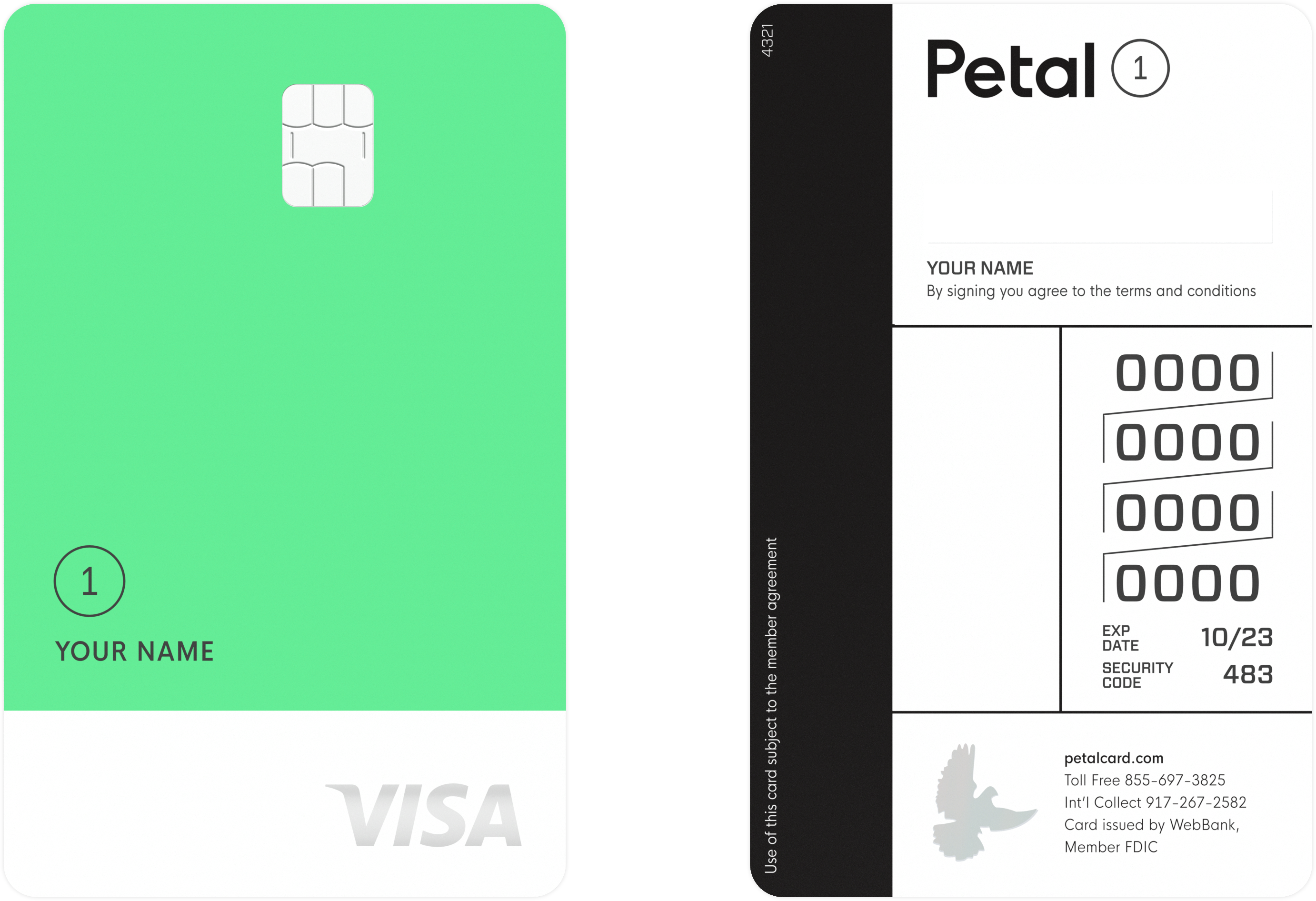

The Petal® 1 "No Annual Fee" Visa® Credit Card is made for building and rebuilding credit. There's no annual fee, and unlike many credit-builder cards, there's no security deposit required, either. It even offers cash back rewards with some merchants. Read our full Petal® 1 "No Annual Fee" Visa® Credit Card review to find out more.

