Under new CEO Satya Nadella, who took over earlier this year, Microsoft (MSFT 0.59%) investors have seen the stock hit highs that haven't been achieved since the dot com boom in 1999 and 2000. In a clear vote of approval of Nadella's leadership so far, the stock is up about 30% since he took over. While the gain has been great for shareholders, can investors expect the stock to continue to reward over the long haul after the run-up? More specifically, is Microsoft still a good dividend stock?

Microsoft's recent dividend history

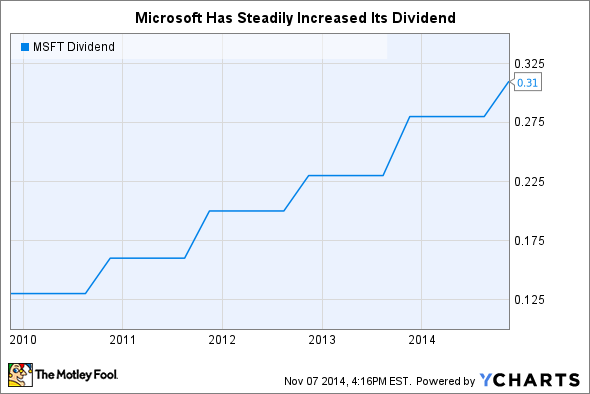

Over the past five years, Microsoft has turned out to be an excellent investment for dividend investors.

Today, the company is paying out $0.31 per share every quarter, or $1.24 annually. Thanks to annual dividend increases, that's up from $0.55 annually five years ago. Best of all, given the software giant's handsome cash flow, investors could actually depend on these annual dividend increases.

MSFT Dividend data by YCharts

And in addition to the growing dividend Microsoft shareholders have gained over the past five years, the value of Microsoft shares have soared 70%, for an annualized ex-dividend return of about 10%.

So Microsoft stock has served investors well over the past five years, with both a meaningful dividend and solid share price appreciation. But is there the same dividend potential for Microsoft over the next five years?

A look at Microsoft's dividend potential today

First and foremost, any dividend stock should have the same sort of qualities investors look for in any other investment. One of my favorite initial qualifiers for stocks to invest in is signs of durability. What gives Microsoft a competitive advantage? For Microsoft, durability is found in its unquestioned leadership in productivity software and its clear place among leaders in enterprise cloud services.

But durability alone isn't enough to make a business a great investment. Investors should also ensure they are not overpaying for the company's earnings and dividend potential. To address this concern, investors should ask whether or not Microsoft can continue to grow its dividend meaningfully going forward.

Two factors that influence a company's dividend payout over the long haul are payout ratio and free cash flow.

MSFT Payout Ratio (TTM) data by YCharts

Payout ratio is calculated by dividing a company's dividend by its earnings. The higher this number, the less room for future dividend increases and the more likely a company will either reduce or stop its dividend if the competitive environment worsens and earnings take a dive. Microsoft's payout ratio of 43%, while still lower than ratios for many staple dividend stocks, is among the highest levels seen in the past eight years. This suggests investors may not see the same growth in the company's dividend over the long haul.

Free cash flow, or cash provided by operating activities minus capital expenditures, is ultimately the cash companies can use to pay out dividends. While there are other uses for free cash flow besides dividends, like share repurchases and future capital expenditures, it's a key indicator of the condition of a dividend investment. Microsoft's growing free cash flow between 2009 and 2012 made dividend increases easy. But the free cash flow levels that have waned since 2012 make future increases less certain.

Looking at these metrics together, current free cash flow levels and a fairly low payout ratio relative to other staple dividend names, it looks like the company will likely continue to increase its dividend in the near term. But investors shouldn't expect Microsoft to be as good a dividend stock as it was in the past five years.