Accounting helps business owners understand and communicate their companies’ financial position. Each of the eight types of accounting provides insight into a business’s operations through a different lens. Today’s lesson: cost accounting.

Overview: What is cost accounting?

Determining the actual cost to manufacture a product isn’t always a straightforward process. You use cost accounting to investigate the true cost of manufactured goods.

For example, it's logical that a shoemaking business would include laces' cost in its shoe cost calculation. It's not as easy to understand how you add factory rent costs to a shoe's cost.

The goal is to provide managers a basis for making manufacturing decisions. Cost accounting parses expenses into fixed and variable classifications and offers methods to allocate indirect business expenses to your products. One of the most common applications of cost accounting standards is calculating contribution margin, which measures profitability, excluding fixed costs.

Cost accounting is a type of managerial accounting that helps managers decide what and how many products to manufacture. Cost accounting gets more granular than external parties like lenders care to see, so it’s only used for internal cost control purposes.

Cost accounting vs. financial accounting: What's the difference?

Cost accounting takes a magnifying glass to your company's processes, scrutinizing every expense to help management build a lean operation. Financial accounting gives a zoomed-out view of your business, fit for investors and lenders who care about profitability.

Cost accounting gives the specificity about your costs that only a manager would care about. Financial accounting trades detail for concision. Cost accounting techniques inform inventory and cost of goods sold balances in your accounting software.

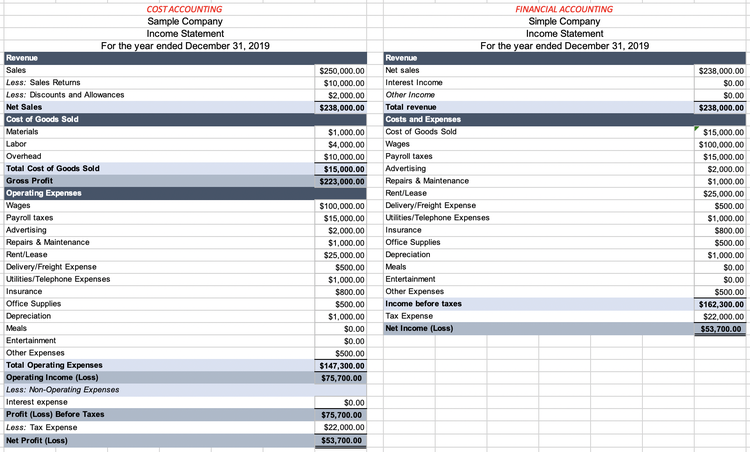

Consider the following income statements, with the same account balances. On the left, you’re getting a level of detail about the cost of goods sold that external parties would find superfluous.

It’s useful for managers to see what goes into the expense, but external users of the financial statement don’t need to know. The right income statement provides just enough information for a potential lender who cares more about whether your business is in the black.

Cost accounting provides a level of detail not found in financial accounting. Image source: Author

Where financial accounting remains fixated on the past, cost accounting standards tend to look ahead. Cost accounting falls under the managerial accounting umbrella, which is all about using financial metrics to make business decisions.

Types of cost accounting systems

Cost accounting aims to calculate your product costs accurately. The first step is choosing the correct way to frame your product costs. Depending on your product, you’ll work within a job or process costing system.

Product costs comprise direct material, direct labor, and manufacturing overhead costs. Your accounting system determines how you calculate direct costs -- direct material and direct labor -- for each product. We’ll address how overhead costs work in the next section.

1. Job costing

Job costing records direct labor and direct material costs by individual order. When your goods and services are easily discernible, you’ll use a job costing system.

For example, say you run a construction company that builds homes. You can easily account for the costs incurred for each home, so you’ll use a job costing system. As you complete the project, you’ll charge the client for all material and labor costs attached to the job.

In general, you’ll use a job costing system for unique products and services. Furniture makers, artists, and consultants all use a job costing system.

2. Process costing

When your business produces identical products in massive quantities, you need to use a process costing system. Since it’s impossible to figure out the exact direct material and labor costs for identical products, you find the total direct material and labor costs for each batch.

When I think of process costing, I imagine a vat of potato chips. You can’t trace costs to a single chip, so you apply direct labor and direct materials costs to each salty and delicious batch.

You can calculate the batch’s direct labor costs by looking at how many hours your employees spent converting the potatoes to chips. Multiply the number of hours spent per batch by the employees’ hourly pay. If each batch requires two hours of labor at $50 per hour, direct labor costs $100 per batch (2 hours of labor ✕ $50 per hour).

Your direct material costs are how much you paid for the potatoes used in the batch. If each batch uses 500 pounds of potatoes at $0.50 per pound, your direct material costs are $250 per batch (500 pounds of raw material ✕ $0.50 per pound).

Your direct labor and direct material costs -- together called prime costs -- total $350 per batch.

Types of cost accounting

While your products determine whether you use job or process costing, you can decide which type of cost accounting to implement for allocating the third and final part of product costs: manufacturing overhead.

Before you allocate manufacturing overhead costs to your products, you need a list of overhead costs. Overhead costs include:

- Indirect materials, like cleaning supplies and oil for machinery

- Indirect labor, like a factory supervisor’s salary

- Factory rent and utilities

- Machinery repairs

- Machinery and building depreciation

- Cleaning

- Quality assurance

1. Traditional costing

The simpler of the two methods, the traditional costing method, applies overhead costs based on one cost driver, such as labor hours or machine hours.

To make potato chips, you might use direct labor hours as the entire process's cost driver. You'll tally up all of the overhead costs and dole out overhead to each batch based on how many hours your workers dedicated to the batch.

For example, say all of your manufacturing overhead costs total $2,000 for the month. In that time, your employees worked 1,000 hours. Using the traditional cost method, you must allocate $2 of overhead for every labor hour ($2,000 manufacturing overhead / 1,000 labor hours cost driver).

2. Activity-based costing (ABC)

Activity-based costing (ABC) is not as easy as ABC, let me tell you. Instead of using just one measure to allocate overhead to your products, you choose the most impactful cost driver to distribute each type of overhead cost.

For example, you’ll allocate utility expenses to each batch by the number of machine hours the batch requires. Then you’ll use the number of inspections to allocate quality assurance costs. I could go on, but you should check out our guide to ABC.

Most small businesses will find the ABC method more harm than help since it takes a lot of time and effort to implement correctly. The payoff is a highly accurate product cost, but paying an accountant to set it up could wipe out any potential upside.

Cost accounting is a must for manufacturers

Manufacturing business owners benefit tremendously from a working knowledge of basic cost accounting concepts. Now that you have a primer, explore our other cost accounting content, such as differentiating product and period costs.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.