Petal® 1 "No Annual Fee" Visa® Credit Card

Great for: Building credit

Fair (300-669)

Regular APR

25.24 - 34.74% Variable

Rewards

2% - 10% cash back at select merchants

-

The combination of cutting fees competitors charge, along with the opportunity to earn rewards, makes this a worthwhile card to consider when working on your credit.

-

- Easy approval process

- No annual fee

- Rewards from select merchants

- No foreign transaction fee

- Limited rewards opportunities

- High APR

- Petal has added fees before

-

- $0 Annual Fee

- Variable APRs range from 25.24% - 34.74%

- $300 - $5,000 credit limits

- Earn a credit limit increase in as little as 6 months. Terms and conditions apply.

- No credit score? No problem. If eligible, we'll create your Cash Score instead.

- 2% - 10% cash back at select merchants

- See if you're pre-approved within minutes without impacting your credit score.

- No annual or foreign transaction fees.

- Build credit alongside hundreds of thousands of Petal card members.

- Petal's mobile app makes it easy to manage your money, track your spending, and automate payments.

- Petal reports to all 3 major credit bureaus

- No deposits required

- Card issued by WebBank

Credit card comparison

We recommend comparing options to ensure the card you're selecting is the best fit for you. To make your search easier, here's a short list of standout credit cards.

| Offer | Our Rating | Welcome Offer | Rewards Program | APR | Learn More |

|---|---|---|---|---|---|

|

Rating image, 5.00 out of 5 stars.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Discover will match all the cash back you’ve earned at the end of your first year. N/A | 1% - 5% Cashback Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically. |

Intro: Purchases: 0%, 15 months Balance Transfers: 0%, 15 months Regular: 17.24% - 28.24% Variable APR |

||

|

Rating image, 5.00 out of 5 stars.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Up to $300 cash back Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That's 6.5% on travel purchased through Chase Travel, 4.5% on dining and drugstores, and 3% on all other purchases. | 1.5% - 5% cash back Enjoy 5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases |

Intro: 0% Intro APR on Purchases and Balance Transfers for 15 months Purchases: 0% Intro APR on Purchases, 15 months Balance Transfers: 0% Intro APR on Balance Transfers, 15 months Regular: 20.49% - 29.24% Variable |

Apply Now for Chase Freedom Unlimited®

On Chase's Secure Website. |

|

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

60,000 bonus points Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. | 5x on travel purchased through Chase Travel℠, 3x on dining and 2x on all other travel purchases Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. |

Intro: N/A Purchases: N/A Balance Transfers: N/A Regular: 21.49%-28.49% Variable |

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Full Petal 1 Credit Card review

This credit card is a good fit for: Consumers who haven't established a credit history yet or have a bad credit score due to some previous problems.

Top perks

The Petal® 1 "No Annual Fee" Visa® Credit Card has several valuable features worth knowing about.

Easy approval process

Petal makes the application process as simple and stress-free as possible. It gives you the option of linking your bank accounts when you apply. Using that information, it can create a Cash Score for you based on your banking transactions.

This Cash Score feature allows Petal to potentially approve you for a credit card, even if you have no credit history or a low credit score. And with Petal's pre-approval tool, you can check if you're pre-approved for one of its cards without any impact to your credit score.

No annual fee

The best credit cards for building and rebuilding credit are no annual fee cards, and there's no annual fee for this Petal card. You can use it to improve your credit without it costing you.

Rewards with select merchants

When you use the Petal® 1 "No Annual Fee" Visa® Credit Card at participating merchants, you earn between 2% and 10% cash back on eligible purchases, depending on the merchant's specific offer. Petal's lineup of participating merchants includes both national and local offers. The cash back rate for this card at participating merchants is excellent.

