There's a common feeling on Wall Street that a drop in oil prices will have a big impact on solar energy companies, especially if prices stay low for long. You can see in the chart below that solar stocks have almost exactly followed the falling price of oil over the last three months.

What's strange about this trend is that oil has little to nothing to do with the solar energy industry. Solar energy produces electricity, which is dominated by natural gas and coal production throughout most of the world. Those are its natural competitors, not oil that's turned into gasoline to fuel your car.

How the market gets solar energy wrong

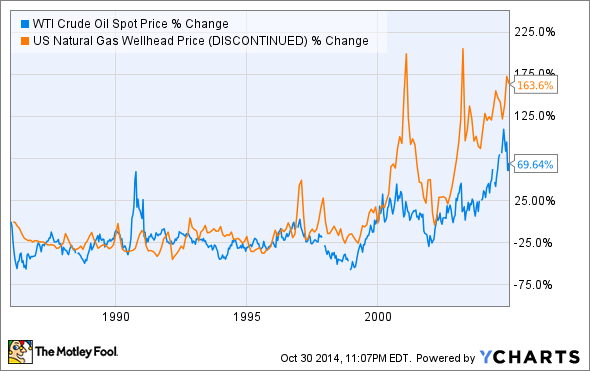

The general assumption in the energy industry is that all energy sources are somehow correlated. For decades natural gas and oil were somewhat correlated, in part because heating oil and natural gas could both be used to heat homes. If the cost of one went down, demand went up, and prices rose again.

Coal was also in this somewhat correlated energy market because it competed with natural gas in electricity generation. If coal got too expensive companies switched to natural gas and vice versa.

WTI Crude Oil Spot Price data by YCharts

But solar energy is playing a completely different game than oil, natural gas, or coal. It's the one energy source that keeps getting cheaper the more that's installed. The chart below is from GTM Research and the Solar Energy Industries Association U.S. Solar Market Insight Report for 2013 and shows a 70% decline in installed solar costs between 2000 and 2013 along with more than a 1,000x increase in installations.

Source: GTM Research and SEIA 2013 U.S. Solar Insights Report.

Not only does solar energy not compete directly with oil and shouldn't be at all correlated with oil, it's riding a completely different trend from oil, natural gas, and coal, which generally see prices rise when demand increases. Solar energy sees higher demand as a driver of cutting costs even more.

Solar leaders see no damage from low cost oil

This week, SunPower's (SPWR) CEO Tom Werner was asked about the low price of oil in his third quarter earnings conference call. He dismissed it without hesitation.

The price of oil has almost nothing to do with future demand, even in [the Middle East]. So we can price solar energy significantly below diesel-produced electricity that $80 oil has no impact on those economics. You have to have substantially lower cost of barrel of oil to even come close to the numbers that you can hit in solar. -- Tom Werner, SunPower CEO

The week also marked an industry milestone when SunEdison (SUNEQ) signed a memorandum of understanding to build 5 GW of solar projects in the Rajasthan state of India. Late in the week the company added another 150 MW in project wins south of Rajasthan in the Karnataka region of India.

If oil prices drove the demand for solar energy around the world you wouldn't know it from India's recent actions or growing demand in the U.S.

Solar energy has shifted the balance of power in energy, allowing homeowners to become energy producers. Image source: SunPower.

Solar energy helps drive energy independence

Another reason solar industry momentum won't slow because of lower oil prices is the energy independence angle. India and China, in particular, have become major oil and coal importers and see solar energy as a way to reduce their reliance on foreign energy to fuel their growth.

China has set a goal of installing 50 GW of solar -- enough to power 8.2 million homes -- by 2018, and NPD Solarbuzz thinks that figure will actually be 100 GW. This will directly fight the coal imports and indirectly impact oil imports when paired with a push to get 500,000 EVs on the road next year and make EVs 30% of the government's vehicle purchases by 2016.

India is limiting coal imports that fuel the country's already unreliable electric grid, and solar is one of the best options to power energy growth. A plan to build 25 GW of new solar generation in the next few years will go a long way to reducing reliance on the outside for India's energy needs and SunEdison's 5.15 GW of deals this week are a step toward reaching that goal.

The solar boom can't be stopped by low-priced oil

Wall Street may be bearish on the future of solar energy at the moment, but the reality is that it's never looked brighter. Solar energy is now cost competitive with the electric grid in dozens of states in the U.S. and a growing number of countries around the world.

It's anticipated that installations will grow 35% from a year ago to 50 GW this year, still just scratching the surface of the industry's potential. Don't let the low cost of oil scare you from jumping into the solar industry. Not even cheap oil can stop this train.