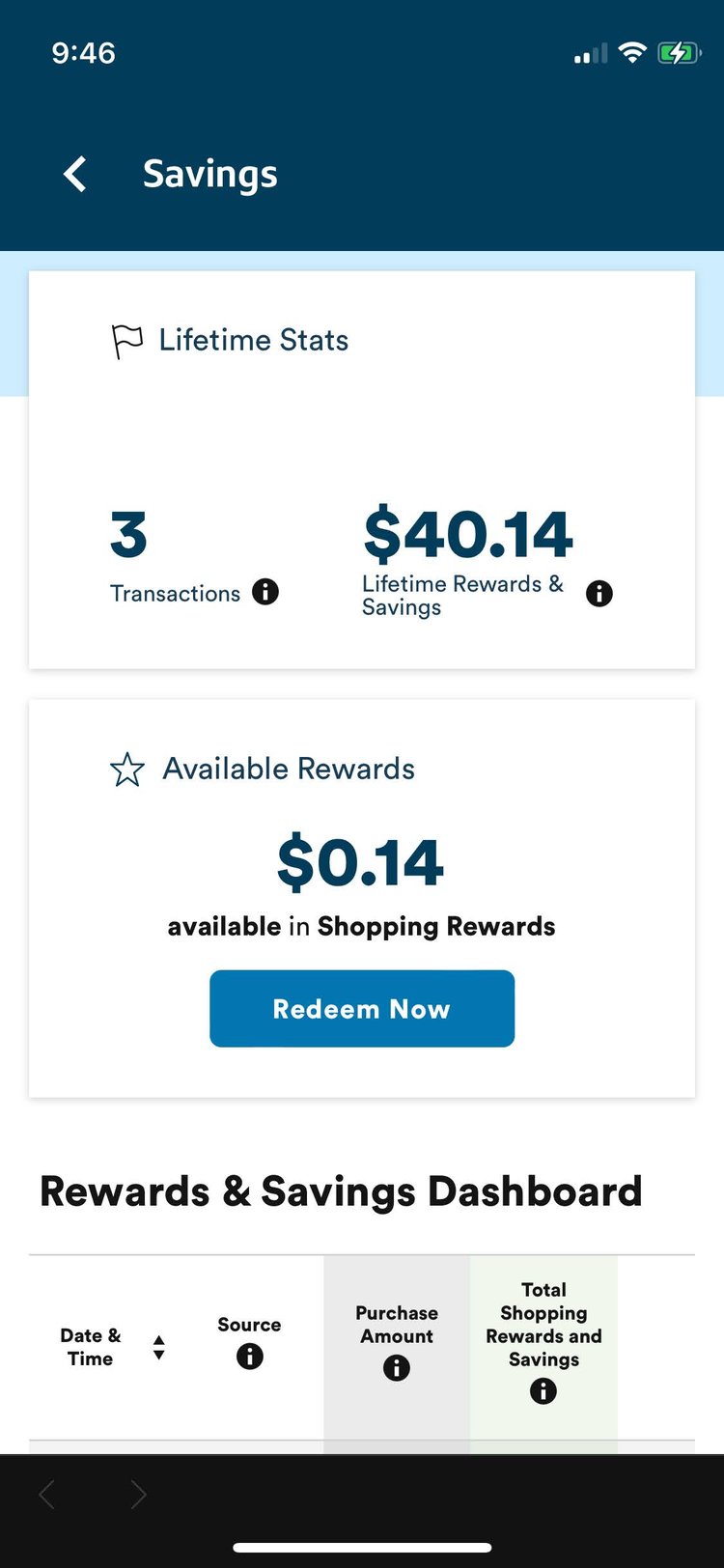

Capital One Shopping is the only coupon-rewards app I use. Downloading the free extension has earned me $40 in four months, mostly through sign-up bonuses. My favorite part is you can earn while shopping as usual, no need to shop through a clunky portal. I'll cover when the popular shopping app can save you money, and where it falls short.

Pros

- Free to use

- Personalized deals

- Automated coupon codes

Cons

- No cash back

- Intrusive pop-ups

- Coupon codes often fail

What is Capital One Shopping?

Capital One Shopping is a free web browser tool that finds you the best online coupons and prices. Formerly known as Wikibuy, it was purchased by Capital One and rebranded as Capital One Shopping.

How does Capital One Shopping work?

The web application searches over 30,000 online retailers to find the best deals. To use Capital One Shopping, download the browser extension (available on Google Chrome, Mozilla Firefox, Microsoft Edge, and Safari) or download the mobile app, available for iOS and Android.

