"Great ideas come from everywhere if you just listen and look for them."

-- Sam Walton, founder of Walmart

One of the things I love about consumer stocks is that -- as a consumer -- I have firsthand experience with many of the companies I'm evaluating. That gives me a leg up when investing, as I can refer to my own likes and dislikes when determining which companies are likely to succeed over the long term.

So, let's have a look at three consumer stocks I think are worth considering right now.

Image source: Getty Images.

Spotify

First up is Spotify Technology (SPOT 0.20%), a stock that has surged some 196% over the last 18 months.

The company, which operates an audio-streaming platform with more than 236 million subscribers, has more than doubled its total revenue over the last five years, from $6.5 billion in 2019 to over $14.3 billion last year.

Spotify's revenue comes from two sources: 86% of the company's revenue is generated from its subscriber base, while 14% comes via ad-supported listeners. Moreover, subscriber-based revenue is more profitable, with a gross margin of 29%, whereas ad-based revenue has a gross margin of 14%.

As a result, one of Spotify's key goals is to attract ad-based listeners, then convert them into subscribers.

And, on that front, the company is doing well. Premium subscribers are growing 15% year over year, led by the Latin American region.

In short, Spotify is at the forefront of the streaming revolution, which has changed the way people listen to music. Given its large and growing subscriber base, investors should consider Spotify.

DraftKings

Next up is DraftKings (DKNG 4.96%), the operator of a digital sports betting platform.

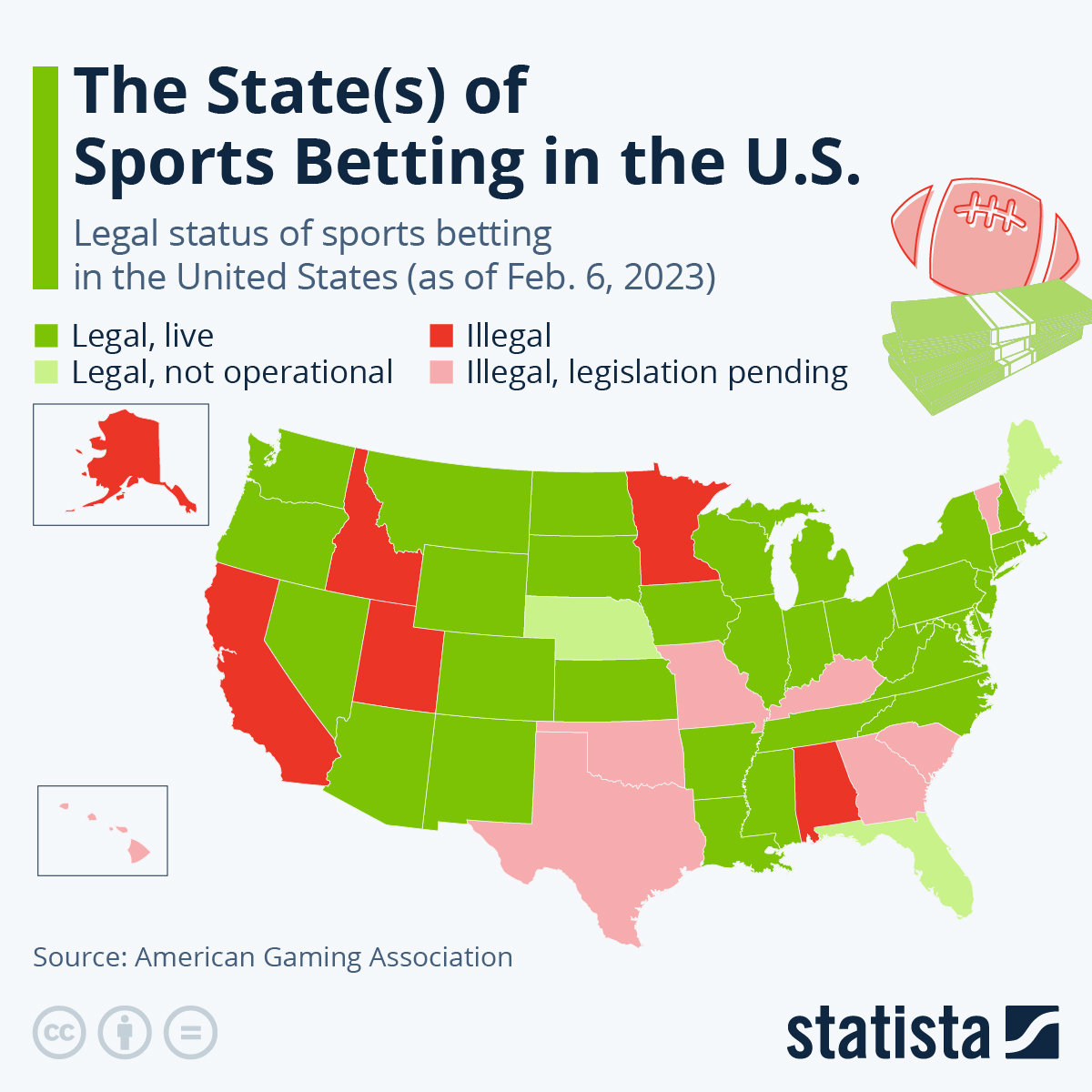

What I like about DraftKings is that it is riding an unstoppable wave. That wave is legalized sports betting.

Prior to 2018, gamblers could only legally wager on sports in a handful of states, such as Nevada. However, since the U.S. Supreme Court legalized sports betting in 2018, dozens of states have passed laws permitting the practice. As of this writing, 38 states now allow some form of sports betting.

Accordingly, sports wagering bets and revenue are skyrocketing for companies like DraftKings. Over the last 12 months, DraftKings has recorded revenue of $3.7 billion. That's up more than 10x from just four years ago, when the company had reported revenue of $344 million.

What's more, analysts expect DraftKings' revenue to top $4.8 billion this year and $5.7 billion in 2025.

Granted, it's a competitive field, with numerous companies aiming to become the dominant player in the sports wagering market. However, thanks to its longtime presence in the fantasy sports market, DraftKings is already a known company to many sports fans and bettors. That could offer it a leg up on the competition.

At any rate, growth-oriented investors should keep an eye on DraftKings.

Amazon

Last is Amazon (AMZN 3.43%). Sure, it's the fifth-largest American company, but that doesn't mean this tech and e-commerce megacap won't keep making new millionaires for a long time.

Like many legendary companies, Amazon has reinvented itself many times over. It began as a online website to buy books, then morphed into an e-commerce giant, and is now as much a cloud services company as anything else.

Yet, the reason I think Amazon will keep making millionaires is because it gets on base, rather than trying to always hit home runs.

Consider this: After the massive surge in demand during the COVID pandemic, Amazon ramped up capital expenditures (and hiring) to expand its logistics network. Yet, as the pandemic wound down, demand slipped, and management had to make a decision: stay the course spending-wise and hope demand rebounds (try to hit a home run) or cut spending and suspend important projects like the company's HQ2 (get on base).

Thankfully for shareholders, Amazon's leadership made the tough calls and cut costs. As a result, the company just reported a fantastic quarter with key metrics like free cash flow per share bouncing back (or exceeding) pre-pandemic levels.

AMZN Free Cash Flow Per Share data by YCharts

The lesson here is that sound management isn't always exciting, but it does pay off in the long term. And because of that, Amazon is likely to keep making more millionaires.