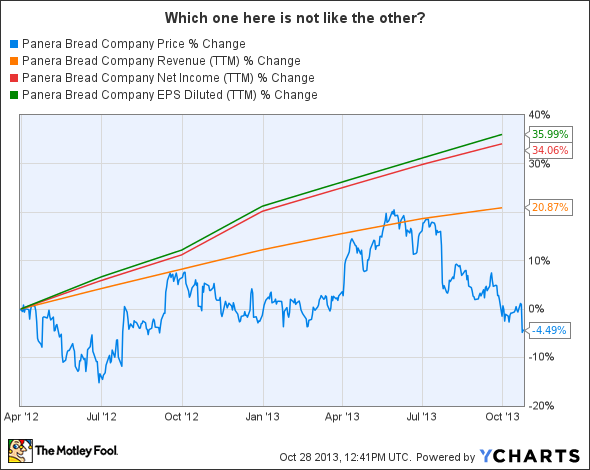

Earnings-per-share growth of 11%. Revenue growth of 8%. Added 91 new locations through three quarters. A $175 million share repurchase last quarter. No debt on balance sheet. Comp-sales up 1.7%. Stock price down over 20% from 52-week highs??

You might think I'm mixing the results from two different companies, but this describes exactly what has happened to Panera (PNRA).

How can we make sense of what has happened, and what hope is there for Panera's future?

What's happened?

Historically, Panera has enjoyed robust comp-sales growth, but lately this has been slowing. What's more concerning is that in the most recent quarter comp-sales increased 1.7%, but guest traffic actually declined. Ignore presumptions that Panera's menu is overpriced; this declining guest traffic is attributable to two factors.

The first factor revolves around stores not being able to complete more transactions during peak restaurant hours. Panera estimates that it loses six to 12 customers per day who decide not to wait in line. Multiply six to 12 by 1,700+ locations and that number becomes significant. If the company could just tap the customer base that isn't waiting in line, this could translate into 1% transaction growth.

Some of Chipotle's (CMG 6.33%) recent comp-sales success is attributable to faster service during peak hours. Co-CEO Montgomery Moran said that lunchtime efficiency increased by five transactions per hour and dinnertime increased by four transactions per hour.

Chipotle's throughput success is attributable to two important positions: the "expeditor" and the "line backer." The expeditor speeds up the cashier's job. The line backer keeps communication smooth between the line and the kitchen. Yet, the company found that even with this success there is room for improvement. The expeditor was only in place 65% of the time, and the line backer only 73%. Chipotle hopes to improve these to 100% for further comp-sales growth.

Panera isn't taking this issue lying down. The company has decided to cut some menu items to make ordering easier. Ease of ordering should lead to faster orders. To meet this higher demand it's also adding 35 hours of labor in every Panera location. It will cost the company just $15 million per year to do this, but will more than make it up if the aforementioned 1% transaction growth can be reached.

The second factor affecting Panera's declining guest counts is a tad more concerning. The company surveyed its customers, and it turns out that they're not digging the in-cafe experience right now. Specifically, customers identified slower service, less comfort, and a rise in inaccurate orders. These are more concerning because they are reputation issues, and public perception is a very hard thing to change.

The situation reminds me a lot of Starbucks (SBUX -1.02%) in 2007. When Howard Schultz returned to the CEO role in 2008, he said one of his objectives was to "re-ignite an emotional attachment" with customers. Schultz felt that as Starbucks had grown, it had made some choices that led to a generic vibe which had caused customers to leave.

Starbucks under Schultz has righted the ship. After closing under-performing stores the company began to look for ways to cut costs, but not at the expense of customer experience. Two big consumer demands were freshly ground coffee and freshly brewed coffee -- changes initiated by the company. Now not only has earnings per share increased over 50% in the last 3 years, comp-sales have increased 7.3% annually during that time.

Hope for the future?

Like Starbucks, Panera can regain customer confidence, but it's not a quick fix. The company will have to proactively reconnect with the customers it has lost. I'm confident it will after reading the eight concrete changes outlined by CEO Ronald Shaich in the earnings release. Beyond growing comp-sales there is plenty more reason for Panera investors to remain optimistic.

This chain is still expanding through company-owned and franchised locations. Through the first three quarters Panera opened 91 new units, and it looks to open 34 more before the end of the year. By opening 125 this year the company grew 7.5%. No official target has been set for 2014, but the growth rate has been around 7% for the last couple of years.

For shareholders, Panera targets 15%-20% earnings-per-share growth every year. This is accomplished through net income growth and share repurchases -- like the $170 million last quarter. Panera's debt-free position allows it to do this consistently. The company is guiding for lower EPS growth in 2014, but growth could still be in the double digits. Not many companies can offer this kind of return.

Fresh out-of-the-oven conclusion

It's rare for a high-caliber company like Panera to be put on sale for this long. Sure, the company has hit a rough patch, but I'm betting the current pressures will be temporary and the company will get turned around. Consider also that Panera's P/E of 23 looks quite attractive. If you're looking to get in, this could very well be as low as the stock drops.