I've tried a handful of different budgeting apps over the years, even reverting to old-school Excel spreadsheets at one point to try and keep things simple. But there's only one platform I've stuck with: Rocket Money.

For me, Rocket Money has been a fantastic "Budgeting 101" option, offering a beginner-friendly interface and an easy way to track spending across all sorts of customized categories. It's also super cheap, with a cost I can easily justify year over year.

Keep reading to learn why I recommend Rocket Money to all my friends and family.

What is Rocket Money?

Rocket Money (formerly Truebill) is a budgeting app that pulls together all your financial accounts in one place.

Just link your bank, credit card, savings, and investment accounts, and Rocket Money will automatically import all transactions. From there, you can track spending, set goals, create budgets, and even cancel subscriptions, all from your phone or computer.

How does Rocket Money work?

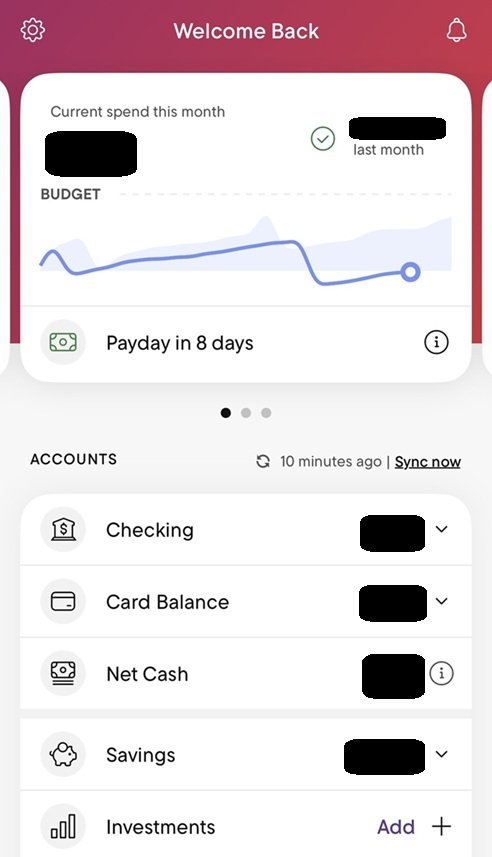

Once I created my account, I was asked to link at least one checking account. From there, I was able to add credit cards, savings accounts, and more. Rocket Money uses Plaid, a secure third-party service used by many major banks, to connect accounts and pull in your transaction data automatically.

The app identified my recurring expenses and bills, and gave me a running total of what was "left for spending" after regular bills and goals are accounted for. I was then able to set up savings goals and use all sorts of smart tools to move my money around.

It also flagged a handful of forgotten recurring expenses -- like my unused subscription services -- and canceled them, a feature that's probably saved me hundreds of dollars per year.

What I like about Rocket Money

A full financial picture in one place

Rocket Money supports most U.S. banks and credit card issuers. Once linked, you can see your balances, bills, and spending patterns in real time. It's a great way to spot issues early, like a higher-than-usual utility bill or a duplicate subscription.

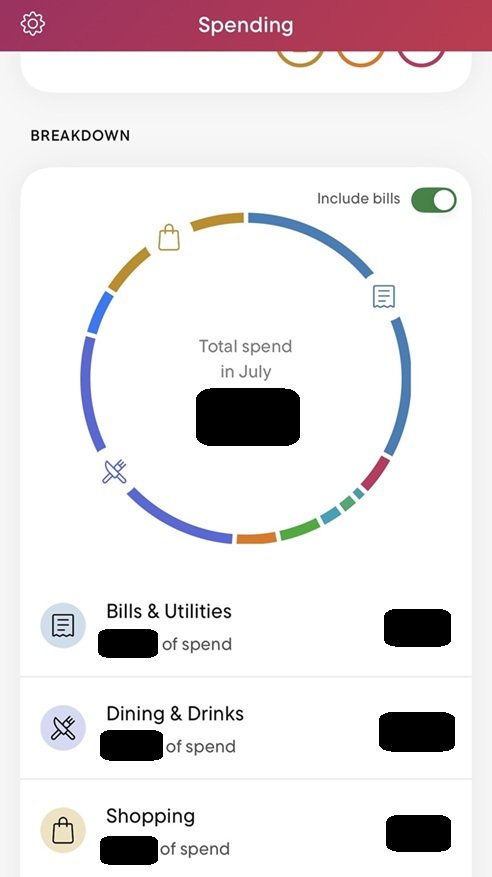

Powerful budgeting and savings tools

The Rocket Money app lets you create custom categories, set spending limits, and track savings goals. I've got my spending categories all set up how I like them, letting me see how much I spend on things like movie tickets and eating out. The Financial Goals tool, formerly known as Smart Savings, can also move money automatically based on your habits. And you get 2 custom budget categories on the free tier.

