolific payment platform is important to return to growth, the fact of the matter is that PayPal's competition is likely here to stay. This means that the company is going to need to do more as it plays catch-up. Like many of its tech cohorts, PayPal recently announced that it will be reducing headcount as the company right-sizes its expense profile.

In theory, the combination of higher transaction revenue and lower expenses should help the company dramatically improve its margin and profitability. The way I see PayPal, management has outlined a clear roadmap to get the company back on track. Now, it's all about execution. For this reason, I understand why management isn't calling for significant growth this year. 2024 represents the beginning of potentially longer-term growth across the top and bottom lines.

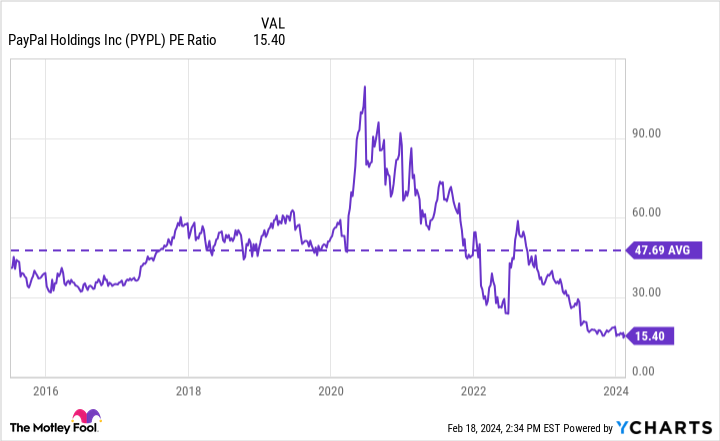

PYPL PE Ratio data by YCharts.

At a price-to-earnings (P/E) ratio of just 15.4, PayPal stock is clearly trading at a steep discount compared to its long-term average. I think a lot of investors have abandoned PayPal -- understandably so. The company's operating performance for the last year has been quite muted, and management's near-term outlook isn't exciting.

But long-term investors may see the potential here. The global e-commerce market will continue to grow thanks to online shopping, peer-to-peer payment apps, and more. PayPal is operating in a high-growth market, but as management pointed out, it's time to execute. The company has put down the foundation for the next phase of growth for PayPal. Only time will tell if these investments will pay off.

In the interim, investors interested in fintech have an opportunity to scoop up shares in PayPal stock at a historically cheap valuation. Now could be a unique opportunity to lower your cost basis or initiate a position before the long-term benefits fueled by AI and a growing digital payments market begin to take effect.