Baby boomers, born between 1946 and 1964, aren't spring chickens anymore. If you're a baby boomer, you're somewhere between your mid-50s and early 70s -- and you're either in retirement or not very far away from it.

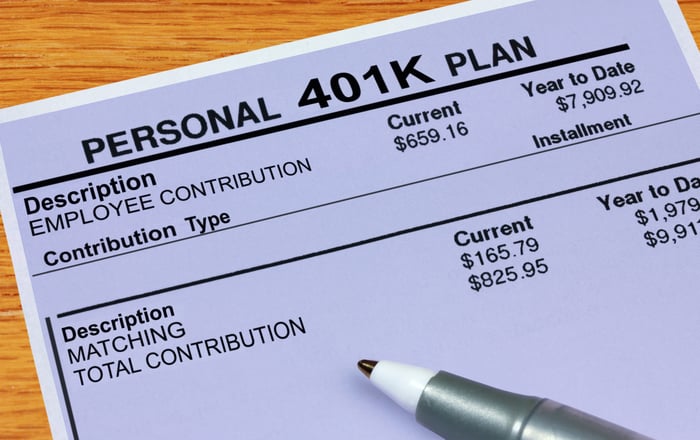

Thus, retirement savings and retirement income should be of paramount importance to you, and you may want to be making the most of any 401(k) plan available to you. Here are eight facts about 401(k) plans that baby boomers need to know.

Image source: Getty Images.

A 401(k) can be critical to your retirement

While our parents and grandparents may have had pension income count on in retirement, pensions have grown more scarce in recent decades. It's up to most of us to provide much of the income we'll need in retirement. Social Security will probably play a critical role, but on average, it will provide only about 40% of our pre-retirement income. If your earnings were below average, it will provide a higher percentage, but if your earnings were above average, you can expect less than 40% of your pre-retirement income.

A 401(k) account, perhaps in tandem with an IRA or two, can be a big help in saving for retirement. One reason is that 401(k) plans typically feature free money from your employer, in the form of matching funds. A common employer match is 50% of the contributions you make up to 6% of your salary. So if you earn $70,000 and contribute 6%, or $4,200, your employer will add another $2,100. That's $2,100 of free money and a guaranteed 50% return on your investment that you'd be hard-pressed to find anywhere else.

401(k)s have generous contribution limits

While the current contribution limit for IRAs is $5,500, plus a $1,000 "catch-up" contribution for those 50 or older, limits for 401(k) accounts are much more generous. For 2017, you can contribute up to $18,000 to your 401(k), plus an additional $6,000 if you're 50 or older -- for a possible total of $24,000!

Image source: Getty Images.

You can amass a huge retirement war chest with a 401(k)

A 401(k) account can help you accumulate a lot of money for retirement, which will probably be very helpful when you're no longer working. The table below shows how effective it is to make big annual contributions and to do so for as many years as possible.

|

Growing at 8% For: |

$5,000 Invested Annually |

$10,000 Invested Annually |

$15,000 Invested Annually |

|---|---|---|---|

|

15 years |

$146,621 |

$293,243 |

$439,864 |

|

20 years |

$247,115 |

$494,229 |

$741,344 |

|

25 years |

$394,772 |

$789,544 |

$1.2 million |

|

30 years |

$611,729 |

$1.2 million |

$1.8 million |

Calculations by author.

There are Roth 401(k) accounts

Many people aren't aware of it, but just as there are two main kinds of IRAs -- traditional and Roth -- many companies now offer their workers two different kinds of 401(k)s, also traditional and Roth. With a traditional IRA and 401(k), you contribute pre-tax money that reduces your taxable income and, therefore, your tax bill for the year. When you withdraw the money in retirement, it's taxed as ordinary income to you. With the Roth IRA and 401(k), you contribute post-tax money that doesn't deliver any upfront tax break. But you eventually get a big tax break when you withdraw from the account in retirement – because if you follow the rules, you get to take all the money out of the account tax-free.

Image source: Getty Images.

