If you're looking for a safe long-term investment where acquisitions are fueling growth and you can receive generous dividend payments, then you have come to the right place. There are many ways for a company to grow and reward shareholders. The first is organic growth, next is share buybacks, another way is acquisitions. McCormick & Company (MKC -0.38%) is one of these companies. It recently purchased Wuhan Asia Pacific Condiments -- manufacturer and marketer of DaQiao and ChuShiLe brand bouillon (broth) products with strong exposure in China. . This acquisition goes well with the company's Comprehensive Continuous Improvement program. Together, they will aid both the top and bottom lines. However, it's possible that another aggressive food company offers more investment potential.

Acquisitions and cost-cutting

McCormick saw sales increase 4% in the third quarter year over year. That's a solid number, but 3% of the gain could be attributed to Wuhan Asia Pacific Condiments. When you look at Consumer Sales in Asia Pacific, you will see a 52% improvement over the year-ago quarter. This is very impressive, but 59% of the gain came from Wuhan Asia Pacific Condiments. Therefore, without that acquisition, Consumer Sales in Asia Pacific would have declined 7%. There's nothing wrong with inorganic growth as long as it's affordable, and McCormick sports a respectable debt-to-equity ratio of 0.77.

Following the acquisition, McCormick now aims for long-term annual sales growth of 4%-6%, operating income growth of 7%-9%, and earnings-per-share growth of 9%-11%. At the same time, McCormick targets $45 million in annual savings from its Comprehensive Continuous Improvement program. In fiscal-year 2013, McCormick will close its operations in the Netherlands while also streamlining its SG&A expenses across the region. The near-term fiscal-year 2013 charges related to these moves are expected to lower earnings-per-share by $0.14. Full-year expectations are now for the low end of $2.89-$2.95. However, the long-term cost-savings picture looks bright.

From a basic business perspective, McCormick is presently seeing strength in snack seasonings and other flavors to food manufactures, but weakened demand from quick service restaurants. However, quick service restaurants in China have been strong thanks to the Wuhan Asia Pacific Condiments acquisition, but India has weakened.

Let's take a quick look at two other food companies that recently made acquisitions and see if one of them is likely to offer a better investment opportunity.

McCormick vs. peers

ConAgra Foods (CAG -0.95%)acquired Ralcorp -- manufacturer of breakfast cereal, cookies, crackers, chocolate, snack foods, mayonnaise, pasta and peanut butter -- for $6.8 billion early this year. Many people wondered if it was worth the price. While ConAgra has high expectations for the long haul, the acquisition has hampered the bottom line a bit. First, let's cover expectations.

ConAgra is currently in a transitional phase. For instance, in the company's first quarter, ConAgra contended with weak volumes, changes in merchandising and marketing support, and increased investments in new products, all of which have negative short-term effects. However, ConAgra expects volumes to improve. It expects Ralcorp to contribute $0.25 in diluted earnings-per-share for fiscal-year 2014, as well as long-term synergies of $300 million by fiscal-year 2017. Currently, ConAgra's debt-to-equity ratio of 1.77 is above the industry average of 1.10. However, ConAgra yields a generous 3.20%.

Then there's Flowers Foods (FLO -0.56%) which recently acquired five Hostess bakeries and five bread brands (Wonder, Marita, Home Pride, Butternut, Nature's Pride), making it the second-baker in the United States. Flowers Foods takes a very methodical approach to growth, a big positive for investors. As an investor, it's nice to know that the management you invested in never becomes overambitious. Its growth is still impressive.

Flowers Foods has made 12 acquisitions over the past decade. Over that time frame, Flowers Foods has expanded its reach from 38% of the population to 77% of the population. Despite all of these acquisitions, Flowers Foods still sports a debt-to-equity ratio of just 0.59 which demonstrates quality debt management. It yields a decent 1.90%.

While all three companies have performed well on the top line over the past five years, McCormick has lagged ConAgra and Flowers Foods:

MKC Revenue TTM data by YCharts

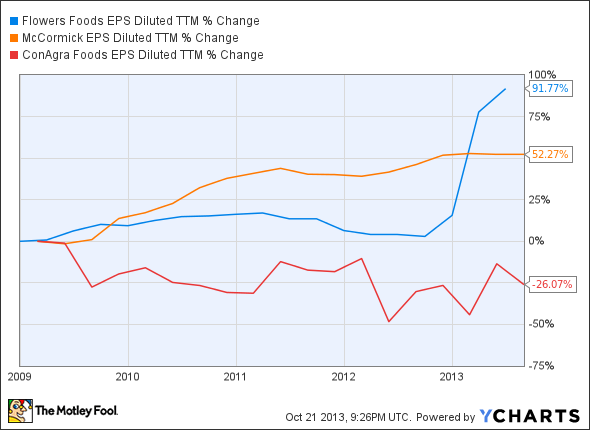

When one company outperforms its peers on the top line and acquisitions are part of the conversation, it usually means that company is suffering on the bottom line. While that might be true for ConAgra at the moment, it hasn't affected McCormick or Flowers Foods:

FLO EPS Diluted TTM data by YCharts

The bottom line

McCormick has a plan to grow its top and bottom lines and so far this plan seems effective, with inorganic growth playing a big role on the top line. Flowers Foods has been even more impressive recently and its methodical approach to growth while maintaining bottom-line growth is comforting. ConAgra's Ralcorp acquisition should lead to long-term rewards, but this could take years. At least you will be paid while you wait, considering the 3.20% yield.