The question that provokes the ire of every fresh high school and college graduate: “What’s next?”

It’s a question you’re continually asked as a business owner. Lenders, investors, employees, and you all want to know what’s coming down the pike. A financial forecast is one of the best ways to express your vision.

Overview: What is financial forecasting?

Businesses create financial forecasts to play out a predicted future. Communicated through forward-looking financial statements, forecasts reflect how your business might look according to your estimates and assumptions about future revenue, expenses, and changes in your business.

Accountants and financiers share common ground in financial forecasting because it relies on the analysis of historical financial statements yet necessitates the input of future expectations.

As a small business owner, you need a plan for what’s next: Financial forecasts can alert you to gird your financial resources when you see sales shortfalls or the payment of a massive debt on the horizon. It can also show you that it’s time to hire more staff when you’re expecting an increase in demand for your products or services.

Lenders and investors often ask for financial forecasts to see your strategic plan for the company.

Financial forecasting can offer profound insight into your business’s future, but there’s no way to get around one immovable bulwark: the unknown of what’s to come.

Financial forecasting vs. budgeting: What's the difference?

Financial forecasting and budgeting operate similarly. The difference lies in how they’re used and why they’re created.

Budgets are a business’s guidebook to reaching its annual profit goal. Even businesses that adopt flexible budgeting, which adjusts spending as expected revenue shifts, enforce budgets to keep the business running as expected.

Most budgets focus acutely on revenue and expenses, and they can get pretty granular.

Compared to budgets, financial forecasts lose some detail and gain some scope. They’re often used to assess current business strategy and how decisions made now can produce a desired outcome in the future.

You’re meant to tinker with a financial forecast, coming back to it as you consider investments in and changes to your business. The forecast reflects, within a margin of error, the bottom-line impact of potential decisions.

Long-term forecasts can address a time frame that looks many years beyond where your budgets end.

How to create a financial forecast for your small business

Large businesses dedicate a portion of their finance staff to financial planning and analysis. They create complex models teeming with variables and assumptions. But you don’t need all that to get an idea of where your business is headed.

1. Dream up your future business

Just like every good movie, start with a dream sequence (wait, what?). Actually take out a piece of paper and a pen, or make a vision board, or write a letter to your future self to articulate where you see your business.

Set your target on a date in the future, whether it’s six months, a year, or five years from now. Imagine the products and services you’re offering, the property you’re owning, and the long-term projects in which you’re investing.

2. Consider upcoming investments and debt payments

Coming back to the here and now, think about what projects you’ve agreed to start and any significant payments coming due in the time frame of your forecasted financials. Think about big expenses before you begin forecasting financial statements, called pro forma financial statements.

3. Analyze your historical financial statements

My favorite Pixar character, Edna Mode from The Incredibles, once said, “I never look back, darling. It distracts from the now.” But in this one instance, I must disagree. You must look back at your company’s financial history to create a future forecast.

For this exercise, pull up your company’s balance sheets and income statements for the past three periods. If you’re looking to make a financial forecast for the next six months, look at financial statements from the last three six-month periods.

Start by calculating the percent change in your five major account types: revenue, expenses, assets, liabilities, and equity. You can find account balances in your accounting software.

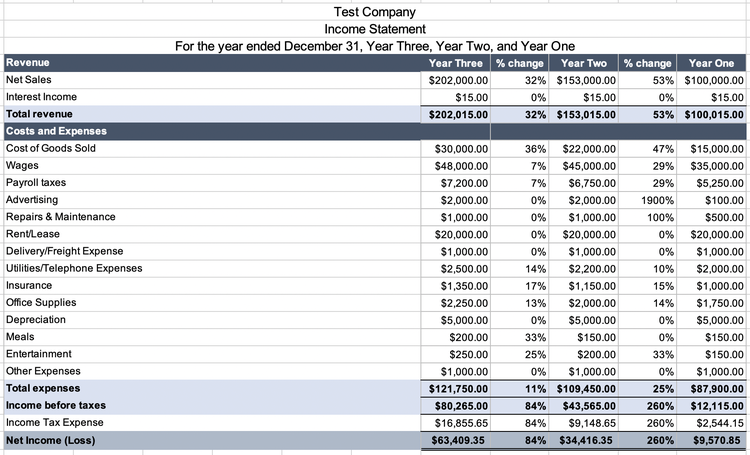

Take a look at this income statement for the last three years.

