As a small business owner, choosing a bank for your business is an important decision. Businesses live and die on the strength of their finances. A business checking account is just the start. The best banks for small business also provide top-notch services with low fees.

Our guide explores the different things you should consider when selecting a new bank for your business.

Show Best Offers Available in

| Offer | APY | Minimum to Earn APY | Next Steps | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

Member FDIC.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

APY:

0%

|

Minimum To Earn APY:

N/A

|

||||||||||

Member FDIC.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

APY:

up to 4.25%

Rate info

Bluevine Premier customers will earn 4.25% APY; Premier subscriptions cost $95 per month. Bluevine Standard customers will earn 2.0% interest on total balances up to and including $250,000 only if they spend $500 or more on their debit card or receive $2,500 or more in customer payments each month. No interest earned on balances over $250,000.

|

Minimum To Earn APY:

$0

|

||||||||||

American Express® Business Checking

Member FDIC.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

APY:

1.30%

Rate info

APY = annual percentage yield

|

Minimum To Earn APY:

$0

|

||||||||||

EverBank Small Business Checking

Member FDIC.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

APY:

0.50%

|

Minimum To Earn APY:

$0

|

||||||||||

Member FDIC.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

APY:

0%

|

Minimum To Earn APY:

N/A

|

||||||||||

Bank of America Business Advantage Fundamentals

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

APY:

0%

|

Minimum To Earn APY:

N/A

|

||||||||||

Novo Business Checking Account

Member FDIC.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

APY:

0%

|

Minimum To Earn APY:

N/A

|

|

|||||||||

LendingClub Tailored Checking

Member FDIC.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

APY:

1.50%

|

Minimum To Earn APY:

—

|

|

|||||||||

We believe a bank should understand the unique financial goals of the small businesses it serves. Here’s what we look for in a good banking partner:

- Top-notch customer service

- A range of banking services for checking, savings, loans, and credit cards

- Low fees and valuable features

These factors are crucial to building a comfortable banking relationship for your small business.

Show Best Offers Available in

Axos Basic Business Checking

- Welcome bonus

- No minimum deposit

- No monthly maintenance fee

- Unlimited transactions

- Free domestic incoming wires

- Unlimited domestic ATM fee reimbursements

- Clunky web interface and mobile app

- No branch access; online only

- Difficult to make cash deposits

The Axos Basic Business Checking account is an affordable and user-friendly option for startups and small businesses. As an online-only bank, it’s able to offer perks, like ATM fee reimbursements, that you don’t typically see with business checking accounts at brick-and-mortar banks. It also has far fewer fees than you typically see, which can help you hold onto more of your cash.

Use promo code NEW400 and apply by December 31st, to earn up to a $400 bonus!

To be eligible to earn all or a portion of the cash incentive as part of the promotional offer "NEW400," an application for a Basic Business Checking account or a Business Interest Checking account must be submitted between 09/30/2023 at 12:00 am PT and 12/31/2023 at 11:59 pm PT. Axos Bank reserves the right to limit each primary account holder or business title to one (1) checking account promotional offer per year. Axos Bank or Axos Bank for Nationwide checking customers or Businesses that have held an Axos Bank or UFB or Axos Bank for Nationwide checking or savings account in the past 12 months under the same title are not eligible for this offer. Promotional terms and conditions are subject to change or removal without notice. Incentive may be taxable and reported on IRS Form 1099-MISC. Consult your tax advisor. After initial requirements above are met, the amount of incentive earned will depend on meeting the additional requirements outlined below:

Small Business Checking bonus up to $400: You must be approved for your new Basic Business Checking or Business Interest Checking account and fund it within 30 days of account opening. An incentive of up to $400 can be earned during the first five (5) statement cycles. A statement cycle is a calendar month consisting of at least one day your account was open during that month. You can earn a maximum of four (4) payouts during the five (5) statement cycles, and the incentive will be deposited into the qualifying account within 10 business days following the end of the statement cycle in which the balance requirement was met.

