If you're a new business owner, or have recently switched accounting methods from cash to accrual accounting, you may not be familiar with accounts receivable.

Accounts receivable plays an active role in the accounting cycle. Accounts receivable totals directly affect your net income since they are considered revenue, but the subsequent collection of any receivables balances does not affect your retained earnings, since they are already part of your revenue total. In addition, accounts receivable is a permanent account and is not affected by closing entries.

Overview: What is accounts receivable?

If you sell goods or services to your customers on credit, your business will always have an accounts receivable balance in your general ledger. Accounts receivable reflects the amount of money owed your business from the goods and services that you provided your customers on a credit basis.

It’s important for business owners to manage their accounts receivable properly, from initial credit application to collection of the accounts receivable balance. If you’re concerned about how quickly your customers are paying, calculating your accounts receivable turnover ratio can provide some insight.

Accounts receivable vs. accounts payable: What’s the difference?

Accounts receivable reflects the money that is owed to your business for providing goods and services. Accounts receivable are considered an asset and are reflected on your balance sheet as such.

Accounts payable is the money that you owe vendors for providing goods and services to your company. Accounts payable is considered a liability on your balance sheet since it is money that you currently owe.

One easy way to remember the difference is that your accounts receivable balance is likely recorded on your customer’s books as an accounts payable item.

Benefits of accounts receivable

One of the signs of a successful business is the ability to increase sales. Providing credit to a select group of customers can do just that, providing those customers can also help to build customer loyalty, allow you to customize sales events for credit customers, and grow your business.

The ebb and flow of your accounts receivable can also help you better manage financial projections, which can be helpful when creating a budget for your business.

How to process accounts receivable

Processing accounts receivable is a straightforward process. If you’re looking to offer credit terms to your customers for the first time, here are the steps you need to follow:

Step 1: Develop a credit approval process for your customers

Be sure to develop a credit approval process for your business. This process must be used by you and your bookkeeper when invoicing customers on credit.

Tips for developing a credit approval process

There are a number of things you should do prior to offering credit to your customers. Here are the things that need to be completed:

- Create a credit application: You can create a credit application from scratch or use a template that can be purchased from an office supply store or downloaded. The application needs to include all of the terms and conditions applicable to the offer of credit and must follow federal laws on credit practices.

- Create credit terms: If your cash flow is healthy, you can extend credit for 30-45 days, but those operating on a tighter cash flow may want to extend credit for 10-15 days. Each customer that is approved for credit should have accounts receivable terms assigned, with that information communicated to the customer prior to any credit sales.

Step 2: Create an invoice for your customers

Invoicing is important. Be sure you have the ability to produce an accounts receivable invoice for your customers immediately.

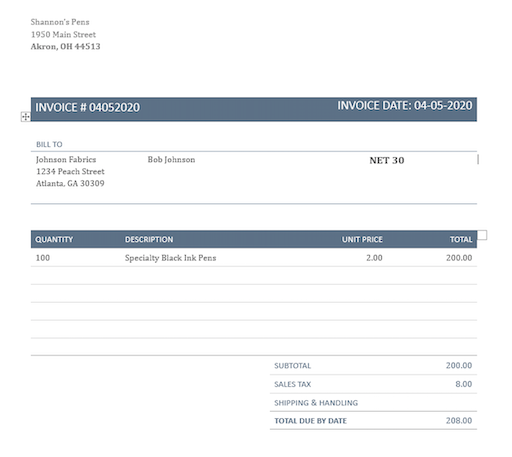

For instance, you sell $200 worth of pens to your customer, charging them $8 in sales tax. Whether you’re posting invoices manually into a ledger, or letting your accounting software handle the posting, here is what the journal entry would look like for this accounts receivable example:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 4-5-2020 | Accounts Receivable | $208 | |

| 4-5-2020 | Sales | $200 | |

| 4-5-20 | Sales Tax | $8 |

Tips for creating an invoice

Sending an invoice to your customers promptly helps to ensure that payment will be made promptly.

