Many economists predicted that the United States would enter a recession in 2023, but what exactly does this mean? In this article, we'll take a closer look at what a recession is, what to expect, and signs that might indicate a recession is coming. We'll also discuss some of the ways you can prepare for a recession -- and navigate through the depths of even a deep recession -- while coming out of it just as financially strong when the dust settles.

What is a recession?

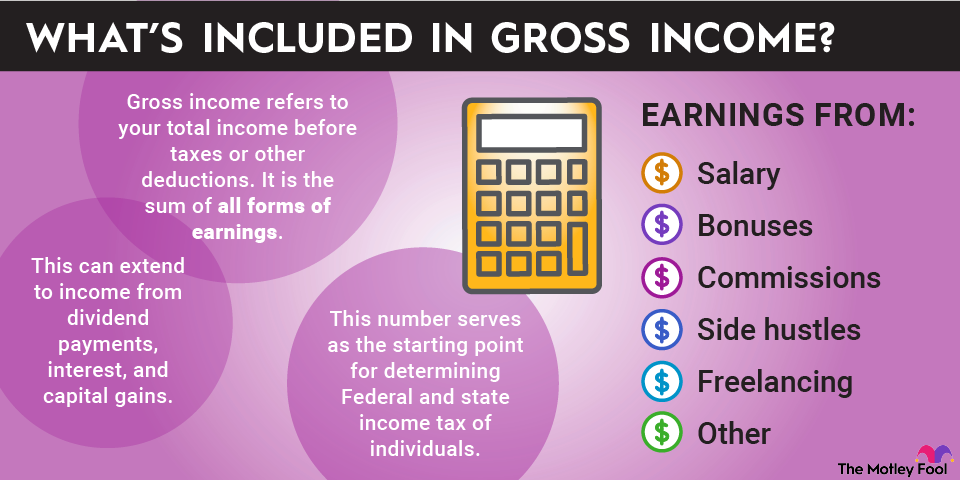

A recession is generally defined as a sustained decline in gross domestic product (also known as negative GDP growth) for two or more consecutive quarters. However, this isn't a perfect definition; having two quarters of negative GDP growth doesn't necessarily mean that we're in a recession.

In addition to poor economic growth, a recession is typically accompanied by widespread job losses, a tightening overall job market, and the need for relief programs such as stimulus checks or funds for certain types of businesses. It is also often accompanied by declines in the stock market.

Understanding recessions and how they work

No two recessions are the same, and it would be almost impossible to put together a meaningful list of things that happen during every recession. For example, stocks don't necessarily lose value during every recession. Sometimes stocks will decline more in anticipation of a recession than they do during the actual recession. However, here's a list of the things that are fairly certain to happen during a recession:

- Economic growth is negative. In other words, GDP declines. If there was one defining characteristic of a recession, this would be it.

- Consumer spending drops.

- Businesses spend less on growth and innovation.

- The unemployment rate increases.

- Loan defaults increase, both for consumers and businesses.

- The government attempts to stabilize the economy.

- The stock market declines and may even fall into a bear market.

It's also worth noting that in recessions, some of these things cause the others or can make them worse. For example, a decline in consumer spending can cause businesses to spend less on things like advertising. Rising unemployment can cause loan defaults to increase as consumers have difficulty paying back their debts.

