Educating yourself about the common small business expense categories will make it much easier to determine what is and isn’t deductible at tax time.

Some of the most common expense categories include utilities, travel, salaries and other wages, and rental expense, but there are many more that you should be aware of.

In this article, we’ll explain what type of expenses are deductible as well as provide you with a list of the most commonly used business expense categories.

Overview: What counts as a deductible business expense?

The IRS has defined business expenses as “the cost of carrying on a trade or business,” going on to say that these expenses are usually deductible if the business operates to make a profit.

But what counts as a business expense? A lot more than you may realize. In fact, any expense that is considered ordinary and necessary for your business is likely a deductible expense.

So, for every dollar that you spend on ordinary and necessary business expenses, which we’ll explain next, you’ll be able to take a tax deduction in the same amount, reducing your tax burden considerably.

A word of caution: You’ll have to factor in your accounting method when it comes time to deduct expenses.

For instance, in December of 2019, you receive a bill from Atlas Roofing for repairs completed earlier in the month. The bill is for $1,750, and will be paid in January 2020.

If you’re using the cash method of accounting, you cannot deduct that expense for 2019, but it can be deducted in 2020, when you pay the bill.

If you use the accrual method of accounting, you are able to recognize the expense in the month that it was performed, December, so you can deduct the $1,750 expense for 2019, even though it will be paid in 2020.

What are the business expense categories?

Below, you’ll find a list of some of the most common small business expense categories that can be deducted from your taxable income.

If you’d like more information on business deductions and exactly what is allowed, be sure to visit the Deducting Business Expenses overview on the IRS website.

You’ll also want to check out IRS Publication 535; Business Expenses, for a more complete explanation of business expenses and exactly what you can deduct.

- Advertising: This includes the cost of placing ads or running commercials for your business.

- Continuing education: Thinking of going back to school to learn the latest in your field? That’s deductible.

- Credit and collection fees: If you need to use outside agencies to collect past due balances, you can deduct that.

- Dues and subscriptions: Subscription costs to publications related to your business are deductible, as are membership dues for professional organizations.

- Employee benefit programs: The cost of employee health insurance or retirement benefits such as a 401(k) match is fully deductible.

- Insurance: General liability, worker’s compensation, product liability, and disability insurance premiums are deductible.

- Maintenance and repairs: Whether it’s for routine maintenance like HVAC servicing, or replacing cracked tile in your reception area, maintenance and repairs are deductible.

- Office expenses and supplies: This includes things such as pens and pencils, file folders, toner for your copier, and ink cartridges for your printer.

- Postage and shipping: The cost of shipping orders or simply mailing a letter is a deductible expense.

- Printing: Whether it’s a one-page document, or a booklet for your customers, the cost of printing is deductible.

- Rent: If you rent office or retail space, the rent is deductible.

- Salaries and other compensation: Employee salaries as well as any wages paid to contract employees is completely deductible.

- Telephone: Whether it’s a state of the art phone system or cell phones for your field reps, the cost of your phones is completely deductible.

- Travel: Any business related travel is deductible, whether it’s local, national, or international, as long as it’s considered necessary for your business.

- Utilities: The cost of your gas, electricity, and water is a completely deductible expense.

How to categorize expenses for your small business

It’s really quite simple to categorize your business expenses, but many small business owners put this process off until it’s absolutely necessary, creating more work in the process.

Remember, if you’re looking for investors, outside financing, or need to create financial projections, you will have to have an accurate estimate of your regular business expenses, categorized properly. Here are a few ways to make the process a bit easier.

Tip #1: Set up your expense accounts to reflect your business

If you provide cell phones for field reps and outside sales people, make sure that you include a separate expense for telephones.

For smaller businesses, or those that only use an office landline, your monthly bill can be expensed to your utilities account. Some smaller businesses combine printing and postage expenses, but if your business routinely ships goods to customers, you should have a separate account for your postage and delivery costs.

Tip #2: Code vendor invoices with the correct expense account

When setting up your vendors, enter a default expense code or category if possible. This links the vendor to the correct expense automatically, eliminating the need to manually code vendor invoices.

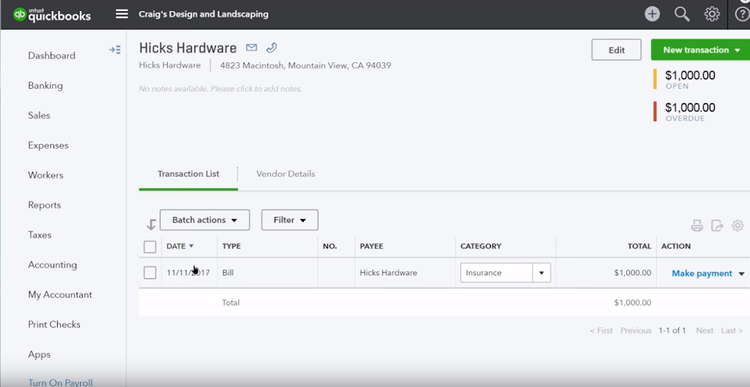

QuickBooks Online allows you to enter an expense category when setting up vendor details. Image source: Author

If this is not possible, be sure to examine and code the bill properly for the accounts payable process, ensuring that every bill entered is coded to the correct account. Consistency is also important, so you’ll want to make sure that you code and record invoices consistently from month to month.

Tip #3: Stop using spreadsheets and start using accounting software

While accounting software won’t be much help if bills aren’t posted to the correct expense account, it can go a long way in helping you categorize and track your expenses throughout the year.

