Southwest Airlines is a go-to for many travelers, thanks to its exceptional customer service and perks like free checked bags. But what's even better than flying with an airline you love? Scoring a heavily discounted or even free flight using points earned from your everyday spending.

In this guide, we'll show you how to transfer your Chase rewards points into Southwest Rapid Rewards points in seven simple steps, so you can start enjoying flight perks right away.

1. Make sure your Chase card earns Chase Ultimate Rewards points

There are three cards that earn transferable Chase Ultimate Rewards points for travel. They are:

|

|

|

| Chase Sapphire Preferred® Card | Chase Sapphire Reserve® | Ink Business Preferred® Credit Card |

|

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

|

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

|

Welcome Offer: Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. 75,000 bonus points |

Welcome Offer: Earn 100,000 bonus points + $500 Chase Travel℠ promo credit after you spend $5,000 on purchases in the first 3 months from account opening. 100,000 bonus points + $500 Chase Travel℠ promo credit |

Welcome Offer: Earn 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Earn 90,000 bonus points |

|

Rewards Program: Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases 5x on Chase Travel℠, 3x on dining, 2x on all other travel |

Rewards Program: Earn 8x points on all purchases through Chase Travel℠, including The Edit℠ and 4x points on flights and hotels booked direct. Plus, earn 3x points on dining worldwide & 1x points on all other purchases 8x points on Chase Travel℠, 4x points on flights and hotels booked direct, 3x points on dining, 1x points on all other purchases |

Rewards Program: Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchases-with no limit to the amount you can earn. Earn 3 points per $1 in select business categories |

|

Intro APR: Purchases: N/A Balance Transfers: N/A |

Intro APR: Purchases: N/A Balance Transfers: N/A |

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

|

Regular APR: 19.99% - 28.24% Variable |

Regular APR: 20.24% - 28.74% Variable |

Regular APR: 20.24% - 26.24% Variable |

|

Annual Fee: $95 |

Annual Fee: $795 |

Annual Fee: $95 |

|

Highlights:

|

Highlights:

|

Highlights:

|

Show More

Show Less

Show Less

|

||

Chase Sapphire Reserve® (see rates and fees) points are worth up to 2x when redeemed through Chase Travel, while Chase Sapphire Preferred® Card (see rates and fees) points are worth up to 1.5x with Chase Travel. Ink Business Preferred® Credit Card (see rates and fees) points are worth 25% more when you redeem through Chase Travel until October 25, 2025.

2. Create a Southwest Rapid Rewards account

If you don't already have one, you'll need to set up a Rapid Rewards account to transfer your Chase points.

Head to the Southwest Airlines website and click on "Create account." You'll be prompted to enter the following details:

- Name

- Date of birth

- Street address

- Email address

Next, create a username and password. Once you've completed these steps, your account is ready to go! Be sure to note your Rapid Rewards number -- you'll need that in a few steps.

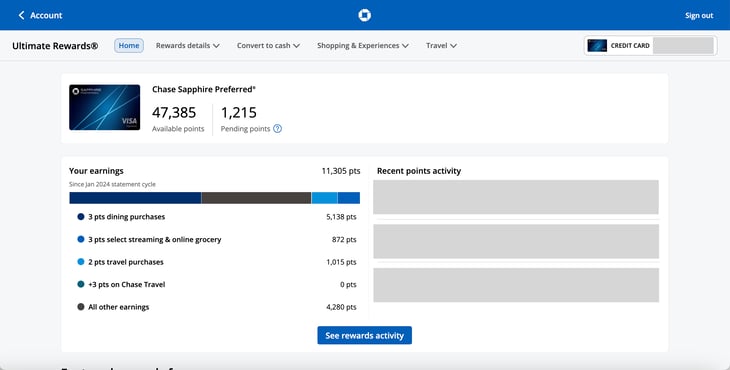

3. Head over to the Chase Ultimate Rewards portal

Navigate to https://ultimaterewardspoints.chase.com/home. If you have multiple Chase credit cards, be sure to select the card with the points you want to transfer when you log in.

Image source: Brooklyn Sprunger

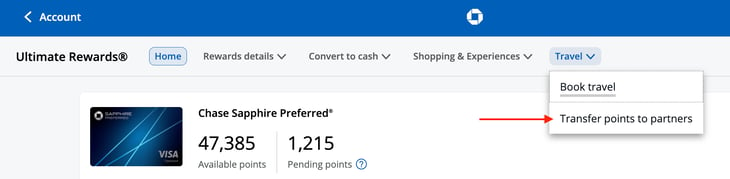

From there, navigate to the Chase Travel Portal by selecting "Travel" in the navigation bar. Then, click on "Transfer points to partners" to get started.