Then, the app can save you money in three ways:

- Find and apply online coupon codes

- Compare prices as you shop online

- Earn rewards you can redeem for gift cards at dozens of retailers

What I like about Capital One Shopping

Free to use

There's no fee to use or install Capital One Shopping. Instead, you give it access to your browsing data. If you're OK with trading data for deals, then it's worth the exchange.

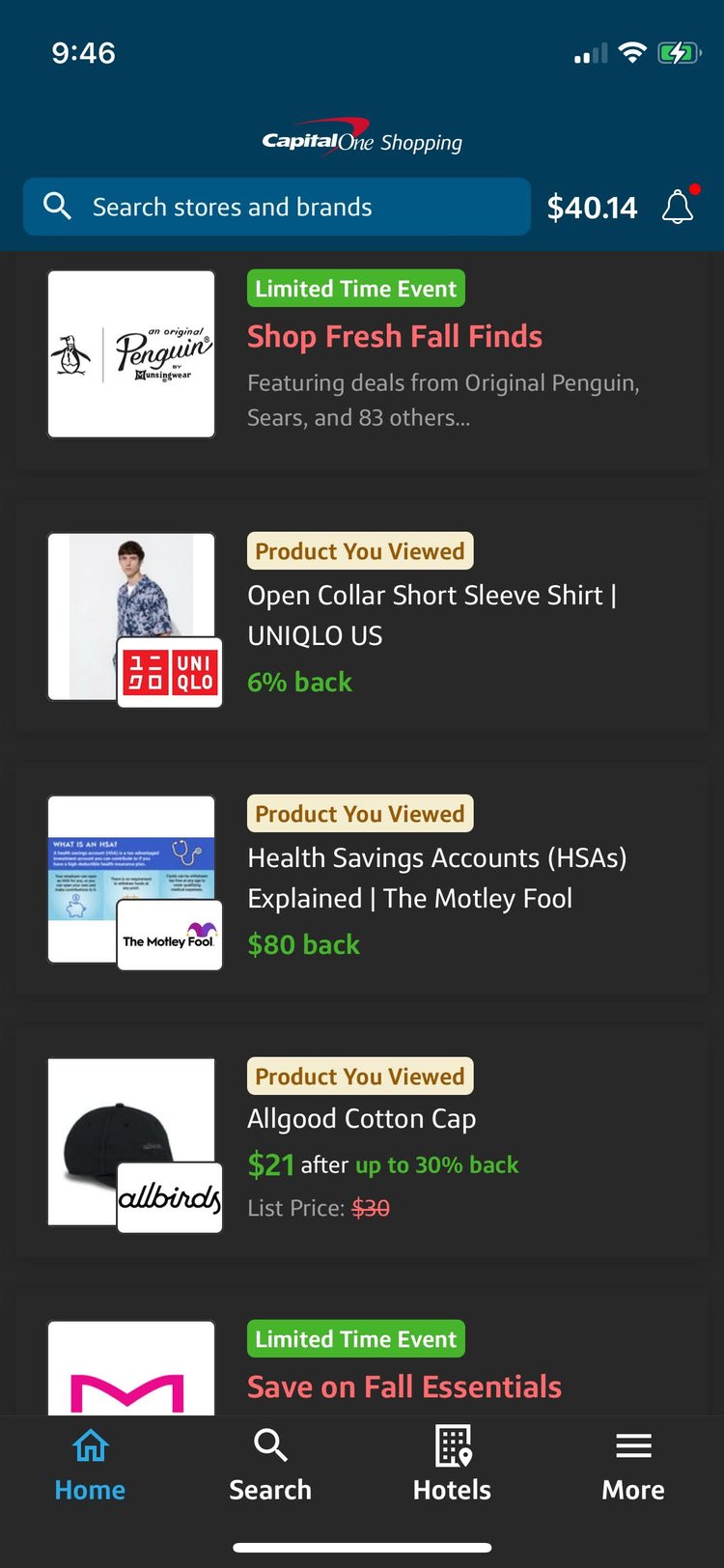

Personalized deals

Unlock personalized deals by shopping online as normal, but with the Capital One Shopping extension installed. Personalized deals show you products you viewed and offer you shopping credits for buying them. Think 6% back on a UNIQLO shirt you passed over last week.

Automated coupon codes

The Capital One Shopping extension will show you available coupon codes that could save you money. If you allow it, the extension will attempt to apply all the codes automatically.

Shopping credits

You can earn shopping credits through Capital One Shopping. When you visit affiliated retailer websites, you can earn a percentage of your purchase in shopping credits. You can redeem them for gift cards to popular retailers.

Compare savings rates

Make sure you're getting the best account for you by comparing savings rates and promotions. Here are some of our favorite high-yield savings accounts to consider.

| Account | APY | Promotion | Next Steps |

|---|---|---|---|

Open Account for SoFi Checking and Savings

On SoFi's Secure Website.