Another bonus: instead of spending your time adding up your expenses, you’ll be able to create a report in minutes that will display all your business expenses for the year, simplifying the deduction process as well.

The best accounting software for categorizing business expenses

If you have numerous expenses to track, it’s best to use accounting software to track them properly.

While it’s certainly possible to track expenses using a business expenses list, or by entering expenses on a spreadsheet, come tax time, you’ll appreciate the ability to extract those expenses easily. Plus you have the security of having adequate backup and a solid audit trail in place, should you ever be audited.

Here are some of the best accounting software applications for tracking your business expenses.

1. Zoho Books

Zoho Books offers excellent bookkeeping and accounting capability for small businesses, including a solid expense management feature.

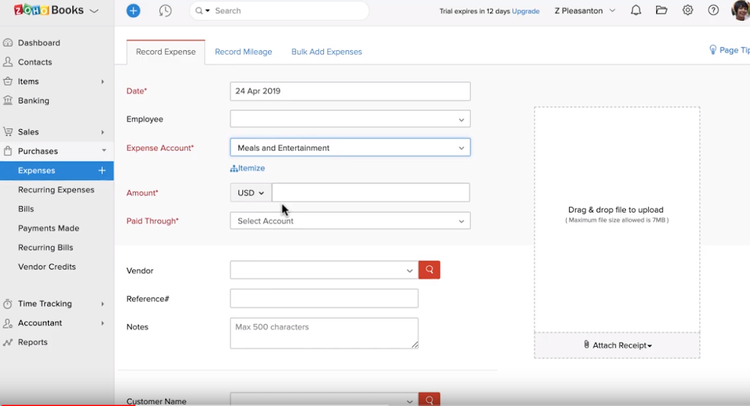

Zoho Books offers numerous ways to record your business expenses. Image source: Author

One handy feature in Zoho Books is the option to record an expense, record mileage, or record bulk expenses. Zoho Books also offers an excellent primer on how to track business expenses.

2. AccountEdge Pro

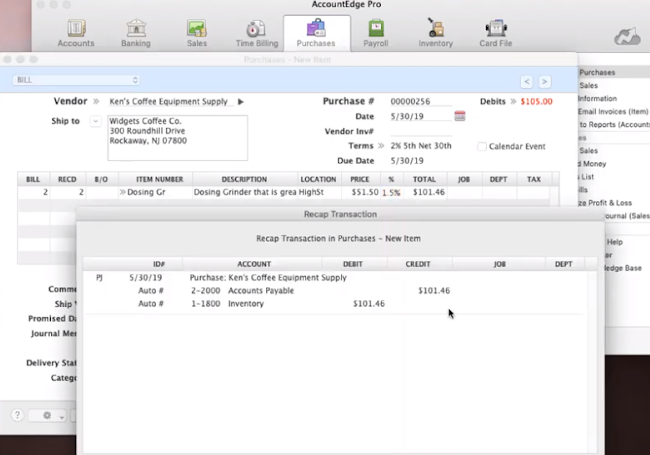

AccountEdge Pro is designed to make life easier for small business owners. One of its best features is the ability to assign an appropriate expense account to each vendor, so when you enter a bill for that vendor, the correct accounts will be debited and credited automatically.

AccountEdge Pro allows you to view the accounts affected by a purchasing transaction. Image source: Author

Source: AccountEdge Pro software.

While there are instances where a vendor can have multiple business expense accounts, such as a business that may offer both printing and shipping services, in many cases, vendors will only represent a single business expense type. By setting this up during the vendor setup process, you can eliminate the need to allocate the expense when it’s entered.

3. FreshBooks

FreshBooks offers multiple ways to track and manage your expenses, including standard expense entry, the ability to upload receipts from your mobile phone, or the option to scan a receipt directly into FreshBooks.

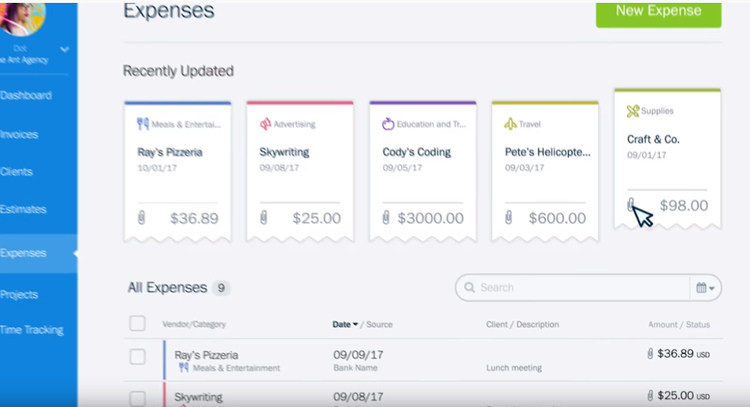

The Expenses feature in FreshBooks categorizes your receipts automatically. Image source: Author

With automated receipt categorizing, FreshBooks makes it easy to track and later deduct all allowable expenses and is also a good option for those preparing expense reports.

Not everything is deductible

Along with this long list of allowable deductions, there are a few expenses that are never deductible for business owners, including lobbying, political contributions, memberships in social organizations, and of course any illegal activities such as kickbacks or bribes.

The good news is that the vast majority of your business expenses are deductible. Just be sure you’re tracking them properly in order to take advantage of them, and if you have any questions about what is and isn’t deductible, it’s always best to refer them to your accountant or CPA.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.