- $75 will be earned for each statement cycle, up to $300 when you meet three requirements: 1) the average daily balance in your Basic Business Checking account or Business Interest Checking Account is between $25,000 and $49,999.99, 2) you have completed ten (10) point-of-sale transactions per month using your Small Business Checking Visa® Debit Card for signature-based purchases with a minimum of $3 per transaction, 3) You must also have bill pay set up and connected to your Basic Business Checking account or Business Interest Checking account. The bill pay transaction minimum is $10.

- $100 will be earned for each statement cycle, up to $400 when you meet three requirements : 1) the average daily balance in your Basic Business Checking account or Business Interest Checking Account is greater than $50,000, 2) you have completed ten (10) point-of-sale transactions per month using your Small Business Checking Visa® Debit Card for signature-based purchases with a minimum of $3 per transaction, 3) You must also have bill pay set up and connected to your Basic Business Checking account or Business Interest Checking account. The bill pay transaction minimum is $10.

Your Small Business Checking account must remain open and in good standing at the time the incentive is paid to be eligible. Furthermore, your Small Business Checking account must remain open for 150 days, or an early closure fee of up to $400 may apply.

U.S. Bank Silver Business Checking

- No monthly fees

- 125 free monthly transactions

- Discounted checks

- Low minimum deposit

- Large branch and ATM network

- Card payment processing and cash management services available

- Not interest-bearing

- Can be costly for businesses with high transaction volumes

- Transaction limits

The U.S. Bank Silver Business Checking account is a good fit for small business owners who aren't ready to pay for a business checking account. Its feature list may not be as robust as some of its competitors, but it comes with all the tools you need to manage your funds as well as a decent number of free monthly transactions.

Earn up to a $800 bonus when you open a new, eligible U.S. Bank business checking account online with promo code Q2AFL24 and complete qualifying activities1, subject to certain terms and limitations. Offer valid through August 30, 2024. Member FDIC.

Bluevine Business Checking

- 2.0% APY on balances up to $250,000 for free customers

- 4.25% APY without restrictions for paying Premier customers

- No monthly or overdraft fees and unlimited transactions

- Can create multiple sub-accounts and securely share access with employees

- Free customers need to meet monthly activity goal to qualify for maximum APY

- Highest APY only available to paying customers

- No physical branches

- Fee for out-of-service ATM networks

- Fee to deposit cash

An online-only business checking account with the potential for a very competitive interest rate for those who can meet the requirements. However, if you don't meet the requirements, you don't earn any interest at all that month. You can avoid those requirements and earn a significantly higher rate, but only if you pay a monthly subscription fee.

American Express® Business Checking

- Competitive APY

- No account fee

- Earn rewards on purchases

- New account bonus with qualifying activity

- Online-only account

- Foreign transaction fees

- No cash deposits

- Can't link to personal Amex account

Amex is, well, Amex. The bank and card issuer is known for some of the best customer service around. American Express offers an online-only business checking account with a very competitive APY (annual percentage yield) and the ability to earn Membership Rewards® points on debit card purchases.

EverBank Small Business Checking

- No cap to earn APY

- No monthly maintenance fee

- ATM fee reimbursements

- $1,500 to open an account

- Few physical branches

- High wire transfer fees

EverBank's small business checking accounts are created exclusively for sole proprietors and single-owner LLCs. The account offers a competitive yield and no monthly maintenance fees. EverBank does not charge ATM fees and will automatically reimburse you up to $15 for the ATM fees paid at other U.S. ATMs each month, regardless of your EverBank account balance. EverBank requires a minimum of $1,500 to open an account, which is rather high.

Chase Business Complete Checking

- Account fee can be waived

- New account bonus with qualifying activity

- Huge footprint of brick-and-mortar locations

- Great variety of accounts and services

- Account fee is high if not waived

- Monthly cash deposit limits

A solid option for business owners who can maintain the requirements for the fee waiver and who want easy access to in-person banking. While the Business Complete account isn't free by nature, meeting the minimum balance to waive the fee is likely doable for many small businesses.

