In 2017, PayPal (PYPL 2.90%) stock was valued at roughly $60 per share. Today, the stock still trades for around $60 per share.

But make no mistake: PayPal stock hasn't been quiet. Between 2017 and today, the shares zoomed beyond the $300 mark, only to give up all of the gains.

Is this a busted growth story? Or can PayPal stock go on another run from $60 to $300?

PayPal is a giant -- one that is no longer growing

PayPal as a business needs little introduction. The company has more than 400 million people who use the payment platform as a trusted way to buy and sell things online, or transfer money between friends and family.

Long owned by eBay, PayPal became an independent company in 2015. During the next five years, its user base more than doubled from 180 million to around 380 million. At its peak -- the fourth quarter of 2020 -- PayPal's user count was growing by 24% year over year.

Also in 2015, eBay ended its partnership with PayPal, moving its backend payments to a competing service while deemphasizing PayPal as a payment method. From that moment, PayPal's quarterly user growth rate began to fall. In the third quarter of 2023, growth turned into a decline. For the first time, PayPal's user based was shrinking.

PayPal's stock price reflects these wild swings in user figures. On a price-to-sales basis -- an easy way to roughly gauge the valuation of a growth stock -- PayPal shares trade at their cheapest levels ever.

Of course, there's a strong rationale behind the depressed valuation. The declining user base is the primary cause, but the company has also destroyed tens of billions of dollars in shareholder value over the years by repurchasing more than $20 billion in stock, all at prices much higher than today.

PayPal stock is priced near all-time lows for a reason, but if you're willing to take a little risk, there could be huge upside in betting on a turnaround.

This stock could be the next Meta

Many growth stocks experience periods of slowing growth. When this happens, the share price almost always takes a huge hit. Growth stocks typically come with pricey valuation multiples, and when the market grows disillusioned, these multiples can come down fast.

Consider one of the largest companies in the world: Meta Platforms. After years of impressive growth, its user base stagnated in 2021. In Q3 of that year, the company had 2.81 billion daily users across its entire network. In Q4, it eked out its lowest growth rate in years, ending with just 2.82 billion daily users.

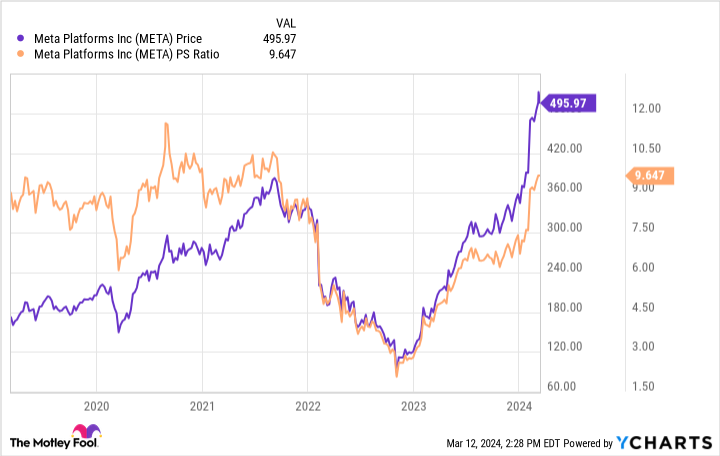

Meta stock -- like PayPal stock -- was punished, losing around two-thirds of its value. And then something amazing happened: Growth rates picked up, returning toward historical norms. Priced at a steep discount due to worries that the business would soon start shrinking, Meta's stock price exploded. Those who took a risk when growth rates were low could have made three times their investment in less than two years.

Could the same revival happen to PayPal stock today? That's the big question on everyone's mind. It should be noted that PayPal's user base has already begun shrinking on a total user count level, whereas Meta's active user base was merely stagnating.

Additionally, Meta is arguably more diversified. For example, it can supplement struggling Facebook user growth with Instagram user growth. PayPal's business is a standalone, and its only avenue for growth right now is to persuade more people and businesses to use its payment platform.

Still, PayPal has several factors working in its favor, the biggest of which is high levels of free cash flow. Last quarter, the company generated $2.6 billion in free cash flow. During the past decade, quarterly free cash flow has averaged nearly $900 million.

While its user base is shrinking, its relatively asset-light business model provides it with enough cash flow to reinvest in new growth initiatives. Its new Fastlane feature, for example, promises to reduce checkout times by up to 40% by leveraging data from the company's huge user base. Since checkout times are a critical metric for online merchants, new innovations like this could spur increased adoption of PayPal as a preferred method of payment.

Ample free cash flow also lets PayPal repurchase more of its stock. Although these share repurchases have destroyed shareholder value in the past, the current stock buyback program -- totaling about $5 billion -- will be executed at significantly lower prices. If growth rates begin to tick up, PayPal could add fuel to the fire by repurchasing shares at an all-time low valuation.

Is PayPal stock a buy today? If you're willing to take a little risk, the shares offer plenty of upside potential. Similar to what happened with Meta, the market has given up on the stock, preferring to value it as a stagnating business. That's true...for now. If growth rates reverse course or even begin to plateau, we should see a quick rebound in the stock price. The shares look like a buy for risk-tolerant investors.