Following a December 2011 deal that Martha Stewart Living Omnimedia (MSO +0.00%) signed with retailer J.C. Penney(JCP +0.00%), things have grown tougher for the home goods company. After Macy's (M 0.26%) found out about the deal between Martha Stewart and J.C. Penney, a lawsuit erupted that could put Martha Stewart on the path to bankruptcy.

You see, Macy's and Martha Stewart have held a contract for several years that dictates that the company may not sell any of its exclusive products under the Martha Stewart Collection name to any of Macy's competitors. Although there is a good deal of controversy between the three companies over what, exactly, the contract does and does not restrict, J.C. Penney and Martha Stewart were of the opinion that J.C. Penney's store-within-a-store model would involve a type of business transaction that would be outside of the restrictions, since Martha Stewart technically wouldn't be "selling" those products to J.C. Penney. Rather, they would merely be located within a J.C. Penney store.

Martha Stewart has been failing for years

For the past several years, Martha Stewart has been in a decline. To illustrate this, if you look at its earnings over the past 10 years, you can see that in nine of those years the company has lost money. To make matters worse, revenue has been falling every year since 2007 as its market presence has diminished considerably.

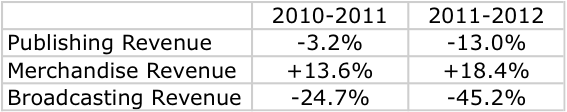

Looking at the table above, we can see how well each of Martha Stewart's three operating segments (publishing, merchandise, and broadcasting) have performed over the 2010 to 2012 time frame. We can see that the company has experienced some very mixed results recently. Publishing and broadcasting have declined considerably, whereas merchandise has increased by a noteworthy amount.

Using information from the company's 10-K, I discovered that the main reason for the decrease in publishing can be attributed to two factors: a decrease in advertising for Martha Stewart's magazines and digital content, as well as lower subscription rates. The broadcasting segment saw its revenue decline primarily as a result of fewer TV integrations and the expiration of a contract with Hallmark Channel in September of 2012.

The only area in which Martha Stewart has been excelling is in its merchandise segment, which made up 29.1% of its 2012 revenue. Although this may seem good at an 18.4% growth rate for the year, the numbers may not be very indicative of the future due to the fact that some portion of the company's $9 million increase is thanks to increased business from Macy's and new product design business with J.C. Penney (though it does not disclose how much).

Cost Containment Woes

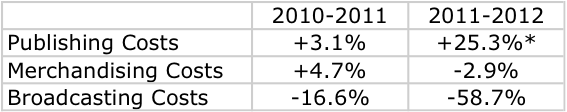

Now, when analyzing the true scale of the company's problems, we would be wise to look at how well it has been able to contain its costs as revenue declines. If you have a healthier, more flexible company, you should see cost reduction more or less match revenue reduction. However, if a company's costs don't fall in line with revenue, then that could indicate that even harder times are ahead, as the business may fail to produce reasonable margins.

What we see when looking at Martha Stewart's costs is that they, like its revenue, are relatively inconsistent. In the case of broadcasting costs, I can discern that management has been able to keep cost reduction not too far out of line from the revenue reduction it has had to contend with. However, publishing and merchandise are two entirely different stories. On the plus side, management has been very good at keeping costs lower than the change in revenue for merchandise, a sign that some combination of product pricing, economies of scale, product mix, or the utilization of previously unused capacity is likely responsible.

On the other hand, publishing costs have skyrocketed as the segment's revenue has fallen steeply. The initial thought I had regarding this was that the company might be trying to increase its workforce in this segment in an attempt to bolster revenue in the long term. However, a further examination revealed that the large 2011 to 2012 increase in costs for the segment were due to a one-time impairment. Removing this impairment, we see that the numbers are a little better at a 4.8% decline in costs for the year, but that's not enough to keep pace with the segment's revenue decline.

What is a worst-case scenario for Martha Stewart?

Even after the deal between Martha Stewart and J.C. Penney was reduced to a fraction of what it once was (with J.C. Penney being forced to return its stake in the company), it has the comfort of its contract with Macy's. However, even with this income stream the company has been suffering for years, and doesn't appear to be getting much better.

To make matters worse, there is always the possibility that Macy's will eventually decide not to renew its business relationship with the company, which would likely reduce its merchandise revenue moving forward. However, with a five-year lifespan on the deal, it's not impossible to imagine a situation in which the two companies reconcile over any bad blood that may have formed since 2011.