There's no shortage of places you can book when you transfer Chase points to IHG. Since it's one of the largest hotel chains in the world, IHG has properties almost anywhere you'd want to go.

Unfortunately, IHG doesn't offer much in the way of high-value redemptions. Most award stays don't even get you $0.01 per point, making them a poor value. But you may luck out and find a great deal, so it's still good to know how to transfer Chase points to IHG. This guide will cover that plus another way you can use your Chase Ultimate Rewards points to book IHG hotel stays.

What you need to transfer Chase points to IHG

To transfer Chase points to IHG, you need an IHG One Rewards account. If you don't have one, you can become a member free of charge on the hotel's website. You also need a Chase Ultimate Rewards card that lets you transfer points. That option is available with the following Chase credit cards:

|

|

|

| Chase Sapphire Preferred® Card | Chase Sapphire Reserve® | Ink Business Preferred® Credit Card |

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

|

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Apply Now for Chase Sapphire Reserve®

On Chase's Secure Website. |

Apply Now for Ink Business Preferred® Credit Card

On Chase's Secure Website. |

|

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

|

Welcome Offer: Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠. 75,000 bonus points |

Welcome Offer: Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠. 75,000 bonus points |

Welcome Offer: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Earn 100,000 bonus points |

|

Rewards Program: Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. 5x on travel purchased through Chase Travel℠, 3x on dining and 2x on all other travel purchases |

Rewards Program: Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases. 5x points on flights and 10x points on hotels and car rentals through Chase Travel℠. |

Rewards Program: Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchases-with no limit to the amount you can earn. Earn 3 points per $1 in select business categories |

|

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

Intro APR: Purchases: N/A Balance Transfers: N/A |

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

|

Regular APR: 21.49%-28.49% Variable |

Regular APR: 22.49%-29.49% Variable |

Regular APR: 21.24%-26.24% Variable |

|

Annual Fee: N/A $95 |

Annual Fee: N/A $550 |

Annual Fee: N/A $95 |

|

Highlights:

|

Highlights:

|

Highlights:

|

|

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Apply Now for Chase Sapphire Reserve®

On Chase's Secure Website. |

Apply Now for Ink Business Preferred® Credit Card

On Chase's Secure Website. |

Show More

Show Less

Show Less

|

||

How to transfer Chase points to IHG

Chase makes transfers quick and simple online. Follow these steps when you're ready to transfer Chase points to IHG:

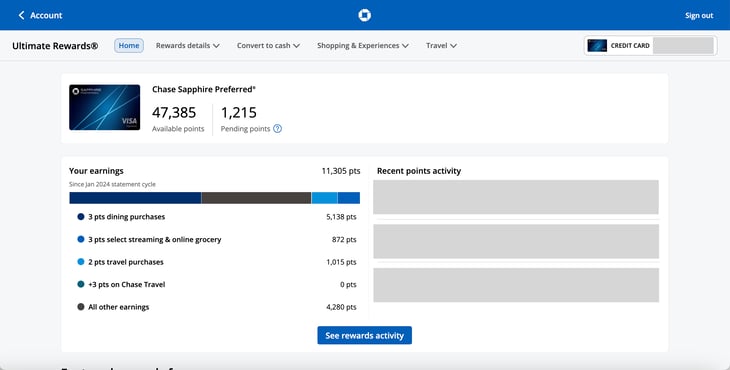

1. Sign in to your Chase Ultimate Rewards account.

If you have more than one Chase card, pick the one with the points you're transferring after you sign in.

Image source: Brooklyn Sprunger

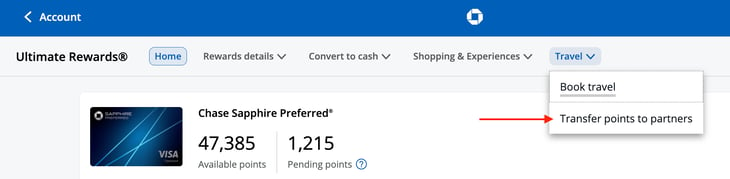

2. Select "Transfer points to travel partners."

You'll find it under the "Travel" option on the top menu.