Image source: Brooklyn Sprunger

4. Choose Southwest Airlines as your transfer partner

The airline options will be listed in alphabetical order. Select Southwest Airlines, and then "Transfer Points."

Image source: Brooklyn Sprunger

5. Enter your Southwest Rapid Rewards number

Here's where you'll need that number we found earlier. If prompted, confirm which card user you're entering the rewards number for, and then input the number.

If for whatever reason you got this far without a Rapid Rewards account, you can create one here by clicking "Join Southwest."

6. Determine how many points you want to transfer

You'll need a minimum of 1,000 Chase Ultimate Rewards points to transfer to Southwest, and transfers must be made in increments of 1,000 points.

Image source: Brooklyn Sprunger

7. Transfer those points!

Hit "Submit," and you're all set! Keep in mind that it can take up to 72 hours for the transfer to reflect in your Rapid Rewards account. To avoid delays, plan to complete your transfer a few days before you're ready to book your travel.

Credit card comparison

We recommend comparing options to ensure the card you're selecting is the best fit for you. To make your search easier, here's a short list of standout credit cards.

| Offer | Our Rating | Welcome Offer | Rewards Program | APR | Learn More |

|---|---|---|---|---|---|

|

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Discover will match all the cash back you’ve earned at the end of your first year. INTRO OFFER: Unlimited Cashback Match for all new cardmembers–only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300. | 1% - 5% Cashback Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases. |

Intro: Purchases: 0%, 15 months Balance Transfers: 0%, 15 months Regular: 18.24% - 27.24% Variable APR |

||

Apply Now for Bank of America® Travel Rewards credit card

On Bank of America's Secure Website. |

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

25,000 points 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases | 1.5-3 points per dollar Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees, and your points don't expire as long as your account remains open. Earn 3 points per $1 spent on travel purchases booked through the Bank of America Travel Center. |

Intro: 0% Intro APR for 15 billing cycles for purchases. 0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days. After the intro APR offer ends, 18.24% - 28.24% Variable APR on purchases and balance transfers will apply. A 3% fee for 60 days from account opening, then 4% fee applies to all balance transfers. Balance transfers may not be used to pay any account provided by Bank of America. Purchases: 0% Intro APR for 15 billing cycles for purchases Balance Transfers: 0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days Regular: 18.24% - 28.24% (Variable) |

Apply Now for Bank of America® Travel Rewards credit card

On Bank of America's Secure Website. |

Apply Now for Bank of America® Customized Cash Rewards credit card

On Bank of America's Secure Website. |

4.80/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

$200 cash back $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening. | 1% - 6% cash back Earn 6% cash back for the first year in the category of your choice, 2% cash back at grocery stores and wholesale clubs, and unlimited 1% cash back on all other purchases. Earn 6% and 2% cash back on the first $2,500 in combined purchases each quarter in the choice category, and at grocery stores and wholesale clubs, then earn unlimited 1% thereafter. After the first year from account opening, you’ll earn 3% cash back on purchases in your choice category and 2% cash back at grocery stores and wholesale clubs up to the quarterly maximum. |

Intro: 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%. Balance transfers may not be used to pay any account provided by Bank of America. Purchases: 0% Intro APR for 15 billing cycles for purchases Balance Transfers: 0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days Regular: 18.24% - 28.24% (Variable) |

Apply Now for Bank of America® Customized Cash Rewards credit card

On Bank of America's Secure Website. |

What to know before you transfer Chase points to Southwest

Keep in mind that there are times where you're better off paying for your Southwest flight with points through Chase's travel portal instead of transferring your points to Southwest and purchasing there.

We'll break it down with an example: Imagine you're planning a flight from Denver, CO, to Nashville, TN.

Image source: Brooklyn Sprunger

If you book through Southwest, the $244 Wanna Get Away fare would cost 17,618 Southwest Rapid Rewards points (so, rounded up to the highest 1,000 points, you'd need to transfer 18,000 Chase Ultimate Rewards points).

Always evaluate your options when considering transferring Chase points to Southwest. The best strategy will vary depending on the card you use and the specific booking details.

-

Article sources

FAQs

-

It can take up to 72 hours for transferred Chase Ultimate Rewards points to appear in your Southwest Rapid Rewards account. Often it takes less time than that, but you should plan accordingly when you're booking travel.

-

Yes, it is free. There is no fee to transfer Chase Ultimate Rewards points to Southwest Airlines.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.

The Motley Fool owns shares of and recommends Visa.