L Brands (LTD 3.93%) leads its categories with its Victoria's Secret and Bath & Body Works brands, its second-quarter sales and comps improved, and it upped its fiscal year 2013 earnings-per-share guidance. This should equate to an excellent investment opportunity. While this could very well still be the case, there's one trend that's somewhat concerning.

Recent results

Prior to getting to that one concerning trend, let's first take a quick look at the company's recent second-quarter results on a year-over-year basis:

- Net sales: Up $117 million to $2.5 billion

- Comps sales: Up 2%

- Operating income: Up $53 million to $358 million

Segment breakdown:

- Victoria's Secret sales: Up 3%

- Victoria's Secret operating income: Up 6%

- Bath & Body Works sales: Up 3%

- Bath & Body Works operating income: Up 16%

- Other sales: Up 25%

- Other operating loss: Improved 62% (growth in international operations)

L Brands also increased its fiscal year 2013 diluted EPS outlook to $3.06-$3.21 from $2.95-$3.15. L Brands is seeing higher merchandise margin dollars thanks to increased international sales and a decline in the buying and occupancy expense rate.

All of this is great news, and it might lead to great results, but comps, which appear to be strong on the surface, might indicate an upcoming headwind.

Comps performance

Below is the comps performance breakdown for the second quarter in 2013 compared to comps performance in the second quarter in 2012:

| Brand |

Q2 2013 |

Q2 2012 |

|---|---|---|

|

Victoria's Secret |

Up 1% |

Up 10% |

|

Bath & Body Works |

Up 3% |

Up 7% |

|

Total L Brands |

Up 2% |

Up 8% |

Source: 10-Q.

Victoria's Secret has seen higher average dollar sales, but transactions have declined. Bath & Body Works has seen higher average dollar sales as well as increased transactions.

These are definitely positives, but if you look at the rate of comps growth year over year, it has slowed at Victoria's Secret, Bath & Body Works, and across L Brands as a whole -- which includes performances at Victoria's Secret, Victoria's Secret Canada, Bath & Body Works, Bath & Body Works Canada, La Senza, and Henri Bendel.

Put simply, loyal customers are returning to company stores, but not at the same pace as last year. The good news is that L Brands can still grow its top line via international growth, and the company recently noted that an uncertain economic environment has led it to a conservative approach in regard to financial management. In other words, L Brands will also focus on improving its bottom line.

The big headwind here is a highly promotional environment, which might lead to L Brands needing to offer consistent discounts in order to compete with products offered by peers.

L Brands vs. peers

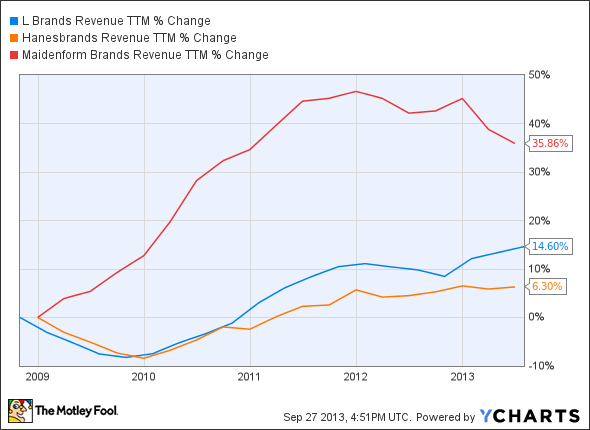

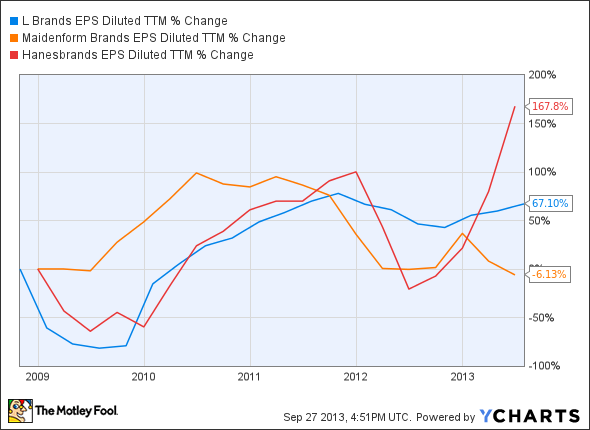

Speaking of top- and bottom-line performance, let's see how L Brands compares to peers Hanesbrands (HBI 2.21%) and Maidenform Brands (NYSE: MFB) over the past five years.

Top-line performance:

L Brands revenue trailing-12-month data by YCharts.

Bottom-line performance:

L Brands EPS diluted trailing-12-month data by YCharts.

L Brands might not jump out at you right away, but it has been a steady performer. Though Maidenform has been the top performer on the top line, it has performed poorly on the bottom line. This is why Hanesbrands acquiring Maidenform makes sense.

Hanesbrands will help Maidenform cut expenses, and Maidenform will help Hanesbrands boost sales. Therefore, it's a win-win. The deal is expected to close on Oct. 8, and Hanesbrands thinks it will lead to $500 million in annual sales.

Attempting to determine a better investment opportunity between L Brands and Hanesbrands, especially considering the upcoming change at Hanesbrands, would be a forced attempt at prophetic ability. All that can be said is that these two companies tend to perform similarly based on industry trends. Limited Brands does offer a higher yield at 2% versus 1.3% for Hanesbrands.

Cautiously optimistic

It's difficult to find retailers with strong potential in the new economy, but L Brands does offer more potential than most retailers thanks to its well-established and category-leading brands, and its international growth potential. On the other hand, slowing comps growth is somewhat concerning. If you want to play it safe, keep an eye on L Brands over the next few quarters and pay careful attention to comps growth prior to investing.