I've been a Chase cardmember for over five years now, and without a doubt, the Ultimate Rewards points are where the real value lies. Every time I swipe my card on things I'm already buying (groceries, flights, my 3 p.m. coffee), I'm earning points I can use for travel, cash back, or even gift cards.

Below, I'll break down everything you need to know about Chase Ultimate Rewards points and some tips I've picked up along the way to help you make the most of your spending.

How Chase Ultimate Rewards points work

What are Chase Ultimate Rewards?

Chase Ultimate Rewards points are points you earn back when you use qualifying Chase credit cards. Think of them like loyalty currency you get every time you use your Chase card. What sets them apart is how easy they are to use and how valuable they can be, especially if you redeem them the right way.

Cards that earn Ultimate Rewards points

Not all Chase cards earn Ultimate Rewards points, but those in the Sapphire, Freedom, and Ink families do. Here are the most popular:

Chase Sapphire cards

|

|

| Chase Sapphire Preferred® Card | Chase Sapphire Reserve® |

|

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

|

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

|

Welcome Offer: Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. 75,000 bonus points |

Welcome Offer: Earn 100,000 bonus points + $500 Chase Travel℠ promo credit after you spend $5,000 on purchases in the first 3 months from account opening. 100,000 bonus points + $500 Chase Travel℠ promo credit |

|

Rewards Program: Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases 5x on Chase Travel℠, 3x on dining, 2x on all other travel |

Rewards Program: Earn 8x points on all purchases through Chase Travel℠, including The Edit℠ and 4x points on flights and hotels booked direct. Plus, earn 3x points on dining worldwide & 1x points on all other purchases 8x points on Chase Travel℠, 4x points on flights and hotels booked direct, 3x points on dining, 1x points on all other purchases |

|

Intro APR: Purchases: N/A Balance Transfers: N/A |

Intro APR: Purchases: N/A Balance Transfers: N/A |

|

Regular APR: 19.99% - 28.24% Variable |

Regular APR: 20.24% - 28.74% Variable |

|

Annual Fee: $95 |

Annual Fee: $795 |

|

Highlights:

|

Highlights:

|

Show More

Show Less

Show Less

|

|

Chase Ink Business cards

|

|

| Ink Business Preferred® Credit Card | Ink Business Unlimited® Credit Card |

|

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

|

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

|

Welcome Offer: Earn 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Earn 90,000 bonus points |

Welcome Offer: Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. Earn $750 bonus cash back |

|

Rewards Program: Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchases-with no limit to the amount you can earn. Earn 3 points per $1 in select business categories |

Rewards Program: Earn unlimited 1.5% cash back on every purchase made for your business Earn unlimited 1.5% cash back on every purchase |

|

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

Intro APR: 0% Intro APR on Purchases Purchases: 0% Intro APR on Purchases, 12 months Balance Transfers: N/A |

|

Regular APR: 20.24% - 26.24% Variable |

Regular APR: 17.49% - 23.49% Variable |

|

Annual Fee: $95 |

Annual Fee: $0 |

|

Highlights:

|

Highlights:

|

Show More

Show Less

Show Less

|

|

Can you have more than one of these cards?

Yep, if you have multiple qualifying Chase cards, you can combine your points to increase their value, like pairing Chase Freedom Unlimited's (see rates and fees) everyday earnings with Chase Sapphire Preferred's (see rates and fees) better travel redemptions.

Ways to earn Chase Ultimate Rewards points

Sign-up bonuses

One of the best ways to kickstart your points is through sign-up bonuses. Most Chase cards offer a set number of bonus points when you meet a minimum spend requirement in the first few months. Depending on the current sign-up bonus, the points can easily be worth hundreds of dollars (and often more) when redeemed for travel. I used my sign-up bonus on a free flight to Cabo, so let's just say I know a thing or two about getting some value out of this.

Everyday spending

This is the easy one. Once you've got your card, use it for your everyday spending and start racking up points. Each card has its own bonus categories. Here are the highlights:

- Chase Freedom Unlimited®: 3% on drugstores, restaurants, takeout, and eligible food delivery, 1.5% on all other purchases outside bonus categories

- Chase Sapphire Preferred® Card: 3X on dining, select streaming services, and online groceries

- Chase Sapphire Reserve® (see rates and fees): 3x on dining worldwide (but 4x on flights and hotels booked direct)

- Chase Freedom Flex® (see ): 5% on up to $1,500 in combined purchases in bonus categories each quarter you activate (this can include popular categories like groceries and gas)

Using Chase offers and Shop Through Chase

Inside your Chase account, you'll find rotating offers that give you bonus points or extra cash back at specific retailers. I recently got 10% cash back from H&R Block after filing my taxes. $129 to file my taxes, $12.90 back into my account.

You can also use the Shop Through Chase portal to earn extra points when you shop online at stores like Apple, Nike, or Sephora. It's basically free points, so if you're going to shop anyway, it's worth checking.

Referral bonuses

Chase often gives referral bonuses when you invite a friend to apply for a card you already have. These range from 10,000 to 20,000 points per referral, and you can get up to 100,000 points in referrals per year. (Enter me shamelessly plugging in everyone I know.)

Business spending

If you're a small business owner (or freelancer), the Chase Ink Business Preferred (see rates and fees) or other Ink cards can help you earn points fast on common business expenses like advertising, shipping, and internet services. Stack that with a welcome bonus and you could earn six figures in points in your first year.