Bank of America Business Advantage Fundamentals

- Account fee can be waived with qualifying activity

- Competitive monthly cash deposit limit

- Large footprint of brick-and-mortar locations

- Account fee is high if not waived

- Wire transfer fees

Bank of America is a good choice for cash businesses thanks to a very competitive monthly cash limit and an account fee that can be waived with qualifying activity.

Novo Business Checking Account

- No account fee

- Unlimited ATM fee reimbursement

- Free incoming wire transfers

- 15+ native integrations

- Minimum balance to open

- Online-only account

- Doesn't earn interest

A no-fee business checking account with more than a dozen apps and integrations good for freelancers who don't need brick-and-mortar access.

LendingClub Tailored Checking

- 1.50% APY on balances up to $100,000 and 0.10% APY after that

- Earn unlimited 1% cash back on qualified purchases

- Unlimited automatic ATM fee rebates

- Only two physical branches (Lehi, Utah and Boston, Mass.)

- Need an account balance of $500 to qualify for no monthly fees

LendingClub is an online-only bank with only two physical branches, one in Utah and the other in Massachusetts. The Tailored Checking account is a business bank account that offers 1% cash back, unlimited ATM rebates, and 1.5% APY on balances up to $100,000. LendingClub offers a robust app where you can create and send digital invoices and also get paid online with Autobooks, an accounting software solution.

What we look for in a great business checking account

While every company will have slightly different needs when it comes to their business bank account, here are a few things all the best small business checking accounts have in common.

1. FDIC insurance

FDIC insurance protects your business funds -- up to $250,000 per person per account type -- against bank failure. However unlikely, you don't want to risk losing all your hard-earned cash just because your bank couldn't keep its doors open. So you must make sure that whichever business checking account you choose is backed by the FDIC. Nearly all brick-and-mortar and online banks have this protection, so it shouldn't limit your options.

2. User-friendly account management tools

Whether you choose a brick-and-mortar or an online bank for your small business checking account, it should include an online portal and a mobile app where you can, at a minimum, view your balance, transfer funds, pay bills, and remotely deposit checks. This is often the fastest and simplest way for businesses to manage their money and it enables you to do so from just about anywhere.

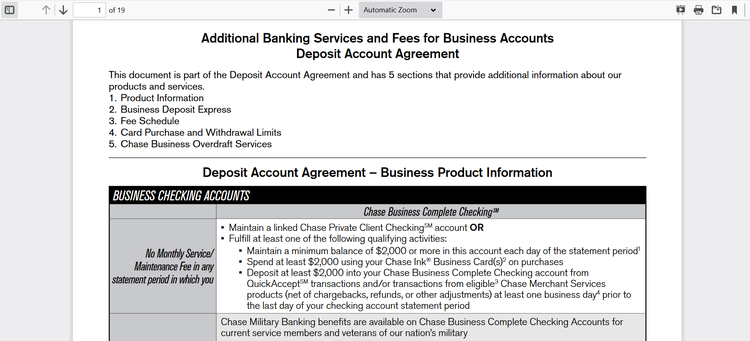

Always check the business checking account's fee schedule before you sign up so you know exactly what your bank can charge you for. Image source: Author

3. Reasonable fees

How much you'll pay for your business checking account depends in part on which bank you choose. Some online business checking accounts don't charge maintenance fees or per-transaction fees at all, but these charges are common among brick-and-mortar business checking accounts.

What's considered a reasonable fee depends in part on what you need from your business checking account. An account with a high monthly transaction and cash deposit limit, for example, will likely have a higher maintenance fee than a more basic business checking account. But the best business checking accounts will have fees that are in line with comparable accounts at other banks and won't nickel-and-dime you for every little thing.

