If you're a small business owner or work for yourself, your expertise is likely in your business, not in understanding basic accounting principles or confusing business terms.

But to manage your business and your finances properly, it’s important to understand these basic accounting terms.

The top 25 accounting terms you should know

Small business accounting software applications have made it easier than ever to manage your finances without a lot of accounting knowledge.

It’s in your best interest to have a working understanding of these basic accounting and business terms and what they mean.

1. Accounting period

An accounting period is a specific period of time covered by financial statements. An accounting period can be one month, one quarter, or one year, depending on the business.

2. Accounts payable (A/P)

Accounts payable (A/P) represents the money that your business owes for goods and services. A/P can be anything from your utility bill to the rent on your office. You typically receive a bill from the vendor for these goods and services, which is usually due within 30 days.

3. Accounts receivable (A/R)

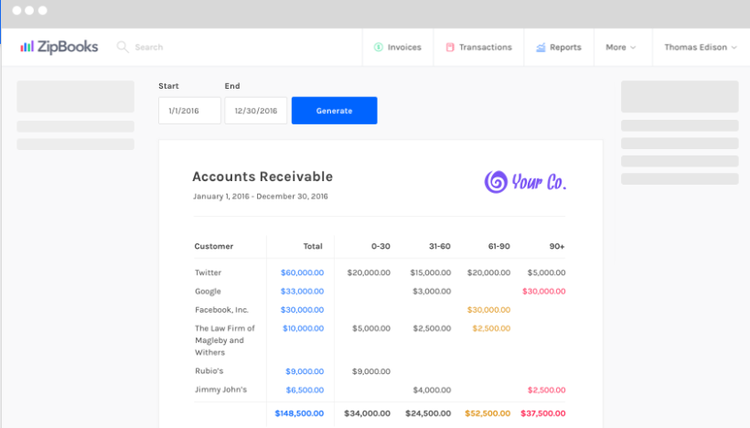

Accounts receivable is the amount of money due your business for goods and services that you have provided. When you write an invoice, that invoice amount becomes part of your A/R balance. Knowing your accounts receivable amount is integral to calculating your accounts receivable turnover -- beneficial for forecasting and gaining deep business insights.

This A/R feature in ZipBooks displays all active accounts that have a balance due. Image source: Author

4. Accrual accounting

Accrual accounting records transactions when they occur rather than when payment is made or received.

Most regular businesses use accrual accounting. If you have employees, you must use the accrual accounting method.

5. Asset

An asset is defined as anything of value that is owned by your company. Cash, A/R balances, inventory, buildings, land, and vehicles are all considered assets. Assets can also be intangible, such as copyrights and trademarks.

6. Bank Reconciliation

This is the process by which you ensure that your general ledger (G/L) accounts are in balance with your ending bank balance for a specific month.

The bank reconciliation process is designed to locate and record any bank charges not included in your G/L as well as locate any bank posting errors. A bank reconciliation should be done each month for all active bank accounts.

7. Capital

Capital, or business capital, is the financial assets that a business needs in order to produce the goods and services it sells. Capital can be in the form of equity by offering stock, or debt, which can be a loan or credit line obtained from a bank. Capital can also be intangible, such as brand name.

8. Cash accounting

Cash accounting records payments when they are received and expenses when they are paid, not when they’re incurred.

Most sole proprietors and very small businesses use cash accounting, but if you have employees, you must use the accrual accounting method.

9. Certified Public Accountant (CPA)

Certified Public Accountant or CPA is a designation given by the American Institute of Certified Public Accountants (AICPA) to individuals who pass an exam and meet both educational and experience requirements.

CPAs are subject to a code of ethics and can specialize in many areas, including auditing, bookkeeping, forensic accounting, and information technology. Most, however, are known for their income tax expertise.

10. Cost of goods sold (COGS)

Cost of goods sold is the direct cost of producing or purchasing the items you have for sale. This can include anything from materials and labor, to the cost of a product you purchase for resale.

It’s important to keep track of your COGS in order to properly calculate your gross and net profit.

11. Credit

A credit is an accounting entry that is made on the right side of any accounting transaction. A credit entry will increase a liability or equity account, while it will decrease an asset account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 12-31-19 | Cash Account | $1,000 | |

| 12-31-19 | Accounts Receivable | $1,000 |

Debits increase assets, while credits decrease assets.

12. Debit

As opposed to credit, debit is an accounting entry that is made on the left side of any accounting transaction. A debit entry will increase an asset or expense account and decrease a liability or equity account.

13. Depreciation

Depreciation represents how much of a particular asset has been used over a period of time.

There are different types of depreciation, and the most basic method is straight-line depreciation. It allows you to report equal depreciation expense each year, until the asset has been fully depreciated.

Other depreciation methods include declining balance, double-declining balance, and sum-of-the-year’s digits.

14. Expenses

Expenses reflect the cost of doing business. Expenses pay for items or services, and are a necessity in order to earn revenue.