Best ways to redeem Chase Ultimate Rewards points

Transfer to travel partners

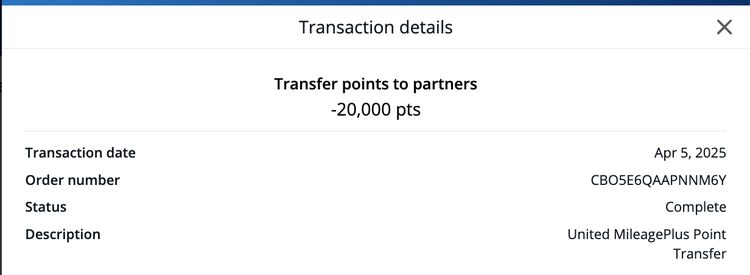

Transferring your points to travel partners, including hotels and airlines, is often the best way to get the highest value from your points. Chase partners with top airline and hotel programs including: United MileagePlus, Southwest Rapid Rewards, Hyatt, Marriott Bonvoy, and British Airways Avios. They transfer at a 1:1 ratio, and it's a great way to book high-value trips without using cash.

My husband recently needed to book a last-minute United flight that was going to cost $782. When I checked the Chase Travel portal, my 20,000 points would only cover $250 of that cost.

But through United's MileagePlus program, the same flight cost 30,000 miles. He already had 10,000, so I transferred 20,000 Chase points to his United account, and boom, he had enough to book the flight entirely with points. That transfer saved us $782 and used the same number of points I would've spent for just a $250 discount in the portal.

If you're flexible and willing to check airline award availability, transferring points can offer double or even triple the value compared to cash redemptions.

Book through Chase Travel portal

You can also use your points to book flights, hotels, and more directly through the Chase Travel portal. Most of the time, the prices in Chase Travel will be similar to what you'll find on the airline's or hotel's website, but you may earn extra value there with Points Boost if you have a Sapphire card:

- Chase Sapphire Preferred: Points are worth up to 1.5x

- Chase Sapphire Reserve: Points are worth up to 2x

This is a great option if you don't want to deal with transfer partners or if you find a solid deal through the portal. I do all of my travel booking through the portal whether I'm paying with points or not, just to get those extra points values.

Cash back and gift cards

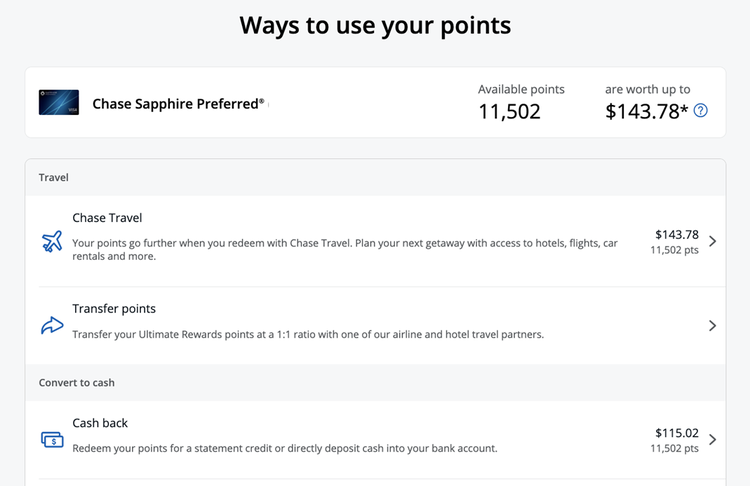

Sometimes you just need some extra cash on hand. You can redeem points for $0.01 each (so $1 is equal to 100 points) as cash back or for gift cards to popular brands. This isn't the highest-value option, but it's a nice fallback if travel isn't on your radar right now.

For example, I have 11,502 points in my account right now. I could cash that out to $115.02 if I needed it. But, if I spend that in the Chase Travel portal instead, they're worth $143.78, offering $28.76 more in value.

TIP

Don't cash out your points unless you really need to. Travel redemptions almost always give you better value.

How to maximize your Chase points

Pairing cards for more value

One of the best strategies is to pair a no annual fee card with a higher-end card. My favorite combo is the Chase Freedom Unlimited for everyday purchases (1.5% cash back on non-category purchases), and the Chase Sapphire Preferred for travel and dining (2X-5X points).

Then you can combine your Freedom Unlimited Points with your Sapphire Preferred points and redeem them with Chase Sapphire Preferred's higher redemption value, while still only paying $95 in annual fees.

Avoid these common mistakes

- Don't cash out if you don't need it: It's tempting to take your points out as cash, but travel redemptions can double your point value. Avoid cashing out if you don't really need the money immediately.

- Check partner values before transferring: Some partners (like Hyatt) offer incredible value, while others may not. Always double check the value in the Chase Travel portal vs. the partner's website, and determine which is the better value.

- Don't lose your points: If you close a card without using or transferring your points first, you'll lose them. If you're planning to close a card, transfer or spend your points before you do so.

Who should get a Chase Ultimate Rewards card?

Anyone looking for flexibility with points should consider one of the Chase Ultimate Rewards cards. Especially if you're a frequent traveler, the value can be insane. Plus, it's one of the easiest programs to earn rewards and to redeem them. Once you get the hang of it, it's honestly fun.

Why Chase points are worth it

I've saved thousands of dollars using points I earned on everyday spending. They're valuable, flexible, and easy to use, and I'd recommend these cards to anyone who wants to get more out of their money.

If you're ready to explore, compare your options with our list of the Best Chase Cards.

FAQs

-

Points don't expire as long as your account is open and in good standing. If you close a card without transferring or using your points, you'll lose them.

-

The Chase Sapphire Preferred, Chase Sapphire Reserve, and Chase Freedom Unlimited are my favorites for earning rewards points. If you own a business, Chase Ink Business Preferred is also a strong option.

-

Yes, but with limits. You can transfer points to a spouse or household member who is also a Chase cardholder. You can also move points between your own personal and business accounts.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.

The Motley Fool owns shares of and recommends Visa.