The debt service coverage ratio (DSCR) is an accounting ratio that measures the ability of a business to cover its debt payments. The DSCR is frequently used by lending institutions as part of their due diligence during the lending process to see how well a business can pay its current debt and if it’s in a position to take on additional debt.

Overview: What is the debt service coverage ratio?

If you’ve recently applied for a loan or are considering doing so, you should know that one of the key items that all lending institutions or investors look at is your ability to pay your current debt and any additional debt you may take on.

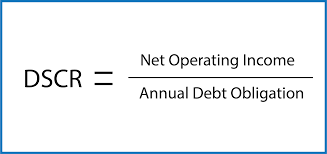

The DSCR calculation is derived by dividing net operating income by annual debt obligation. Image source: Author

To make that determination, most lending institutions use the debt service coverage ratio, or DSCR. Similar to cash coverage ratios -- like the interest coverage ratio, which is used to calculate the ability of a business to cover interest payments using net operating income -- the DSCR looks at the ability of a business to cover both principal and interest payments.

What does the DSCR tell you?

The DSCR reveals how much money you have available to cover current debt, as well as whether you have enough income to cover any additional debt. A DSCR of less than 1 can indicate that you need to increase your net operating income (NOI) or decrease expenses to take on additional debt.

Most lenders have a set requirement for lending and look for a DSCR of at least 1.2 to extend a loan. In the eyes of a lender or investors, a DSCR of 1 indicates that you have enough net operating income to cover your current debts but are not in a position to take on any additional debt.

How is the DSCR used?

You can calculate your DSCR before you even apply for a loan. Doing so gives you an idea of your chances of being approved or if it’s better to wait until your DSCR has improved. But the DSCR is used most frequently by lending institutions to determine how able a business is to repay current debt and take on more.

What is the DSCR formula?

The DSCR formula is:

Annual Net Operating Income ÷ Annual Debt Payments = Debt Service Coverage Ratio, or DSCR

It’s important to note that while most financial institutions use net operating income when calculating the DSCR, some lenders use EBIT, which is earnings before interest and taxes. Be sure to check with your lender to see if they use this pre-tax method to calculate the DSCR.

To get started calculating your DSCR, you’ll need to calculate both net operating income and debt payments.

To calculate net operating income:

Revenue - Operating Expenses = Net Operating Income

If you’re using an accounting software application, you can obtain this information directly from your year-end income statement. If not, you’ll need to calculate it manually using the totals recorded in your accounting journals.

Next, you’ll want to calculate your total debt payment for the year. Again, when using accounting software, you can obtain this information from the general ledger report, but you will need to calculate debt payments manually if you’re not currently using accounting software.

To calculate total debt payment:

Principal Payment + Interest Payment + Lease Payments = Total Debt Payment

How to calculate your DSCR

If you’re ready to calculate your DSCR, first obtain your net operating income from your year-end income statement. For this example, we’ll say that your net operating income is $51,000. Next, you’ll have to calculate your annual debt payment. For example, your business currently has a loan for $250,000 for the building that you occupy. Your monthly principal payment is $2,100, while your interest payment is $675 per month.

That makes a total monthly payment of $2,775 ($2,100 + $675). You would then multiply your monthly debt payment by 12 to arrive at an annual total:

$2,775 x 12 = $33,300

Since you have both your net operating income and your annual debt repayment amount, you can calculate your DSCR.

$51,000 ÷ $33,300 = 1.5

Example of a DSCR calculation

Let’s go ahead and do another DSCR calculation. Jim owns an auto parts store in the Chicago area. He currently has one location on the northwest side of the city but would like to add a second store on the southwest side.

Before purchasing a commercial property, your lender will determine loan eligibility using various information, including calculating the DSCR. Image source: Author

Jim’s 2019 net operating income was $125,000. His mortgage on the building that houses his business has a principal payment of $34,000 annually, while his interest payments are $6,000 annually, for total debt payments of $40,000. He also has a lease payment on automotive equipment that runs $1,000 monthly, or $12,000 annually, making his annual debt payments $52,000.

With these totals in place, Jim can calculate his debt service coverage ratio:

$125,000 ÷ $52,000 = 2.40

The result means that Jim can cover his current debt more than twice based on his net operating income.

If Jim were to obtain a second loan with a monthly payment of $1,100 in principal and $500 in interest, that would add a total of $19,200 in payments annually. Let’s calculate what Jim’s DSCR would be with a second mortgage:

$125,000 ÷ ($52,000 + $19,200) = 1.76

Even with the second mortgage added to his debt total, Jim is still in a good position to cover his debts as long as he maintains his current net operating income level. But if the second loan had put Jim’s DSCR at 1 or less, chances are that he would not be approved for the loan.

Calculate your DSCR before applying for a loan

While the DSCR is almost always run by lending institutions before approving a loan, why not be proactive and run the calculation yourself? Knowing what your DSCR is can be a deciding factor in whether to apply for a loan or wait until your net operating income increases or your total debt is lower.

If your DSCR does come back low, there are some things that you can do to increase it before you apply for a loan.

- Pay down current debt: Reducing or eliminating debt payments will increase your DSCR and make it more likely that your loan request will be approved.

- Revamp operations: If you’re using old, inefficient equipment, chances are these inefficiencies are costing you money. An old heating system can waste thousands of dollars annually, while outdated factory equipment means slower production and higher employee costs. Looking at your operations across the board can help you reduce your expenses and operate more efficiently, increasing your odds of getting that loan. However, even if you don’t, improving your operations is always a good idea.

- Reduce expenses: This goes with revamping operations, but even if your operations are running smoothly, chances are there are things you can do to reduce your expenses.

Getting your DSCR to 1 is a good starting point, but if you want a better shot at a loan, you’ll want a DSCR between 1.2 and 1.5 at least.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.