For a seasoned pro or a new owner, it can sometimes feel that managing your business is more difficult than selling your products and services. For new businesses, in particular, it can be difficult to understand all of the accounting and business terminology you may come across.

While we don’t have enough space to list all of the business and accounting terms that you should know, we can give you a list of some of the more important ones.

1. Accounting

Accounting is the act of recording and analyzing financial transactions. In the past, accounting involved managing multiple journals and reconciling them at month-end, but the process has been made simpler with the advent of accounting software that automates many of these manual tasks.

There are several fields of accounting, with financial accounting and management accounting the two most often performed by business owners.

2. Accounts payable

Accounts payable, or AP, is the money owed to vendors for goods and services purchased by your company. Rent, utilities, and postage are common examples of accounts payable. AP is recorded as a liability on your balance sheet.

3. Accounts receivable

Accounts receivable, or AR, represents the money owed to you by your customers. Any time you sell goods and services to customers and prepare an invoice for payment due, that amount becomes part of your AR balance. AR balances are recorded as an asset on your balance sheet.

4. Accrual accounting

Accrual accounting records both revenues and expenses at the time they are earned rather than when cash exchanges hands. Accrual accounting is the recommended method of accounting for businesses of any size.

5. Asset

An asset is anything of value owned by your business. The cash balance in your bank account, your AR balance, inventory, and buildings are all considered assets. The value of any asset that your business owns is recorded on your balance sheet. Most businesses have a combination of both short-term and long-term assets.

6. Audit

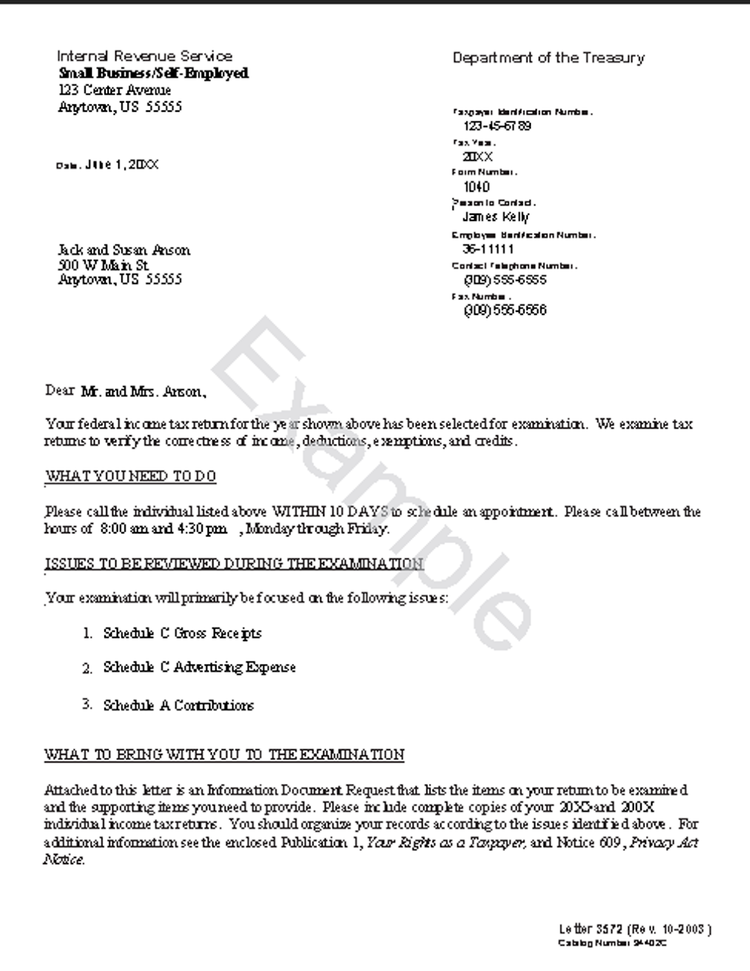

An audit is a verification process of sorts and looks at business processes to ensure a business is in compliance with those processes. For example, if the Internal Revenue Service (IRS) audits your business, you will be asked to produce documentation that the proper procedures were followed. You may also be asked to justify any business expenses that were deducted from your tax return.

An IRS audit will begin with a letter outlining what part of your return will be audited. Image source: Author

Along with IRS audits, there are also external and internal audits. Publicly held companies are required to have an external audit performed each year, while an internal audit is often used to improve current policies and procedures.

7. Balance sheet

One of the big three financial statements (along with an income statement and cash flow statement), a balance sheet gives you a snapshot of your business asset, liability, and equity totals at a particular point in time. What you own, what you owe, and what you have invested in your business are all reflected on your balance sheet.