4. Good customer service

The best business checking accounts provide customers with multiple avenues for seeking support when they need it. Phone and email support are fairly common, and brick-and-mortar banks have branches where you can get in-person assistance from someone who knows you and your company. The best banks also have high customer satisfaction ratings, which you can gauge by looking at customer reviews and third-party customer satisfaction surveys.

What should I look for in a bank for my small business?

To choose a bank for your business, you need to know what you actually want out of it. The basic things to think about include:

- Type: The type of bank you choose will dictate everything from how you make deposits to the price you pay for your account. Do you want in-person services, or are you comfortable doing everything online? What kind of accounts do you need, and how much are you willing to pay for them? Answering these kinds of questions can help you decide between traditional banks, online banks, community banks, and credit unions.

- Services: Nearly every bank that offers small business accounts has a basic checking account option. But most will also offer other services, like business loans and credit cards. Choose a bank with the services that suit your needs.

- Fees: A few banks offer no fee business checking accounts, especially for entry-level accounts. Others may have fees that can be waived by meeting certain conditions. It's not uncommon to see these fees reach $15 to $25 a month, so it's important to consider if you can (continuously) qualify to have it waived.

- Interest: Many business checking accounts will earn interest on your balance. Banks with business savings accounts may offer better rates. If you're going to keep your profits in the account long enough to earn interest, it may be worthwhile to look around for a decent rate.

How to choose the best bank for your small business

There are a lot of considerations when comparing your banking options, from the type of institution to the fees they charge. In the end, each business is unique, and you'll need to make the decision based on your specific needs. Here are a few different aspects to consider when making your choice:

The type of institution

You can find many different types of financial institutions for your small business banking needs. The type of institution you choose will influence the services they offer and how you use them.

- Large traditional bank: Large national -- and multinational -- banks tend to have many brick-and-mortar locations and lots of services. They also typically have higher fees and may not provide the personal service of a smaller institution.

- Regional/community banks: While the large banks tend to make the headlines, most areas have a number of smaller regional or local banks. These will have fewer locations than larger banks, but may offer better fees and service.

- Online bank: The last decade or so has seen a massive increase in the number of banks that operate entirely online. These banks have lower overhead than competitors who maintain brick-and-mortar locations, so they often have lower fees and better interest rates. The downside is that you'll need to do everything online, including depositing checks and chatting with customer service.

- Credit union: A credit union is essentially a bank that is owned by its members (rather than investors). Credit unions typically have small local footprints, with only a few locations. You need to become a member to use their services. All of the credit union's profit is put back into the credit union, so they often have the lowest fees and best rates.

Learn more: Credit Unions vs. Banks

The services offered

You could be looking for a basic business bank account, or a one-stop-shop for all your business's financial needs. Either way, be sure to explore all of the services offered before choosing a bank. Here's a look at a few of the most common services offered by small business banks.

Business checking accounts

This is the most basic service a small business bank should offer. It is the account you use to make payments and deposits. It should also come with a debit card that lets you make purchases and withdraw funds from an ATM. A business checking account is the cornerstone of a well-organized small business.

Business savings accounts

Some business checking accounts offer modest interest rates. But if you want more interest on your deposits, a business savings account may be a better option.

In general, you should aim to keep your everyday funds in your checking account and just use the savings account for money you're hanging onto for a while. That's because most savings accounts limit how many withdrawals you can make from your account each month. This is typically due to the Federal Reserve’s Regulation D, which limits transfers from certain accounts.

Merchant services

Some banks provide merchant services, which let you accept credit and debit cards from customers. Using your bank for this can have a few benefits over third-party services, including quicker funding. That said, you'll still want to compare a few options to find the best rates and fees.

Business loans / credit lines

Small business loans and credit lines can be hard to get before you build a solid business credit history. But a good relationship with the bank could help you secure financing for your business. This seems to be particularly true of smaller banks and credit unions. Having your business bank account and business loan in the same institution can also make it far easier to make payments and manage your accounts.