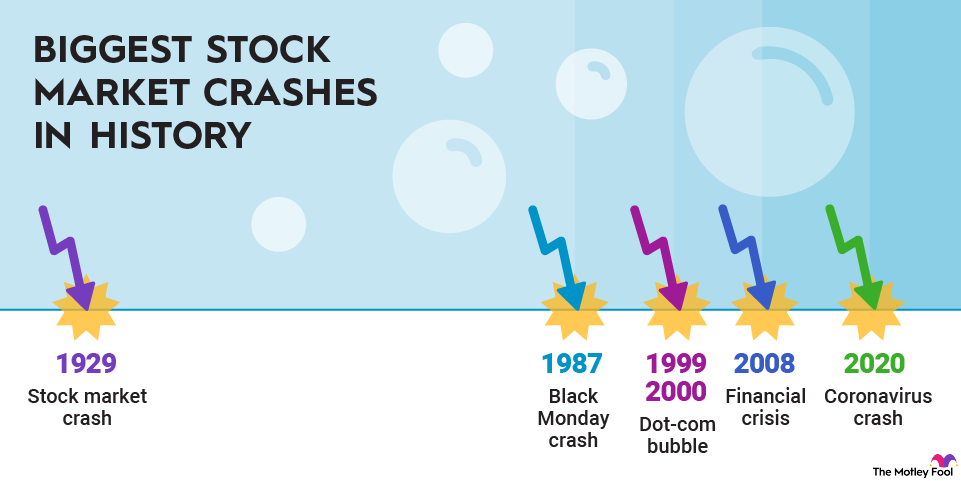

Also, these effects don't only take place during recessions. For example, the recession following the dot-com bubble officially lasted from March through November 2001. However, the unemployment rate in the U.S. didn't peak until June 2003.

Signs a recession is coming

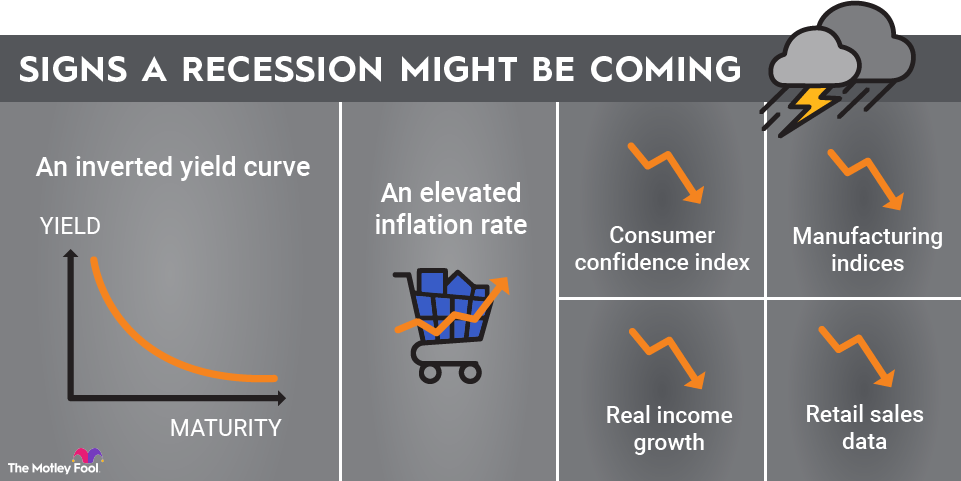

Perhaps the most widely used recession indicator is an inverted yield curve, or when the 10-year Treasury note yield drops below the two-year Treasury yield. In a healthy economy, Treasuries with longer maturities have higher yields.

Yield Curve

Here's an important point: Every recession since the 1970s has been preceded by an inverted yield curve. However, an inverted yield curve occurred in 1998 without a recession following soon. So the presence of an inverted yield curve doesn't automatically mean a recession is coming, but it generally has been a reliable sign.

It's also worth noting that even with an inverted yield curve, there is no way to know the timing of a recession. Generally, an inverted yield curve means a recession won't occur until more than a year later.

There are a few other economic indicators that can predict a recession as well, such as an elevated inflation rate. When inflation is high, the Federal Reserve Board generally tightens monetary policy to bring down the inflation rate, contributing to a recession. Interest rate increases were a big driver of a major 1980s recession.

Other popular economic indicators that a recession might be on the horizon include the consumer confidence index, real income growth, manufacturing indexes, and retail sales data. But, like the inverted yield curve and elevated inflation rates, none are perfectly reliable when it comes to predicting a recession.

Economic Indicators

What causes recessions?

There is no one thing that causes recessions, aside from the generalization of "reduced economic activity." But here’s a list of the five most recent U.S. recessions and the short version of what caused each one:

- COVID-19 recession (February to April 2020): The onset of the COVID-19 pandemic led to widespread lockdowns, which resulted in 24 million people losing their jobs in just three weeks and economic activity plunging at the fastest rate in history.

