The Only 10 Debt-Free Companies in the S&P 500

The Only 10 Debt-Free Companies in the S&P 500

Debt free is the way to be

Low interest rates made taking on debt to finance everything from new buildings to share buybacks OK, but that’s changing because interest rates are rising. With debt becoming more expensive, it could be best to invest in debt-free companies, including these members of the S&P 500.

ALSO READ: 5 Companies With the Strongest Balance Sheets in the World

Previous

Next

No 1. Align Technology (NASDAQ: ALGN)

Debt-free companies, including Align Technology, often sport envy-inspiring pricing power thanks to competitive moats.

Align Technology’s Invisalign is the most widely-known clear treatment for aligning crooked teeth and, as an alternative to traditional metal braces, it has a near monopoly. Initially, Invisalign could only be used in easy-to-treat cases; however, due to advances it can now be used in complex cases and teens and that’s fueling profit-friendly sales worldwide. In Q4, 2017, its sales jumped 44% to $421 million.

So far, its sales growth has funded management’s expansion plans and given Invisalign still has less than 10% market share in the dental braces market, it doesn’t appear they’ll need to take on any debt anytime soon.

Previous

Next

No. 2: Ansys Technology, Inc. (NASDAQ: ANSS)

Once software is built, it can be distributed cheaply and resold to many customers and as a result, software companies like Ansys Technology are often high-margin companies with little need for debt.

Ansys Technology makes simulation software that’s used by engineers to build better cars, rockets, electronics, and other products. A global company that’s been in business for nearly 50 years, Ansys customers span most industries and are in most countries.

In 2017, growing demand from its customers for simulation software boosted its revenue by nearly 11% to $1.1 billion. With 35.7% operating margin that outpaces many other software makers, including giants Oracle and SAP, Ansys generated $430 million in operating cash flow last year. That was plenty enough to keep this business humming along without having to tap banks for funding.

Previous

Next

No. 3: Chipotle Mexican Grill, Inc. (NYSE: CMG)

A bullet-proof balance sheet comes in handy in a crisis and that’s been particularly true for Chipotle Mexican Grill, a restaurateur that’s seen its profitability shrink following reports of foodborne illnesses.

After more than doubling revenue since 2010, Chipotle’s sales growth has slipped as it’s struggled to win back customers. New store openings and menu items are offsetting some of the headwind, but it still has work to do to overcome the drag on sales caused by lackluster foot traffic.

It’s anyone guess when the king of queso will get back to its winning ways, but at least its debt-free balance sheet makes its future less concerning than it might be otherwise.

Previous

Next

No. 4: Expeditors International of Washington (NASDAQ: EXPD)

A logistics company that helps customers with their global shipping needs, Expeditors International helps customers transport goods across borders by sea and air more quickly and cheaply by buying cargo space upfront in bulk and handling complex situations, such as clearing customs.

The company’s been a big beneficiary of growing global trade. Last year alone, its revenue grew by 13% to $6.9 billion, and as a result, it pocketed $700 million in operating income.

Perhaps the biggest concern right now is the threat to its business from a trade war. The risk of tariffs denting shipping demand does create some uncertainty, but with an operating margin of 10% and over $1 billion in cash and equivalents on its balance sheet, Expeditors International could end up winning business away from competitors that are on less stable financial footing. If so, the risk of a trade war might not be as bad in the long term as it seems.

Previous

Next

No. 5: Facebook, Inc. (NYSE: FB)

Facebook’s recent Cambridge Analytica data debacle puts it on thin ice with its users. However, a bullet-proof balance sheet should insulate it against any dip in advertising revenue caused by changes in how it shares users' data.

The company’s sales eclipsed $40 billion in 2017 and with 87% gross margin, Facebook generates mountains of cash. Its free cash flow exceeded $17 billion last year alone and as of Dec. 31, it boasted $42 billion in cash and investments. With resources like that, it should have plenty of financial flexibility to survive this scandal without having to go into debt.

Previous

Next

No. 6: F5 Networks, Inc. (NASDAQ: FFIV)

When it comes to managing and securing data, F5 Networks’ customers have more choices than ever before, and that’s slowing their decision times and crimping F5’s sales growth. Nevertheless, F5’s revenue still increased 4.8% and its net income grew 15% in 2017.

The company’s wheelhouse is balancing complex workloads and securing information and its debt-less balance sheet gives it the financial firepower to boost R&D spending so that it can better address those needs. Given the exponential growth in data and that cyber security is increasingly important, F5 could see its sales reaccelerate if customers' decision timelines start shrinking again.