MORE OPTIONS: Best Rewards Credit Cards

No foreign transaction fee

You won't need to pay extra if you use your Petal® 1 "No Annual Fee" Visa® Credit Card while you're traveling internationally. The lack of foreign transaction fees is a helpful perk we don't see very often from credit cards for bad credit.

High credit limits

Petal offers credit limits of $300 to $5,000 for the Petal® 1 "No Annual Fee" Visa® Credit Card. The benefit of a high credit limit is that it can help you keep your credit utilization ratio down, a key factor when building credit.

RELATED: How to Build Credit Fast

What could be improved

This Petal credit card has a few downsides worth knowing about.

Rewards on everyday spending

The Petal® 1 "No Annual Fee" Visa® Credit Card doesn’t earn cash back anywhere except participating merchants. That limits the value you'll get from it, especially compared to other cash back credit cards.

It's also disappointing when you consider that the Petal® 2 "Cash Back, No Fees" Visa® Credit Card offers cash back on purchases and up to 2% to 10% back with its merchant offers. The Petal® 1 "No Annual Fee" Visa® Credit Card likely doesn't have those same perks because it's an option for consumers who are rebuilding credit, whereas Petal's original card isn't.

High APR

Like most credit cards, this Petal card charges a variable APR that depends in part on your creditworthiness. However, its APR range is higher than most other cards, including credit cards for consumers with bad credit. It's recommended to always pay your credit card bill in full to avoid interest, and if you do that, then the APR doesn't matter. But if you carry a balance at any point, this card's high APR will cost you more.

LEARN MORE: What Is APR and What Does It Mean for Your Credit Cards?

Petal has added fees before

While the Petal® 1 "No Annual Fee" Visa® Credit Card has no annual fee, the Petal site also mentions that card fees and terms may vary for those who got the card before May 16, 2023.

Some cardholders who had the Petal® 1 "No Annual Fee" Visa® Credit Card before that date received notice that they would be charged an $8 monthly fee going forward. The only way to opt out was to close the card. This doesn't affect new applicants, but it makes you wonder if Petal may do the same thing to more cardholders in the future.

Suggested credit score

There's no minimum suggested credit score for the Petal® 1 "No Annual Fee" Visa® Credit Card. It's possible to qualify for it with poor credit, fair credit, or no credit at all.

Compare credit card rewards, fees, APRs, and more using our side-by-side comparison tool.

The Petal® 1 "No Annual Fee" Visa® Credit Card is right for you if:

You're looking for your first credit card so you can start building credit, or you need to rebuild credit after missteps.

Petal and its Petal® 1 "No Annual Fee" Visa® Credit Card have their issues. It'd be nice if the card earned cash back on all types of purchases, not just those at select merchants. And the fact that Petal once added an annual fee for some cardholders is problematic. Still, for improving your credit score, this Petal credit card does the trick and doesn't require you to pay a deposit.

SEE MORE: Best Starter Credit Cards for No Credit

Our credit card methodology

At The Motley Fool Ascent, we rate credit cards on a five-star scale (1 = poor, 5 = best). Our rating criteria includes rewards rates, welcome bonuses, fees, and perks like travel credits and 0% intro APR offers to evaluate our ratings.

We combine these factors with an evaluation of brand reputation and customer satisfaction to ensure you're getting the best card recommendations. Learn more about how The Ascent rates credit cards.

FAQs

-

The credit limit for the Petal® 1 "No Annual Fee" Visa® Credit Card ranges from $300 to $5,000 depending on your creditworthiness.

-

Yes, you can get prequalified for the Petal® 1 "No Annual Fee" Visa® Credit Card. To check if you prequalify for that and other Petal credit cards, go to the Petal website to see offers and fill out their form. After you submit it, Petal will let you know if you prequalify for any of its cards.

-

This card's customer service gets mixed reviews. Some consumers like Petal's customer service, but others have found it unhelpful. Petal hasn't been evaluated by any big customer service studies yet, so it's difficult to say how it ranks compared to other card issuers.

Our Credit Cards Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

The Motley Fool has no position in any of the stocks mentioned.