Subscription tracking and cancellation

One of the coolest features: Rocket Money scans transactions for recurring charges and lists them out for you to see. You can cancel many of them quite easily, a feature that's been handy for me more than once. It's not perfect -- it's made a few mistakes in my experience -- but it's still a great way to track subscriptions you are (or aren't) using.

Built-in credit tracking

You can also monitor your credit score with Rocket Money and get regular updates. It's a simple way to stay on top of any major changes that might affect loan rates or credit approvals.

What could be improved

Bank linking is required

You can't use Rocket Money unless you connect at least one bank account. If you're not comfortable sharing that information, even with secure tools like Plaid, this app isn't for you.

Most features require Premium

The free version is very limited. You can see your balances and transactions, but that's about it. Subscription cancellation, Financial Goals, formerly known as Smart Savings, and more than 2 custom budgets all require a Premium Membership.

Bill negotiation is expensive

Rocket Money offers to lower your cable, phone, or internet bills through its Bill Negotiation service. If successful, though, it charges 35% to 60% of your first year's savings up front (you pick the amount). It's a cool idea, but I've mostly stayed away from this feature myself for that very reason.

How much does Rocket Money cost?

Free plan: Includes account syncing and basic budgeting tools. Not much else.

Premium Membership: You pay Rocket Money what you want -- between $7 and $14 per month (subject to change) -- and get the same features no matter what you choose (there's also a seven-day free trial).

These currently include (subject to change):

- Subscription cancellation

- Credit score monitoring

- Financial Goals, formerly known as Smart Savings

- Unlimited budgets

- On-demand account syncing

- Account sharing

- Net worth tracking

- Customizable dashboards

- Data exports, including transaction exports

- Transaction tags, rules, splits, and notes

- Manual transactions

- Account balance alerts

- iOS widgets

- Rocket Money on web

Bill negotiation: Costs 35% to 60% of your first-year savings, billed in a lump sum.

Rocket Money reviews and ratings

Users of Rocket Money say it's user-friendly and makes budgeting easier. Its design is clean and the mobile app is especially well-reviewed.

That said, many reviewers have flagged issues with the Bill Negotiation tool, including high fees and inflated savings estimates.

- iOS rating: 4.5 out of 5 stars

- Android rating: 4.7 out of 5 stars

Rocket Money platform

I can say with certainty that the Rocket Money platform is clean, modern, and easy to navigate, once you spend a little time with it. Both the web and mobile apps are laid out logically, with clear categories for budgets, subscriptions, savings, and accounts.

Menus are intuitive -- I especially appreciate how easy it is to switch between accounts or dive into a spending category without losing your place.

Once I got familiar with the layout, I found myself checking in regularly, mostly just to confirm my spending habits were staying on track. No matter how I've used Rocket Money, I've found the experience to be smooth and responsive -- and easier to use than some competing apps I've tried.

Is Rocket Money safe?

Yes. Rocket Money uses bank-level encryption and doesn't store your login credentials. Instead, it relies on Plaid to link your accounts, which is used by apps like Venmo and Cash App. Still, always use your best judgment before sharing financial access with any platform.

Alternatives to Rocket Money

If you're more of a visual person: Monarch Money comes with all sorts of charts and tables if you prefer to see your finances laid out. Rocket Money has this too, but Monarch Money does it better. Read more about Rocket Money vs. Monarch Money.

If you want all sorts of customization: You Need a Budget (YNAB) offers full control, manual tracking, and shared budgeting. Again, Rocket Money is customizable as well, but if you really want to drill into details you might look into YNAB. Read more about Rocket Money vs. YNAB.

Rocket Money might be right for you if:

- You want a simple way to view all your accounts in one place

- You're trying to get serious about budgeting and savings goals

- You don't mind paying a small monthly fee for premium features

- You want help cutting out wasteful subscriptions

Ready to start saving? Sign up for a Rocket Money Premium account for as little as $7 a month today.

-

Sources

- https://apps.apple.com/us/app/rocket-money-bills-budgets/id1130616675

- https://play.google.com/store/apps/details?id=com.truebill&hl=en_US&pli=1

- https://help.rocketmoney.com/en/articles/2217739-how-much-does-rocket-money-cost

- https://help.rocketmoney.com/en/articles/9744564-how-to-submit-a-bill-negotiation

- https://www.rocketcompanies.com/our-companies/

FAQs

-

Yes, but the free version is limited. You'll need to upgrade to Premium to access most features.

-

If you want automated budgeting, subscription tracking, and AI-based savings, Rocket Money could absolutely be worth the monthly cost -- especially if you use it consistently and use it to change spending habits.

-

In many cases, yes, but results may vary by provider. It's a helpful tool, though not guaranteed.

-

Rocket Money uses Plaid to link accounts, and neither company stores your banking passwords. Data is encrypted for safety.