Image source: Brooklyn Sprunger

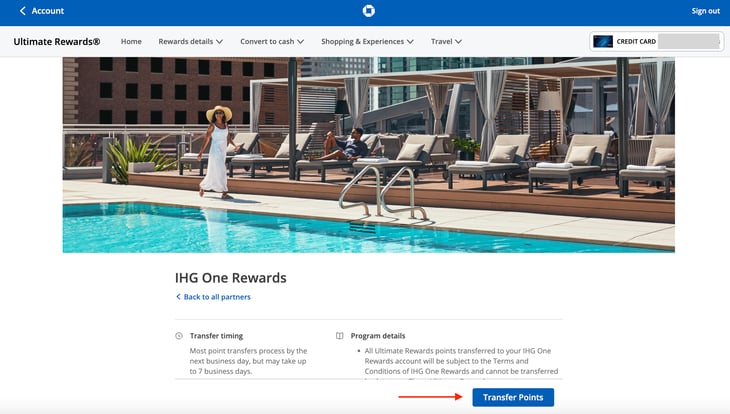

3. Select IHG Hotels & Resorts.

This travel partner is listed in the Hotels section.

Image source: Brooklyn Sprunger

4. Choose a transfer recipient.

Select the name of the recipient from a dropdown menu (if necessary), and then enter the IHG One Rewards account number. Remember that when you transfer Chase points to IHG, the recipient must be you or an authorized user on your credit card account who is also a member of your household.

5. Decide how many points to transfer.

Chase has set its transfer minimum at 1,000 points. That's also the increment you must use for the transfer. For example, you could send 25,000 points, but not 25,500. You get a 1:1 ratio when you transfer Chase points to IHG (or any of its other travel partners). So, you get 1 IHG point for each Chase Ultimate Rewards point you send over.

6. Confirm the transfer.

The final page in the points transfer process lets you review everything and submit it. Your transfer should process instantaneously.

Keep in mind that there are no cancellations after you transfer Chase points to IHG. You can't get your Ultimate Rewards points back later. Make sure you have an award stay you're ready to book before you make the transfer so your travel rewards don't go to waste.

How to book an IHG award stay

It's easy to book an award stay with IHG. Here's what you need to do:

- From the IHG homepage, enter your destination, followed by the dates of your stay. Adjust the number of guests or rooms as needed, and then perform your search.

- The search results will list all of IHG's hotels in that area and their cash prices. To see prices in points, open the "Pay with" dropdown and select "Points." There's also a "Points + Cash" option.

- When you've decided on a hotel, click "Select Hotel."

- Select the room and the rate you want. You'll see all the available room options at that hotel, as well as prices in points and points plus cash.

Log in to your IHG One Rewards account if you haven't already. Proceed through the checkout process to complete your award stay booking.

The limited value of IHG points

IHG One Rewards points have a big problem -- they're just not very valuable.

A typical IHG award stay will earn you about $0.005 to $0.007 per point. Because of that low value, it rarely makes sense to transfer Chase points to IHG. There are much better redemptions for Ultimate Rewards points that can easily get you double or triple that value. Even cash back redemptions offer more at $0.01 per point.

Once in a blue moon, you may find an award stay at an IHG property that offers a respectable value. But in nearly all cases, there's a better alternative.

A better option: Redeem points through the Chase Travel portal

You can also book IHG stays through the Chase Travel portal. This valuable feature lets you use your Chase points to make cash travel bookings. The value of your points depends on which Chase card you have. You get:

- $0.0125 per point if you have the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card

- $0.015 per point if you have the Chase Sapphire Reserve®

As you can see, you'll likely get much more for each Ultimate Rewards point through the Chase portal than if you transfer Chase points to IHG.