Previous

Next

No. 7: Garmin Ltd. (NASDAQ: GRMN)

Sales of Garmin’s mapping products to automotive customers continues to shrink at a double-digit pace, but the company’s been able to leverage its healthy balance sheet to significantly expand its aviation, wearables, and marine sales.

The share of sales coming from automotive has declined from nearly half its business to less than a quarter of it and growing demand from its other markets offset automotive’s decline last year, allowing the company to post a 2% year-over-year revenue increase to $3.1 billion.

Importantly, the company’s tight lid on expenses has helped its gross margin expand recently, which in turn, helped its operating income climb 7% in 2017 to $669 million. That’s good news for its dividend yield, which is currently 3.6%.

Previous

Next

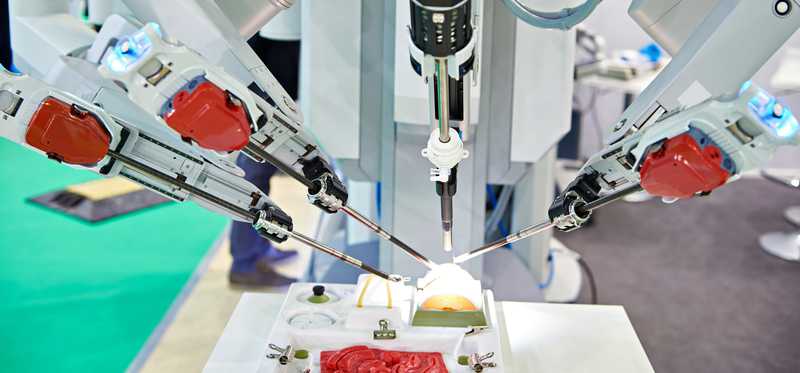

No. 8: Intuitive Surgical (NASDAQ: ISRG)

Intuitive Surgical’s “razor and blade” business model is paying off for the company and its investors. Because robotic surgery is becoming more mainstream, the company’s selling more of its da Vinci surgical robots to hospitals worldwide, and that’s boosting sales of high-margin services and consumables associated with da Vinci procedures.

In 2017, 875,000 procedures were performed using a da Vinci system and as a result, Intuitive Surgical’s revenue grew 15.6% year-over-year to $3.1 billion. About 72% of those sales were from recurring revenue from services and consumables, which is one reason why the company’s gross margin was 70%, its operating margin was nearly 34%, and its net income was a healthy $660 million. Those profit-friendly figures make it easy to understand why Intuitive Surgical hasn’t had to get weighed-down by taking on debt.

ALSO READ: 3 Top Robotic-Surgery Stocks to Consider Buying Now

Previous

Next

No. 9: Skyworks Solutions, Inc. (NASDAQ: SWKS)

Fears it would lose its contract to supply Apple with chips that allow its mobile devices to communicate with networks has weighed-down Skyworks Solutions' share price lately.

Apple represents about 40% of Skyworks' sales and that’s undeniably a risk, but Skyworks is knee-deep in securing deals to supply chips to other companies that are working on next-generation connectivity products targeting the Internet of Things and the upcoming shift to 5G mobile networks, which run at speeds that are up to 100 times faster than 4G.

The fact that it doesn’t have any debt on its balance sheet offsets some of the concern surrounding the company’s reliance on Apple and with operating margins that are near 35%, free cash flow margin of over 30%, and a growing list of non-Apple customers, Skyworks' recent drop could make this a good time to buy shares.

Previous

Next

No. 10: T. Rowe Price Group, Inc. (NYSE: TROW)

Managing money is a good business to be in right now. The markets have been climbing for years and falling unemployment is boosting balances in retirement accounts, such as 401(k) plans that are a key contributor to T. Rowe Price’s nearly $1 trillion in assets under management.

The company’s conservative approach to its balance sheet has helped it increase its dividend payment for 31 consecutive years. With gross margins of 93%, operating margins of 44%, and $1.5 billion in bottom-line profit over the past 12-months, it doesn’t appear that track record is in jeopardy, either.

That said, like most of the companies on this list, there are challenges facing this company. For instance, its active-management approach is under fire from passive approaches, including exchange-traded funds (ETFs), and that could crimp its fee revenue. Nevertheless, its target-date funds are among the most popular retirement products available and given its got one of the healthiest balance sheets out there, T. Rowe Price is one of the more intriguing financial services stocks investors can buy.

Todd Campbell owns shares of Align Technology and Facebook. The Motley Fool owns shares of and recommends Align Technology, Chipotle Mexican Grill, Facebook, Intuitive Surgical, and Skyworks Solutions. The Motley Fool owns shares of Oracle and has the following options: short June 2018 $52 calls on Oracle and long January 2020 $30 calls on Oracle. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.