Salaries, advertising, rent, commissions, and the items you report on your expense report are considered business expenses you should track.

15. Equity

Equity is the owner’s stake in a business.

Equity is measured by calculating the difference between assets and liabilities reported on your balance sheet. The difference represents the value of your business, which can be a positive or negative number. If your equity is a negative number, your business loses value.

16. Financial statements

Financial statements are designed to report the financial performance of your company and are used by investors, auditors, and creditors to determine the business’ financial health. The basic three financial statements are:

- Balance sheet

- Income statement

- Cash flow statement

17. Generally accepted accounting principles (GAAP)

Generally Accepted Accounting Principles (GAAP) are a common set of rules which include basic accounting principles, standards, and procedures that have been issued by the Financial Accounting Standards Board (FASB).

GAAP guidelines currently operate on ten key principles. Any publicly-traded company in the U.S. must follow GAAP standards.

18. General ledger (G/L)

General ledger (G/L) is a complete record of all of your accounting transactions.

Whether you use accounting software or handle your accounting manually, you will use a G/L, which represents a repository of all of the financial transactions made by your business.

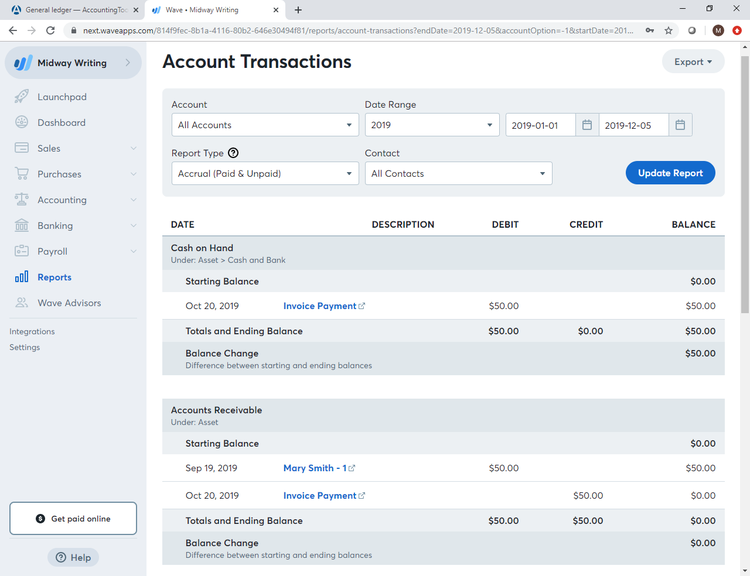

This is an example of a G/L report in Wave Accounting. Image source: Author

While simplified, this G/L report in Wave Accounting provides you with a list of all transactions completed for each G/L account.

19. Gross profit

Gross profit is the amount of revenue left after you deduct the cost of providing a service or making/manufacturing a product.

To calculate gross profit, take your revenue and subtract the cost of costs sold. The total revenue left is considered your gross profit.

20. Inventory

Inventory is the goods owned by a business that are ready or being made ready for sale. There are three stages of inventory:

- Finished goods that are ready to be sold

- Work-in-progress such as assemblies or kits

- Raw materials that are used to create ready-to-sell inventory

If you sell products, it’s important that you manage your inventory properly, including receipt of goods or materials along with sales of completed goods in order to maintain an accurate valuation of inventory.

21. Journal entry

Journal entries record business transactions. Common with manual bookkeeping systems, journal entries are still used today to record financial transactions. All journal entries should have a date, as well as the account to be debited and the account to be credited.

| Date | Account Number | Account | Debit | Credit |

|---|---|---|---|---|

| 12-31-19 | 6000 | Bank Fees | $55 | |

| 12-31-19 | 1000 | Cash Account | $55 |

This is how you would record bank fees as a journal entry.

22. Liability

A liability reflects a financial obligation your business owes to another entity. Accounts payable, accrued expenses, and payroll are all considered liabilities.

23. Net profit/loss

Net profit reflects the final profit or loss of a business after all expenses are calculated.

Like gross income, net income subtracts any cost of goods sold from revenue received. However, in order to determine your net profit or loss, you will also have to subtract all expenses from the revenue total as well.

For example, if your revenue total was $450,000; cost of goods sold was $150,000; and operating expenses were $200,000, your net profit would be $100,000.

Revenue COGS Expenses Net Profit

$450,000 - $150,000 - $200,000 = $100,000

24. Overhead

Overhead reflects the cost of doing business that is not directly related to creating a product or service. Administrative costs such as office rent, insurance, utilities, and administrative personnel are all considered overhead.

25. Revenue

Revenue is the income that your business receives from regular business activity. Whether that activity is selling products or providing services, revenue is what you receive when your customers pay for those goods or services.

The top 25 is a good start

While you’ll likely continue to run into various unfamiliar words, phrases, and acronyms, getting acquainted with these top 25 accounting terms can go a long way towards making you much more comfortable with the accounting process.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.