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

up to 3.80%

Rate info

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus.

Min. to earn: $0

|

New customers can earn up to a $300 bonus with qualifying direct deposits!

|

Open Account for SoFi Checking and Savings

On SoFi's Secure Website. |

Open Account for Western Alliance Bank High-Yield Savings Premier

On Western Alliance Bank's Secure Website.

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

4.30%

Rate info

The annual percentage yield (APY) is accurate as of May 2, 2025 and subject to change at the Bank’s discretion. Refer to product’s website for latest APY rate. Minimum deposit required to open an account is $500 and a minimum balance of $0.01 is required to earn the advertised APY.

Min. to earn: $500 to open, $0.01 for max APY

|

N/A

|

Open Account for Western Alliance Bank High-Yield Savings Premier

On Western Alliance Bank's Secure Website. |

Open Account for Barclays Tiered Savings

On Barclays' Secure Website.

Rating image, 5.00 out of 5 stars.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

4.00%

Rate info

Balances less than $250,000 earn 4.00%, and balances greater than $250,000 earn 4.20%.

Min. to earn: $0

|

N/A

|

Open Account for Barclays Tiered Savings

On Barclays' Secure Website. |

What could be improved

No cash back

All rewards are shopping credits.

If Capital One says you get $60 back on a product, it means you get $60 back you can apply to gift cards through the rewards portal. Kind of misleading, but there you have it. Don't expect cold, hard cash deposited into your checking account.

Coupon codes often fail

Capital One Shopping often offers coupon codes that fail to apply.

For example, if the code is for 10% off your order of $50 or more, it won't work if you only have $40 worth of goods in your shopping cart. There are also times when you might run into expired coupon codes. I've had the extension promise me $1 on DoorDash purchases, only to check the app later and find out the rewards were deemed as "invalid." Whomp whomp.

The app can be intrusive

App pop-ups can make shopping more unpleasant.

You'll see Capital One Shopping pop up anywhere that sells merchandise online. Sometimes, you're just window shopping online and don't want extra pop-ups on your screen. It slows things down, and for what? Well, the money, that's what. But it's not always about that.

How much does Capital One Shopping cost?

Capital One Shopping is free to use, regardless of whether you're a Capital One credit card or banking customer. You can download and use the app and web extension for free anytime. Sometimes, Capital One Shopping even pays you for downloading it. I earned $10 for adding the mobile extension and $30 just for signing up.

Capital One Shopping online ratings

The Capital One Shopping app has strong mobile reviews, with caveats. Many reviewers confuse the shopping app for Capital One's other services. A fair bit seems spammy, too. The most relevant reviews cite not earning promised payouts, and not actually earning anything through the app.

- iOS app rating: 4.9/5 stars

- Android app rating: 4.8/5 stars

Capital One Shopping platform

Capital One Shopping offers a mobile app, a desktop platform, and a browser extension. I use the extension, only navigating to the app and the desktop platform to check rewards (and occasionally, personalized deals).

Capital One Shopping offer screen. Image source: Capital One Shopping, captured by author.

Capital One Shopping stats screen. Image source: Capital One Shopping, captured by author.

Is Capital One Shopping safe?

Capital One Shopping is reasonably safe to use. It doesn't ask you to provide sensitive information, and you can log in with your Google or Capital One account. It does collect a lot of data for its own use, but it doesn't let partners use that data to market their products to you.

Alternatives to Capital One Shopping

If you want an app that earns cash back: Rakuten is a money-saving app that helps you earn cash back for online purchases. Depending on your rewards preference, you may want to stick with Capital One Shopping and redeem rewards for gift cards.

If you want an app that rewards in-person shopping: Fetch is another app that earns rewards, but includes in-person shopping at physical stores. The app lets you scan store receipts and e-receipts to earn valuable rewards you can redeem for gift cards and more. But if you don't shop in person much, Capital One Shopping may be a better choice.

Capital One Shopping might be right for you if:

- You frequently shop online.

- You'd like personalized offers on things you shop for.

- You'd like Capital One to automatically search and apply coupon codes for you.

-

Review sources

FAQs

-

No. Capital One Shopping is available to everyone, including those who don’t have a Capital One credit card or bank account. You can use it by simply downloading the browser extension or the mobile app.

-

Capital One Shopping is a free browser extension that searches for coupon codes and allows you to earn rewards while shopping online. You can also use the Capital One Shopping website to search for the best deals available.

-

Most rewards will become available within 30 to 90 days of making a purchase to account for returns, cancellations, adjustments, and exclusions. Travel-related rewards may take up to 90 days after the travel has been completed to post to your account.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.