- Great Recession (December 2007 to June 2009): Irresponsible and predatory lending practices led to a near-collapse of the U.S. housing market and set off ripple effects throughout the financial system. Home equity plunged and access to credit tightened, which made consumer spending drop dramatically. Technically, the Great Recession lasted for a year and a half.

- Dot-com recession (March to November 2001): A speculative bubble in tech stocks fueled by the widespread adoption of the internet burst in the early 2000s, and the Sept. 11 attacks created additional shocks to the economy.

- Early 1990s recession (July 1990 to March 1991): A combination of consumer pessimism, rising debt levels, and an oil price jolt to the economy in 1990 led to a recession after a boom in the 1980s.

- Early 1980s recession (July 1981 to November 1982): Out-of-control inflation in the late 1970s and early 1980s led to aggressive tightening of monetary policy by the Federal Reserve. This, combined with a spike in oil prices caused by the Iranian Revolution, created a relatively long recession.

Tips to survive a recession

Recessions can be scary times to be an investor. But, as we find out every time the stock market declines, there are two types of investors when it comes to recessions and general economic turbulence: Those who are ready for it and those who aren’t. Here are some steps you can take to make sure you are well positioned to not only survive a recession but to come out even stronger on the other side.

Be financially prepared for a recession

One of the smartest things you can do to survive a recession, whenever it comes, is to think defensively when it comes to your personal finances. This mentality can help you prepare for a recession before it arrives.

It’s important to keep an emergency fund. Most financial planners suggest that saving six months' worth of expenses is a good target, but you don't necessarily need to get there to have a valuable level of protection. Remember, recessions are typically accompanied by elevated unemployment and tight labor markets. An emergency fund can help you survive a job loss without needing to tap into your retirement savings or use credit cards for day-to-day expenses.

Cost Cutting

It's also a smart idea to think about cutting expenses, which you can either do proactively or when a recession comes. It can be a useful exercise to identify how much money you're spending on things you don't need. Try printing out the past two months of your bank and credit card statements and highlight any expenses you could potentially cut.

Finally, getting rid of high-interest debt before a recession hits can be a smart way to recession-proof your personal finances. In recessions, we typically see loan default rates spike as people lose their jobs and can't pay their bills. As a general rule, the lower your debt level, the better prepared you’ll be for a recession.

Don't cash out of the stock market

It's common knowledge that the central goal of investing is to buy low and sell high, regardless of whether you're talking about long-term investments such as a 401(k) or a stock trading strategy. We invest because we hope to sell whatever we buy for more money in the future. However, our instincts tell us to do the exact opposite when times get tough. When the stock market plunges, it's a natural reaction to wonder, "Should I sell and cut my losses before things get any worse?"

With that in mind, it's important to emphasize that cashing out during a recession or market downturn is one of the worst moves a long-term investor can make. For example, if you had cashed out of an S&P 500 index fund when the market first dropped by 20% in the 2007-2009 recession, you would have avoided another 30 percentage points of losses before the market reached the bottom. However, you also would have missed out on a subsequent 300% gain. If stock fluctuations stress you out, stop checking your stock portfolio every day and focus on the long term.

Related recession topics

Don’t try to time the bottom

In the previous example, you might be thinking, "Sure, but why wouldn't I just buy back when the market bottoms out?" The answer is: It's much easier said than done. Nobody knows how far the markets will fall during tough times.

The S&P 500 declined by more than 19% in 2022. It recovered a significant percentage through the first six months of 2023. But it could fall another 20% or more if a bad recession comes, or it could simply continue moving higher and enter a new bull market. Nobody knows.

Trying to time the stock market is a losing battle. The best course of action (especially during recessions) is to continue to look for excellent stocks or exchange-traded funds (ETFs) trading for attractive valuations and to build positions over time.

The bottom line on recessions

Recessions are a natural part of the economy. There will always be a future recession, but there is no reliable way to predict when. The best thing you can do as an investor is to know what a recession is and how to prepare and react to one.

FAQs

FAQs about recessions

About the Author

The Motley Fool has a disclosure policy.