Signing a piece of paper agreeing to save the environment is easy. Doing what that piece of paper says is hard. That's what countries around the world are finding out about Earth-friendly targets they've set. That's good news for coal and nuclear power, even if environmentalists are upset.

The pot calling the kettle black

At a recent United Nations meeting on climate change, China, the world's largest emitter of carbon dioxide, expressed "dismay" that Japan was backing away from its earlier carbon-cut pledges. Japan, the third largest economy in the world, is now going to allow its CO2 emissions to rise about 3% instead of cutting them by the pledged 25%. Of course, that goal was set before a major nuclear disaster led the nation to close its entire fleet of nuclear power plants. So there are extenuating circumstances.

That said, Peabody Energy (BTU) expects China to build 220 gigawatts of coal fired power plants over the next four years or so. It seems a bit odd for a country that will increasingly use a "dirty" fuel to comment on Japan's post-Fukushima reality check. In fact, Jonathan Grant of PricewaterhouseCoopers told Bloomberg that "The decision highlights the awkward compromises that many countries are making..."

Not so easy

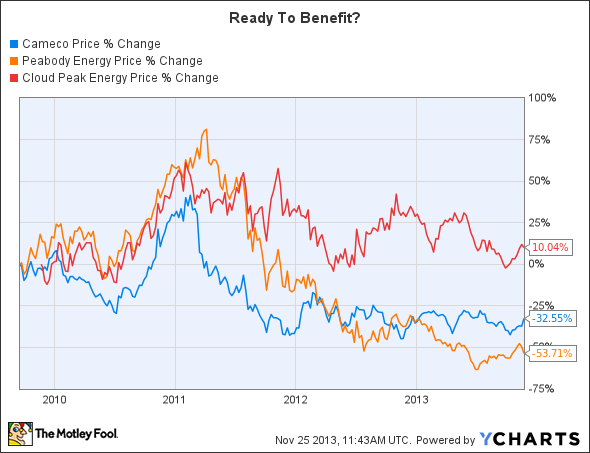

Peabody, with about half of its revenues derived from its Australian mines, is perfectly situated to benefit from Japan's back step and from China's continued coal power push. But it isn't the only company looking to take advantage of Asian coal demand. That includes India, a nation on the same scale as China. For example, U.S. miner Cloud Peak Energy (CLD) has a leading position in South Korea and recently sent test coal to Japan.

That said, Peabody has the infrastructure to deliver coal around the world. Cloud Peak doesn't; it's waiting on new export capacity that won't be available for several years. What Cloud Peak has, however, is an agreement with the Crow Tribe for access to a massive horde of cheap Powder River Basin coal (PRB). So, when the Gateway Pacific Terminal gets built, Cloud Peak will have ample reserves to mine and export. Peabody is also a big player in the PRB, so it too will benefit from the export demand that Cloud Peak is trying to drum up.

Another rethink

Japan's choice to shut nuclear power plants, however, isn't set in stone. In fact, according to uranium miner Cameco (CCJ 0.39%), the country is looking to restart as many as 14 nuclear power plants. While that's clearly good news for Cameco, which effectively lost an entire country as a customer after Fukushima, it further highlights the difficulty of making big promises.

For example, Germany, which has also pledged to shut its nuclear power plants to the chagrin of Cameco, is opening new coal power plants. Why? Because power prices are so low and natural gas prices so high that natural gas power producers are losing money. While low gas prices in the United States makes building gas fired plants an easy choice, hurting miners like Cloud Peak and Peabody, the exact opposite situation is taking shape in Europe.

Obviously the European trend is a good thing for coal miners like Peabody and Cloud Peak, but a bad thing for Cameco and environmentalists. Luckily for Cameco China and India have such a ravenous appetite for energy that nuclear growth in those two nations will drive notable demand for uranium regardless of Germany or Japan. That said, Japan's backstep on nuclear proves that nothing is set in stone.

Undesirable but needed

As countries around the world reevaluate their environmental commitments and the reality of everyday life, demand for coal and nuclear power will continue to expand. Watch global giant Peabody and export focused Cloud Peak on the coal front, as both are trying to capitalize on the trend. Cameco, meanwhile, will benefit from Chinese and Indian demand, and from countries like Japan that realize abandoning nuclear is harder than it sounds.