- Send the invoice immediately: Don’t wait a week before sending an invoice. Once a purchase is completed, the invoice should be completed as well.

- Use accounting software if you can: One of the nice things about using accounting software is that once the sale is processed, you can immediately invoice your customers.

- Be sure terms are front and center on your invoice: If you expect payment in 30 days, be sure that’s noted prominently on the invoice. Remember, you customers can’t pay you on time if they don’t know when payment is due.

An example of an invoice with NET 30 credit terms included. Image source: Author

Step 3: Track accounts receivable balances

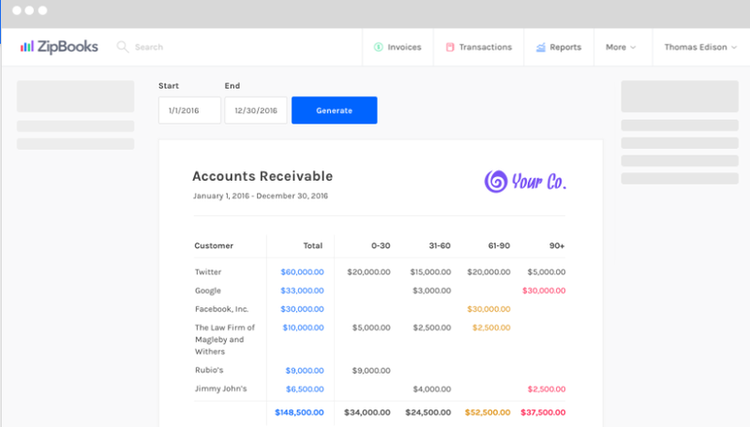

It’s vital that you stay on top of your accounts receivable balances. This way you can make sure that customers are reminded when payment due dates draw closer as well as follow up when payments are late.

offers good accounts receivable tracking.

If you’re using accounting software, you can run a weekly accounts receivable report to see which accounts are past due and which will soon be due. This can help you collect past due accounts.

Tips for tracking accounts receivable balances

Proper management of your accounts receivable balances is important. Here are a few tips to ensure that you receive payments on a timely basis:

- Always know when payments are due: Whether you’re using a spreadsheet or accounting software to track your accounts receivable, you should always be aware of which payments are due.

- Send your customers a reminder: A quick email reminder to your customers that their payment is due shortly can be helpful.

- Be proactive: Be sure to follow up with your customers immediately once the invoice due date has passed without payment. While it doesn’t guarantee payment, it sends a timely reminder to your customers that payment is due.

Step 4: Post payments

The final step in the accounts receivable process is posting payments that you have received from your customers.

Once you receive payment from your customer, the journal entry would be:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 4-5-2020 | Cash | $208 | |

| 4-5-2020 | Accounts Receivable | $208 |

Note that the sales tax is not included in this journal entry, because sales tax remittance is handled in a separate transaction.

Tips for posting payments

The easiest way to post customer payments is by accepting payments online. However, many people still have their customers remit payments through the mail. Whatever your method, here are some tips to manage customer payments properly:

- Provide multiple payment options: The quickest way to receive payment is to provide your customers with numerous payment options. While online payments offer greater convenience, some businesses still prefer to pay bills with a check. Make sure your customers have the option to do both.

- Double-check that online payments are posted accurately: If your accounting software automatically posts payments from your bank, be sure that the payment is posted properly. In most cases, the automatic posting is completed without issue, but there are times when payments are put in limbo or even posted to the wrong account.

Maintaining accounts receivable is good for business

What business doesn’t want more customers? If you’re looking to expand your customer base, selling products and services to your customers on credit will help tremendously.

It’s important that the process is handled properly, including proper vetting of customers, offering credit terms that are suitable for your business cash flow, and being proactive in collecting accounts receivable balances.

The best way to handle accounts receivable is by using accounting software. If you’re in the market for accounting software that is a good fit for your business, be sure to check out The Ascent’s accounting software reviews.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.