Compare income statements from the last three periods. Image source: Author

The company’s revenues increased drastically year-over-year. While total expenses also rose, they didn’t increase by nearly the same margin as revenues. We’ll keep this in mind when we create the pro forma income statement. Do the same for balance sheet accounts.

4. Complete a ratio analysis

Ratio analysis is an advanced step, so just keep moving if you’re satisfied with the analysis you got in step three.

But those who want to dive deeper should calculate the following accounting ratios for the last three years. Businesses with little to no inventory can leave off the quick ratio.

- Gross profit margin ratio = (Sales Revenue - Cost of Goods Sold) / Sales Revenue

- Profit margin ratio = Net Income / Sales Revenue

- Debt-to-asset ratio = Total Liabilities / Total Assets

- Current ratio = Current Assets / Current Liabilities

- Cash ratio = Cash / Current Liabilities

- Quick ratio = (Current Assets - Inventories) / Current Liabilities

You can also compare your ratios to the benchmark in your industry to assess your business’s health. ReadyRatios is an excellent resource for industry ratio benchmarks, but take this information with a grain of salt: Small businesses will have less favorable ratios because they simply can’t achieve the same economies of scale that larger businesses can harness.

5. Draft a pro forma income statement

After taking a look at your company’s past, it’s now time to predict its future. A crystal ball wouldn’t be unhelpful at this stage.

The standard suite of pro forma financial statements is an income statement, balance sheet, and cash flow statement. Start the process by exporting the most recent version of each statement from your accounting software to a spreadsheet.

New businesses with no historical data should rely on whatever they can glean from similar businesses that have opened in their industry and area in recent years, with a particular focus on sales information. Older businesses can refer to their own data.

To draft a pro forma income statement, follow these steps:

- Estimate future revenue and expenses with a growth or decline percentage

- Fine-tune your estimates to account for the effect of internal and external factors

Step 1: Estimate future revenue and expenses with a growth or decline percentage

The most straightforward forecasting technique is to take your business’s most recent income statement and apply a rate of growth or decline for each revenue and expense account. The results of your financial statement and ratio analyses will guide your forecast.

Consider the income statement above. Revenues increased by 53% between years one and two and 32% between two and three. It would make sense that revenue would grow again in year four, but by a smaller margin, perhaps 10%. That means revenues for year four are a forecasted $222,200 ($202,000 year three revenue * 1.1 growth rate).

You have multiple expense accounts to project, and they won’t all change by the same percentage. Fixed costs, like rent and insurance, won’t rise as fast as wages and the cost of goods sold. Looking at historical data, create a realistic growth forecast for each account.

If you completed a ratio analysis, you’d bring in that data to sharpen the forecast.

Step 2: Fine-tune your estimates to account for the effect of internal and external factors

Internal factors are those you can expect or control, including:

- Introducing or discontinuing product lines

- Hiring new employees

- Investing in machinery, land, or buildings

- Paying down debts

External factors are harder to see coming, but might be:

- Changes in consumer attitudes and industry standards

- Changes in tax law and other regulations

- An economic boom or downturn

- A pandemic (looking at you, 2020)

Adjust your estimates based on what you see coming down the pike.

6. Draft a pro forma balance sheet

In a similar process to creating the income statement, start with the most recent version of your balance sheet. The balance sheet is home to asset, liability, and equity accounts.

Adjust cash according to the expenses you plan to pay with cash, accounts payable for expenses paid on credit, and accounts receivable for credit sales.

Don’t forget to adjust your fixed asset balance during this step. If you’re planning to make a major investment in land or machinery, this is the place to reflect that.

You’ve made a proper balance sheet when assets = liabilities + equity. The most easily forgotten step: Add forecasted net income to retained earnings, an equity account.

7. Draft a pro forma cash flow statement

The cash flow statement helps business owners understand where their cash goes during the period. It can help to break this statement into monthly or quarterly statements to make sure your business is never spending more cash than it has at the time.

8. Adjust often

Return to your financial projections frequently to adjust for changes in business strategy, internal and external factors, and new financial insights. Forecasts are more a moving target than a guiding star.

Good for insight, not for reliance

We live in the present, waiting to experience an unknown future. While financial forecasting can offer insight into your business’s future, it can’t tell you what exactly will happen. The discipline of keeping close tabs on your accounts and your projections, though, will stand you in good stead no matter what the future brings.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.