In the aftermath of the 2022 bear market, many stocks are trading at significant discounts to their previous highs. This is mostly due to market sentiment changing for some companies as business fundamentals were previously detached from the stock performance. For others, however, the fall from grace has been warranted due to challenges with the business.

Unfortunately, at-home fitness company Peloton (PTON 4.29%) falls into the latter category. While it's true that some of its recent stock performance is due to an inflated price during pandemic-induced market exuberance, the company has also made some strategic mistakes that it's still trying to recover from. And there's a chance Peloton's stock may recover, but investors might be better off watching from the sidelines before taking a position.

The cycle of expectations

When 2020 began, Peloton stock was trading for around $30 per share and the company was doing great. Peloton ended calendar year 2019 (the second quarter of fiscal 2020) with its revenue growing 77% and its connected fitness subscribers increasing by 96% year over year. Then came the COVID-19 pandemic. When we were all locked down in our homes, the idea that in-home fitness could be the way of the future became conventional wisdom in the market. Over the next year, Peloton stock rose to as high as $167.

2021 was entirely a different story. Pandemic restrictions eased, stores, schools, and gyms reopened, and Peloton saw its meteoric growth slow. Peloton's stock fell 78% that year and dropped another 23% in 2023. At the time of this writing, shares trade for less than $5, and the stock is down 82% from its debut as a public company.

So where are we today?

In early 2022, Peloton's co-founder and CEO John Foley stepped down, and the company brought in Barry McCarthy to try to right the ship. One of the new CEO's priorities was to stop the cash burn, and to be fair, he has done that. In the first reported quarter after he took over, Peloton's third quarter of 2022 (the quarter ending March 2022), the company reported free cash flow of negative $747 million, an all-time low.

From that point, free cash flow has steadily improved. In the most recent quarter (Q2 2024, ending in December 2023), free cash flow was negative $37 million. Management hoped to be free cash flow positive for fiscal 2024, and while they're expecting to fall short of that, the company is expecting positive free cash flow in the fourth quarter. There's clearly some work to do, but the steady improvement is encouraging.

The improving trend in free cash flow has been matched by a similar trajectory with profitability. Net income has improved from negative $1.3 billion in Q4 2022 to negative $195 million in Q2 2024. While no guidance was provided on net income expectations, the company is expecting 76% growth in adjusted EBITDA in fiscal 2024, so it's reasonable to assume there would be further improvement in net income as well.

Still an uphill climb

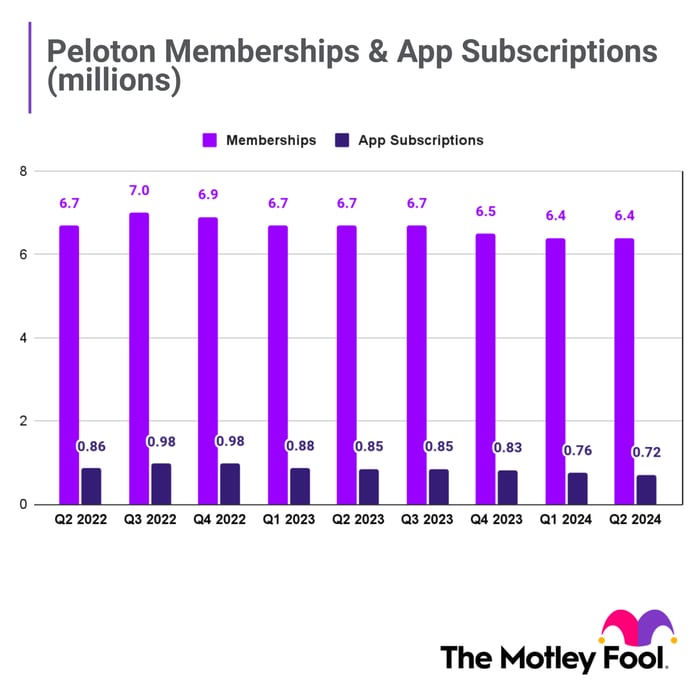

Despite the bright spots in the financial results, there are discouraging trends within membership and subscriptions. In Q2, total members fell 4% year over year and 1% sequentially, and the total number of paid app subscriptions at the end of the quarter was down 16% compared to Q2 2023. Taken in isolation, one could make the case that this is just a bump in the road, but the long-term trends are similar.

Data source: Peloton.

To be clear, there's still a chance Peloton will turn this around. Management made the point that because the focus has been on getting the company's financial house in order, there's been little time for creating new products. McCarthy believes the next two years will see a significant increase in product innovation and believes this will change the trajectory of the business.

Is it time to get on the Peloton treadmill?

Management's optimism notwithstanding, there's still a lot that has to go right for Peloton to make a compelling investment. The slow improvement on the bottom line and with cash generation is encouraging, but the company has still not yet broken even and doesn't expect to for the remainder of this fiscal year. Slowing memberships and app subscriptions make the expected financial recovery less certain.

Peloton is still an intriguing business with a loyal and engaged user base. While I wouldn't buy shares today, it remains on my watchlist. The stock has fallen so far (it currently trends for only 0.6 times sales) that there's plenty of time to wait and see if the turnaround is successful and still invest early enough to be rewarded as a shareholder.