If you're looking for a winner in the casual-dining space, then you might have a difficult time. Due to the decline of the middle-income consumer, casual dining hasn't been doing so hot over the past several years. These consumers are primarily saving their money, only spending on what is necessary. If a discretionary item or service is desired, it's often purchased after research as well as comparison shopping -- promotions and discounts included. This trend has led to restaurants like Ruby Tuesday (RT +0.00%) struggling. However, there are two good pieces of news to report here.

One is that Ruby Tuesday isn't sitting back and waiting for the industry to change back to the way it used to be. Instead, it's looking to change with industry trends. Therefore, potential exists. The other piece of good news won't be revealed just yet, but it may lead to significant shareholder rewards for another company in the casual-dining space. First, let's take a look at the Ruby Tuesday situation.

Poor results and plans for improvement

In the first quarter, Ruby Tuesday suffered a year-over-year comps decline of 11.4% for its company-owned restaurants, as well as an 8.4% comps decline for its domestic franchise restaurants. These are atrocious numbers, and they left little reason for hope. That said, as stated above, Ruby Tuesday is taking the initiative.

Ruby Tuesday's first goal is menu transformation, which we have already seen with the pretzel burger and flatbreads. According to the company, this is only the beginning of its menu transformation, and Ruby Tuesday is going to base its menu offerings on trends that are hot. This should drive more foot traffic to Ruby Tuesday restaurants. On the other hand, this can only be accomplished if Ruby Tuesday also offers different price points. Fortunately, Ruby Tuesday plans on doing so, which should increase its target market at least to some extent.

The best news is that based on this menu transformation and marketing initiative, Ruby Tuesday expects to see positive comps growth by the fourth quarter. This will be difficult to achieve, but if the company succeeds it's going to look like a successful turnaround story. The tricky part is figuring out if Ruby Tuesday is capable of achieving this goal. On one hand, it's making the right moves to help drive growth. On the other hand, industry trends are often the most powerful force.

Ruby Tuesday might have to find a way to transform itself from a casual-dining eatery to more of a quick-service restaurant if it wants to succeed in today's value-conscious consumer environment. It will also need to cut costs if it wants to see profitable sales growth. Let's take a look at how the company is cutting costs.

Cost-cutting

Ruby Tuesday has already reduced operating expenses through workforce reductions, including 50 positions at its Restaurant Support Center in Tennessee. This move, combined with additional cost reductions targeted by a consulting firm, is expected to lead to a $6 million reduction in annual SG&A expenses beginning in 2015. Ruby Tuesday will need to close this gap between revenue and SG&A expenses in order to succeed:

RT SG&A Expense (TTM) data by YCharts

Now let's take a look at that other interesting opportunity in the casual dining space.

Big potential

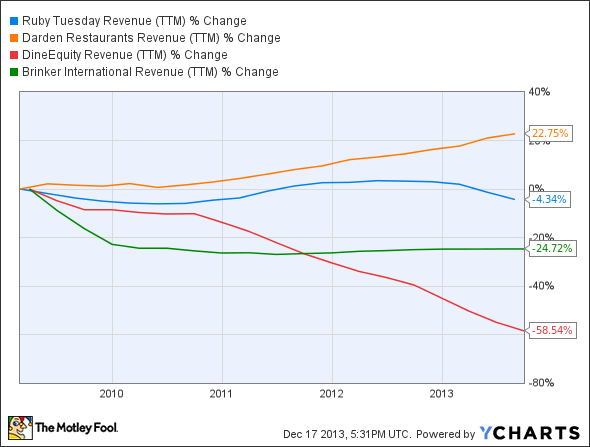

The most commonly discussed names in casual dining are Darden Restaurants (DRI 0.88%), owner of Red Lobster, Olive Garden, LongHorn Steakhouse, Capital Grille, Yard House, and Bahama Breeze; DineEquity (DIN 0.72%), owner of Applebee's and IHOP; and Brinker International (EAT +0.74%), owner of Chili's and Maggianos Little Italy. Now take a look at top-line performance comparisons for these companies over the past five years:

RT Revenue (TTM) data by YCharts

Only Darden has managed to stay north of the casual-dining equivalent of the Mendoza line. On top of that, Barington Group believes that a split-up of the company -- Red Lobster/Olive Garden vs. LongHorn Steakhouse/Capital Grille/Yard House/Bahama Breeze -- could lead to the stock being worth $71-$80 per share.

This is essentially a way for Darden to split into a mature company (Red Lobster/Olive Garden) and a growth company (LongHorn Steakhouse/Capital Grillee/Yard House/Bahama Breeze). Barington Group believes that Darden is too big and complex to compete in its current state. Additionally, it has thrown out the idea of the company forming a REIT as well.

For more on Darden Restaurants's spinoff of Red Lobster read here.

Barington Group owns more than 2% of Darden. Therefore, it has a voice. However, even if this concept doesn't come to fruition, the idea and the excitement surrounding it have the potential to drive the stock price higher. Even if that's not the case, Darden is still delivering top-line growth while also yielding 4.10%. This is a more generous yield than DineEquity and Brinker International, which yield 3.60% and 2%, respectively. Ruby Tuesday doesn't pay a dividend. On top of that, Darden isn't as highly leveraged as DineEquity or Brinker International. Darden has a debt-to-equity ratio of 1.33, whereas DineEquity and Brinker International have debt-to-equity ratios of 4.48 and 7.01. When you combine these facts with Darden outperforming its peers on the top line, Darden looks like the most logical investment option.

Foolish Takeaway

Ruby Tuesday has the best debt management of the group, with a debt-to-equity ratio of 0.55. Not paying a dividend helps. Also, Ruby Tuesday has turnaround potential. However, turnarounds are risky investments, so please do your own due diligence prior to investing. If you're looking for high upside potential with less downside risk in casual dining (relatively speaking), then Darden is likely to be your best option.