8. Business plan

A business plan or strategic plan is a necessity for small business owners who want to avoid the typical pitfalls that new business owners may encounter. Creating a business plan helps you identify your customers, fine-tune your product offerings, and plan for growth.

9. Capital

Capital refers to cash and other assets held by your business. Capital is used to create wealth and business expansion through investment. Any assets that your business currently owns, including bank accounts, stock, intangible assets such as patents or trademarks, and equipment, are all considered capital.

10. Cash basis accounting

Unlike accrual accounting, cash basis accounting does not consider when expenses are incurred but instead records payments when received and expenses when they are paid. Sole proprietors and very small businesses often use cash basis accounting, but if you have employees, you need to use accrual accounting.

11. Cash flow statement

A cash flow statement or statement of cash flows provides you with details on the amount of cash your business receives, as well as how much it has spent. Particularly important for small businesses using accrual accounting, the cash flow statement lets you know just how much cash you have available at any given time.

The statement of cash flows provides detailed information on cash flowing into and out of three distinct areas of your business. Image source: Author

12. Cost of goods sold (COGS)

Your cost of goods sold is an important metric for small business owners to track. COGS is the direct cost of purchasing or producing goods or services that you offer your customers. To calculate profitability accurately, you have to know your cost of goods sold.

13. Depreciation

Depreciation is the act of allocating the value of an asset over its useful life. Depreciation is used for large purchases, such as buildings, equipment, vehicles, and other items that are used over a long period, with the cost of the item allocated over that specific period. That allocation is recorded as accumulated depreciation on your balance sheet.

14. Employer Identification Number (EIN)

Unless you’re a sole proprietor working under your Social Security number, you will need to apply for an EIN from the IRS. An EIN serves as a way to identify your business and is used when you file your business tax return and will remain the same throughout the life of your business.

15. Equity

Equity reflects the amount of money you have invested in your business. Equity is always calculated by subtracting your total liabilities from your total assets, with the difference representing the total value of your business.

16. Fiscal year

A fiscal year allows you to begin your accounting year at any time. While smaller businesses often use a calendar year (January through December) for their accounting year, larger corporations often use a fiscal year instead.

17. Fixed assets

Fixed assets are typically classified as property, plant, and equipment (PP&E) and can include factory machinery, furniture, and vehicles. Fixed assets are tangible assets, meaning they have a physical presence and should always be depreciated over their useful life. For example, if your factory equipment has a useful life of five years, it should be depreciated over that period.

18. Fixed and variable costs

Fixed costs or overhead costs are costs that do not vary based on manufacturing levels. For example, whether your factory produces 1,000 baseball bats or 5,000 baseball bats, your rent for the month will remain the same.

Variable costs are directly related to production and vary when production levels vary. For example, your supply costs will rise as production increases and will drop when production drops.

19. Income statement

An income statement, otherwise known as a profit and loss statement, is a summary of your business income and expenses. One of the three main financial statements, the income statement provides a way to view financial performance over a specific period.

20. Inventory

Inventory is the goods owned by your business that are offered for sale. Materials and other supplies can also be considered inventory. There are three stages of inventory that can be held by a business, including:

- Finished goods purchased for resale

- Work-in-progress assemblies

- Raw materials that are used to create inventory items

If you sell products, you must have an adequate method in place for tracking inventory properly.

21. Intangible asset

Intangible assets are long-term assets that are not physically tangible. Trademarks, copyrights, goodwill, and intellectual property are all considered intangible assets.

22. Liability

A liability is a financial obligation that your business owes. Any time you receive a bill from a vendor and record it in your accounts payable account, it’s considered a liability. There are two main types of liabilities: short-term liabilities, such as accounts payable and accrued payroll, which are due within a year’s time, and long-term liabilities, such as notes payable and loans, which are due over a longer period of time.

23. Marketing

Marketing is not the same as advertising, although advertising is part of a marketing strategy. Marketing is used to engage and influence potential customers. Market research, branding, and promotion are all part of marketing.

24. Retained earnings

Retained earnings is the amount of money left over after dividends have been paid to shareholders. These earnings then become part of your owner/shareholders equity account and are reported on your balance sheet.

25. Revenue

Revenue is the income received from your customers for products and services that you sell. Revenue totals can serve as a good measuring tool for banks and investors because the amount of revenue earned can indicate whether your business offerings are in demand.

Why knowing business terminology is important

It’s difficult to track your accounts receivable if you’re not sure what it is. The same goes for retained earnings, revenue, and depreciation.

That’s why keeping up with current business lingo is important. Business management terminology covers a lot of territory, so don’t worry about knowing every single entrepreneurial term that may pop up. You’d never have time to spend on your business.

Instead, review this business glossary to help you get familiar with some of the more important business terms you should know and learn the rest as they pertain to your business.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.