Since this counts as a cash travel booking, you can also earn IHG rewards points on your stay, just like you would if you were paying with your credit card. The rate you'll get at most IHG hotels as a member of the Rewards Club is 10 points per $1. You'll get a bonus of between 20% and 100% on your points if you're in one of the hotel's elite status tiers. Those are points you wouldn't earn on an award booking.

LEARN MORE: How to Use the Chase Travel Portal

Chase's IHG credit cards

Chase and IHG also offer hotel credit cards. If you're a frequent guest of IHG, one of these cards may be worth getting to maximize your rewards and get some extra IHG perks. Here are the two consumer IHG credit cards:

|

|

|

IHG One Rewards Premier Credit Card |

IHG One Rewards Traveler Credit Card |

|

Rating image, 5.00 out of 5 stars.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Rating image, 3.50 out of 5 stars.

3.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

|

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

|

Welcome Offer: Earn 165,000 Bonus Points after spending $3,000 on purchases in the first 3 months from account opening. Earn 165,000 bonus points |

Welcome Offer: Earn 80,000 bonus points after spending $2,000 on purchases within the first 3 months of account opening. Plus up to $50 in IHG® statement credits on purchases at IHG® Hotels and Resorts during the first 12 months from account opening. Earn 80,000 bonus points plus up to $50 in IHG® statement credits. |

|

Rewards Program: Earn up to 26 total points per $1 spent when you stay at IHG Hotels & Resorts. Earn 5 points per $1 spent on purchases on travel, at gas stations, and restaurants. Earn 3 points per $1 spent on all other purchases. Earn up to 26 total points per $1 spent when you stay at IHG Hotels & Resorts |

Rewards Program: Earn up to 17X total points at IHG® Hotels & Resorts worldwide when you combine your IHG® Rewards Traveler Credit Card benefits with your existing IHG® Rewards member benefits. Up to 10X points from IHG® for being an IHG® Rewards member. 5X points at IHG® Hotels & Resorts. 3X points on dining, utilities, select streaming services and at gas stations. Up to 2X points from IHG® with Silver Elite Status. 2X points on all other purchases. 2x - 17x points |

|

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

|

Regular APR: 21.49% - 28.49% Variable |

Regular APR: 21.49% - 28.49% Variable |

|

Annual Fee: N/A $99 |

Annual Fee: N/A $0 |

|

Highlights:

|

Highlights:

|

Show More

Show Less

Show Less

|

|

The information related to IHG One Rewards Traveler Credit Card has been collected by The Ascent and has not been reviewed or provided by the issuer.

Don't you wish you could take a peek inside a credit card expert's wallet sometimes? Just to see the cards they carry? Well, you can't look in anybody's wallet, but you can check out our experts' favorite credit cards. Get started here:

Getting the most out of your Chase points

For the most part, you shouldn't transfer Chase points to IHG. It's not worth getting only $0.005 per point on an IHG booking when there are so many transfer partners where you can do better. If you want to book an IHG hotel, go through the Chase Travel portal and redeem Chase points toward the purchase that way.

This isn't to say that IHG award stays are a lousy deal. With the amount of points you can earn through cash stays and credit card sign-up bonuses, it doesn't take much to get free nights. These award stays simply aren't worth sacrificing versatile and valuable Ultimate Rewards points.

Still have questions?

Here are some other questions we've answered:

FAQs

-

Yes, you can transfer your Chase points to IHG. However, it's not recommended, because your rewards won't be worth as much when you convert them to IHG points. You'll almost certainly get a higher value per point if you book a hotel stay in points through the Chase Travel portal.

-

Chase points normally transfer instantly to IHG, based on reports from cardholders. On the Chase Ultimate Rewards site, it says that most points transfers are processed by the next business day but may take up to seven business days.

-

You can transfer Chase points to the following hotels:

- IHG Hotels & Resorts

- Marriott Bonvoy

- Hyatt

Our Credit Cards Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.