RELATED: Small Business Loans vs. Personal Loans

Business credit cards

This is perhaps the least important service to look for in a prospective bank for your business. It's relatively easy to get great small business credit cards even if you don't have a banking relationship with the issuer. However, some banks offer rewards or checking bonuses if you have both a bank account and a credit card account, which can be a valuable perk.

RELATED: Best Business Credit Cards

The account fees

Many banks charge monthly maintenance fees for business checking and savings accounts. A basic business checking account fee could be $15 to $25 in some cases. If you want a business account with more features -- higher transfer limits, better interest, etc. -- you may pay even more.

The easiest way to avoid these fees is to choose a bank account with $0 monthly maintenance fees in the first place. Many online banks and credit unions offer business checking accounts without maintenance fees. Keep in mind that these low-cost accounts may not have a ton of features.

Alternatively, many accounts will waive the monthly fees if you meet certain conditions. These commonly include:

- Meeting a minimum daily balance

- Making a minimum number of monthly deposits

- Having/using a credit card from the same bank

- Opening/linking a higher-tier account

The requirements you need to meet to waive the monthly fee will vary based on the account type and fee amount. Basic accounts with low fees may only require a small daily balance. Top-tier accounts with many features will require you to meet high balance or transaction requirements.

The minimum balance requirements

Certain types of accounts may have minimum balance requirements you need to meet to open and/or maintain the account. These minimums will vary significantly based on the type of account.

For instance, basic, entry-level business checking accounts will have a low ($100 or less) or even $0 minimum balance requirement to open an account. Top-tier checking accounts -- those with lots of features or particularly high interest rates -- may have minimum balance requirements in the five and six figures.

As noted above, accounts without initial balance requirements may have them to waive monthly fees. This also varies by account type, with basic accounts having the lowest requirements.

The interest rates

One feature offered by banks is the ability to earn interest on your balances. A number of popular business checking accounts let you earn interest (albeit at a low rate). But business savings accounts will usually offer a better APY (annual percentage yield).

Some banks will have tiered interest rates that give you a better APY for having a higher balance. Others may offer a boost to your APY if you bundle multiple bank products, such as opening their business credit card. (Just watch out for additional account fees that could reduce the value of that added interest.)

The transaction and transfer limits

How often you need to use a bank's various services can impact which bank you choose. For example, some banks put limits on the number of deposits you can make into a business checking account each month. If you have a cash-heavy business and will need to make nightly or even weekly deposits, it's important to check for these limitations.

Similarly, banks that offer merchant services tend to have caps on how many transactions you can process. These caps may be per day, per month, or even per year. If you process many transactions each day, you'll want a merchant services account that can handle a large volume of transactions.

The security and convenience

Nearly all banks and credit unions these days offer the basics like online banking. Most will also have some sort of mobile banking app. In general, the bigger (and richer) the bank, the better the digital experience will be.

At a minimum, these platforms should all offer the ability to check your balances and perform basic banking functions. For instance, mobile check deposits are pretty much universal. They should also include standard security features, such as:

- Reporting lost or stolen payment cards

- Freezing your debit and credit cards

- Disputing/reporting unauthorized transactions

- Two-factor authentication

While the digital features are fairly common, if you want the option to pop in and speak with a human, the type of bank you choose will play a part. Online banks don't have brick-and-mortar locations. Community banks and credit unions typically have limited locations. Frequent travelers may find themselves outside their bank's range. In that case, a large national or multinational bank may be the best fit.

Ready To Get Started? How to open a bank account for a business

What you will need in order to open a business checking account

In order to open a business checking account, you'll need the following things.

1. Employer Identification Number or Social Security number

Sole proprietors may be able to open a business checking account with just their Social Security number, but if you want to open an LLC bank account, you will need an Employer Identification Number (EIN), which you can get for free on the IRS website.

2. Personal identification

You'll need a driver's license, passport, or other government-issued photo ID in order to open a business checking account.

3. Business license

Your bank will want to see your business license that proves that you are operating a legitimate business in your state. It should list your name, any business partners' names, and your business name.