401(k)s have downsides

Of course, 401(k) plans, like most things, aren't perfect. For example, they offer limited menus of investment choices, such as a handful of mutual funds. By contract, most IRA accounts let you invest in just about any stock and choose among hundreds or even thousands of mutual funds.

Then there are fees, which many 401(k) investors are hardly even aware of. That's a problem, because they can sometimes be quite hefty, and even when they seem small, they can do meaningful damage to your ultimate results. (Indeed, some plans charge big fees even for index funds that you can invest in elsewhere for a pittance.)

A Wall Street Journal article earlier this year noted that, "According to Vanguard Group, investors in a plan that charged 0.25% a year could in theory amass 20% more money over a four-decade career than they could in one that charged 1.25%, all else being equal." A Department of Labor report offers a starker example:

Assume that you are an employee with 35 years until retirement and a current 401(k) account balance of $25,000. If returns on investments in your account over the next 35 years average 7% and fees and expenses reduce your average returns by 0.5%, your account balance will grow to $227,000 at retirement, even if there are no further contributions to your account. If fees and expenses are 1.5%, however, your account balance will grow to only $163,000. The 1% difference in fees and expenses would reduce your account balance at retirement by 28%.

Fortunately, the trend is in the workers' favor, as fees have been falling in recent years, in part because of lawsuits brought about against some employers. In the meantime, you can look up ratings for many companies' 401(k) plans at www.brightscope.com -- where it rates them on fees, among other things.

Image source: Getty Images.

There are withdrawal rules to follow

In most cases, you won't be able to withdraw money from your 401(k) until age 59 1/2. Take money out before then and you'll probably face a 10% early withdrawal penalty. There's an exception, though: If you leave your job in the year that you turn 55 or later, the 10% penalty won't apply. Retiring early because of a qualifying disability can also free you from the penalty, as can a few other circumstances, such as financial hardship.

If you're in no hurry to withdraw money, know that you can't delay doing so forever. A 401(k) account, whether traditional or Roth, features "required minimum distributions" (RMDs). According to the IRS, RMDs are generally required to begin on "April 1 following the later of the calendar year in which you reach age 70 1/2 or retire." (Note that traditional IRAs also feature RMDs, and you can't delay them by delaying retiring.) Withdrawals from a traditional 401(k) will be counted as taxable income to you, while Roth 401(k) withdrawals should be tax-free, as contributions to a Roth 401(k) are made with taxed money.

Image source: Pixabay.

There are some big 401(k) mistakes to avoid

If you're saving aggressively in a 401(k) account, that's great! Don't make some common blunders, though, lest you hurt your financial future. For example, don't be one of the many people who cash out their 401(k) account every time they change jobs. Sure, you may have only worked at a given company for three years and may not have much in your account, but if you remove even $20,000 that could have kept growing for you for another 25 years, you could lose out on about $137,000 retirement dollars (assuming an 8% average annual growth rate). Similarly, don't borrow from a 401(k) plan, either, unless it's an emergency and you really have no better option. That's another way of stealing from your financial future.

Finally, don't keep most of your money in the stock of your employer. Yes, you know that company best, but remember that it's already providing most or all of your income now. To have it provide most of your future income, too, is putting a lot of eggs in that one basket. Remember -- even great companies can fall on prolonged hard times -- or can defy expectations and fail. Try not to keep too much of your net worth in company stock -- perhaps not more than 10%, at most.

Some investments are better than others

Once you're socking money away in your 401(k) account, invest it effectively. 401(k) plans typically feature default investment choices, and they tend to be conservative low-risk-low-return ones that won't serve you well if you're young and may not be great if you're older, either. Make sure that you decide how your 401(k) money will be invested.

Index funds are a terrific investment choice for 401(k) money, as long as they're low-fee ones focused on the broad market, such as the S&P 500 or the total U.S. or world stock market. They will probably outperform most managed stock mutual funds. There are bond index funds, too.

Your 401(k) account can be a vital part of your future financial security, so don't be afraid to seek the guidance of a financial advisor, if you don't have much confidence in your own money management skills. He or she may be able to help you set up your 401(k) (and other investments) in the most effective way.