The Dow Jones Industrial Average (^DJI 0.51%) has been America's most-watched market index for decades, despite -- or perhaps because -- of its narrow focus on a mere 30 stocks. Where other indices might track 500, or 2,000, or even 5,000 different stocks, the Dow's steady focus on 30 business bellwethers has made it both easier to understand and easier to dismiss as a relic of simpler times. But as long as the Dow remains front and center in every day-to-day market analysis, it and its component companies will remain the most important barometers of American markets.

Source: Wikimedia Commons.

That's why it's important to understand not only the Dow, but its components as well. What do they do? What do they represent on the Dow, and why do they matter to the American economy? Where have they come from and where might they head in the future? Today we'll dig into the details of Caterpillar (CAT 1.61%) to find answers to these questions and more, so that we can understand not just what moves the Dow, but why.

Caterpillar at a glance

- Founded: April 15, 1925.

- Joined the Dow: May 6, 1991.

- Current Dow weighting: 4.1% (eighth-largest weighting).

- Replaced: Navistar as the Dow's industrial-vehicle component.

- Sector represented: Industrial (heavy equipment and machinery).

- Rank (by revenue) among all industrial stocks:

- o 1st (Fortune Global 500, construction and farm machinery)

- o 1st (KHL, construction equipment manufacturers)

Caterpillar, like many of its Dow peers, parlayed early innovations into market leadership. It was named after the "caterpillar-tracked" tractors it pioneered in the early 1900s -- these tracks inspired the design of World War I's tanks, and they also dramatically improved the utility of the farm and construction machinery for which Caterpillar is now known.

Caterpillar boasts of its equipment participating in the construction of numerous important projects over the past century -- nearly every major construction effort in the United States (and many in other countries) since the Great Depression has been heavily supported by Caterpillar machines. Caterpillar has been a bellwether of American (and global) construction and resource extraction for decades; these segments have generally tended to move in sync with the rest of the economy, which makes this company an ideal representative of American industrial might.

Although 2013 was a weak year for Caterpillar, the company nonetheless sold over $52 billion worth of equipment -- $3 billion of its $55.7 billion in fiscal-year revenue came from financial products -- with its energy and power systems division leading the way with over $20 billion in sales. The company is also one of America's largest exporters, shipping nearly $17 billion worth of equipment outside of the United States last year.

Caterpillar by the numbers

- Ten-year share price growth: 181%

- Ten-year dividend growth: 193%

- Total return (with dividends reinvested): 258%

- Average P/E over the past decade: 15.8

- Current P/E premium over average P/E: 17%

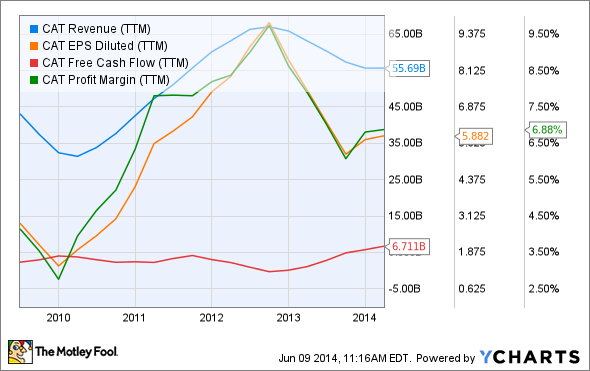

CAT Revenue (TTM) data by YCharts.

- Annualized revenue growth (past five years): 5.3%

- Annualized EPS growth (past five years): 15.3%

- Annualized free cash flow growth (past five years): 23.8%

- Change in profit margins (past five years): 66% improvement

Despite declining revenue and profit in 2013, Caterpillar has nonetheless put together an impressive five-year performance coming out of the financial crisis. The company's growth may now be in jeopardy as the global economy retreats from a boom in resource extraction: Caterpillar now expects its mining segment to suffer a 20% year-over-year decline in revenue for 2014. This isn't the first time that a weak economy has undermined Caterpillar in the short term -- and growth in construction-equipment sales should help hold up its overall revenue for 2014 at levels similar to last year -- but over the long term, Caterpillar has clearly been a good addition to the Dow, as its stock has gained 1,650% (which jumps to 2,800% when accounting for dividend reinvestment) since joining the index, compared to total growth of 475% in the Dow itself. Every time Caterpillar has faded, it's come back stronger than before.

Caterpillar's long-term strategy is remarkably vague -- its "Vision 2020" guidelines offer no specific financial targets and provide no specific estimates otherwise -- but Wall Street remains optimistic, as analysts have projected that Caterpillar will achieve an average earnings-per-share growth rate of 12.8% for the next five years. That falls slightly short of a sector-wide expected growth rate of 13.5%, but it's still remarkably strong for a company that is already by far the leader in its field.