4. Business organization documents

You must present your articles of incorporation or articles of organization in order to open a business checking account. What these documents must entail varies slightly from state to state, but it should include your business name and address as well as an outline of how your company is structured, the type of business you do, and who its registered agents are.

5. Certificate of assumed name

If your business advertises to customers using something other than its legal name, you must have a certificate of assumed name, also known as a "doing business as" name. Your bank will need to see this when you open your business checking account.

6. Partnership agreement

If you have business partners, you will need to present your partnership agreement to your bank outlining each partner's rights and responsibilities to the business.

Discover our other checking account top picks

Our checking account methodology

At The Motley Fool Ascent, we rate checking accounts on a five-star scale (1 = poor, 5 = best). We evaluate all checking accounts across four main criteria: brand and reputation, APY and rewards, fees and minimum requirements, and perks.

Our scores are weighted as:

- Brand and reputation: 30%

- APY and rewards: 30%

- Fees and minimums: 15%

- Other perks: 15%

Learn more about how The Motley Fool Ascent rates bank accounts.

Banks we monitor

-

Here are the 100+ financial institutions we've evaluated in our research:

Alliant, Ally, All America Bank, American First Credit Union, American Express® National Bank, Arvest Bank, Aspiration, Axos Bank, B2 Bank, Bank of America, Bank5 Connect, Bank7, Barclays, Bask Bank, Betterment, Bluevine, BMO, Bread Financial, Capital One, Carver Federal Savings Bank, Charles Schwab Bank, Chase, Chime, CIT, Citibank, Citizens Bank, Citizens Savings Bank, Columbia Bank, Connexus Credit Union, Consumers Credit Union, Copper, Cross River Bank, Customers Bank, Discover® Bank, E*TRADEEdward Jones, EverBank, Fidelity, Fifth Third Bank, First Foundation Bank, First Internet Bank of Indiana, First National Bank, First Tech Federal Credit Union, Flushing Bank, Freedom Bank, Generations Bank, GN Bank, Golden 1 Credit Union, Greenlight, Harborstone Credit Union, HSBC, Huntington Bank, Ivella, Kabbage by American Express, KeyBank, Laurel Road, LendingClub, Liberty Bank, Liberty Federal Credit Union, Marcus by Goldman Sachs, Mercury, Municipal Credit Union, Mutual of Omaha, NASA Federal Credit Union, Nationwide Bank, Navy Federal Credit Union, NBKC Bank, New York Community Bank, Northpointe Bank, Novo, OceanFirst Bank, Old National Bank, ONE Finance, OneUnited Bank, Oxygen, Pacific Western Bank, PNC Bank, Ponce Bank, Popular Direct, Presidential Bank, Prime Alliance Bank, Quontic, Radius, Raisin, Redneck Bank, Regions Bank, Relay, Republic Bank of Chicago, Revolut, Salem Five Bank, Sallie Mae, Santander Bank, SchoolsFirst Federal Credit Union, Simple, SoFi, Synchrony Bank, Tab Bank, TD Bank, Third Federal, Truist Bank, U.S. Bank, UFB, Upgrade, USAA, Valley Bank, Vanguard, Varo Bank, Vio Bank, Wealthfront, Wells Fargo, Western Alliance Bank, and Zeta.

FAQs

-

Yes, people who have a small business should have a business checking account. Individual accounts help keep your personal and business finances separated. This makes it easier to budget for your business, as well as being beneficial at tax time.

-

The choice between online and traditional brick-and-mortar banks is largely about personal preference. One big consideration is that online banks don't provide in-person services. Instead, you'll complete all of your banking tasks, including making deposits, through an online account or mobile app. If you're more comfortable with visiting a branch for certain tasks, a traditional bank may be a better choice.

Online banks can have -- but aren't guaranteed to offer -- lower fees than traditional banks due to the reduced overhead costs. But you can also typically find similar rates at small community banks and credit unions. On the other hand, larger traditional banks frequently offer more services, especially for larger businesses.

Our Banking Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.