You might have heard that profit margin ranks high on the list of essential business metrics to track. But did you know there are actually two types of profit margin?

After you read this article, the next time someone asks, “What’s the profit?” your answer should be, “Gross or net?”

What is gross profit?

Gross profit, also called gross profit margin, is a company’s earnings after subtracting the cost of goods sold (COGS).

Gross Profit = Net Sales - Cost of Goods Sold

Net sales refer to the money, cash or credit, your company brings in through the sale of its products minus returns, discounts, and allowances. For manufacturing businesses, the cost of goods sold has three parts: direct labor, direct material, and manufacturing overhead. The cost of goods sold for merchandise businesses includes just the cost of acquiring the goods for resale.

Businesses use gross profit to assess what portion of sales revenue goes toward making or buying inventory. The multi-step income statement, which your accounting software can prepare for you, lists gross profit.

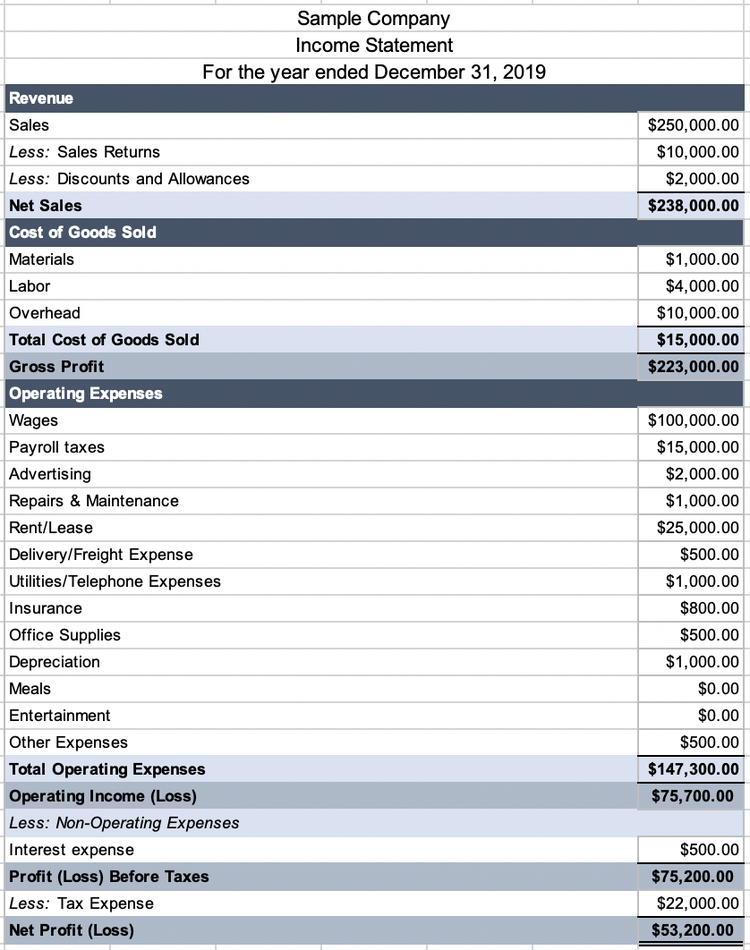

The multi-step income statement lists gross profit. Image source: Author

Be sure not to mix up gross sales with net sales. The $250,000 figure in the income statement above is gross sales, which includes sales returns, discounts, and allowances. Net sales, sometimes called net revenue, reflect your company’s sales revenue more accurately than the gross amount.

You can also express gross profit as a percentage, or the gross profit margin ratio.

Gross Profit Margin Ratio = [(Net Sales – Cost of Goods Sold) ÷ Net Sales] x 100

How to calculate gross profit

Use the gross profit formula, net sales minus cost of goods sold, to calculate gross profit.

Let’s say a company’s net sales totaled $100,000 last year. If COGS is $30,000, gross profit is $70,000.

The gross profit margin ratio is 70% ([($100,000 - $30,000) ÷ $100,000] x 100).

Now consider another business with net sales of $150,000 and COGS of $85,000, resulting in a gross profit of $65,000 ($150,000 net sales - $85,000 COGS).

Gross profit can indicate company success better than net sales. While the first business had lower net sales, it earned a higher gross profit than the second business. Without knowing the companies’ other expenses, it appears the first one is doing better.

What is net profit?

Net profit, also called net income, is the amount of money a business earns after accounting for all expenses. It’s the bottom line on the income statement.

Net Profit = Total Revenue - Expenses

The net profit formula accounts for all revenues and all expenses that a company incurs. Corporations do not include the distribution of cash dividends in this calculation.

Creditors and investors look at your net profit, also called net profit margin, to know whether your entire company is profitable. If you have a net profit, your revenues are higher than your expenses. When expenses exceed revenues, you have a net loss.

You can also express net profit as a percentage, called the net profit margin ratio:

Net Profit Margin Ratio = [(Total Revenue - Expenses) ÷ Total Revenue] x 100

How to calculate net profit

You calculate net profit by subtracting all expenses from total revenue. The net profit calculation includes non-operating revenues and expenses such as interest and taxes.

Net profit is different from operating profit, which doesn’t include interest and income tax expenses.

Consider the following income statement.

Net profit is shown as the bottom line of the income statement. Image source: Author

All business expenses get counted in the net profit calculation:

- Cost of goods sold: The direct material, direct labor, and manufacturing overhead costs associated with creating and distributing your products.

- Operating expenses: The expenses related to running your main business activities.

- Non-operating expenses: The expenses incurred outside your core business operations, including interest.

- Income tax expense: I’m sure you’re already familiar with this one.

Gross profit vs. net profit: What’s the difference?

While both are used to gauge a business’s profitability, gross profit and net profit differ by the types of revenue and expenses counted in each formula.

Gross Profit = Net Sales - Cost of Goods Sold

The gross profit calculation focuses solely on the revenue and expenses you can directly trace to your products. Since interest income, the sale of machinery, and most operating expenses aren’t directly tied to your products, they’re excluded from the gross profit calculation.

Net Profit = Total Revenue - Expenses

Net profit includes all revenue and expenses that your business incurs. Unlike gross profit, which only considers product costs, the net profit calculation includes both product and period costs.

Let’s look at a portion of the general ledger for Gotta Lick It Up, a local ice cream store.

| Account | Amount balance |

|---|---|

| Sales revenue | $200,000 |

| Cost of goods sold | $30,000 |

| Wages expense | $50,000 |

| Payroll tax expense | $5,000 |

| Equipment maintenance | $15,000 |

| Rent expense | $30,000 |

| Income tax expense | $15,000 |

To calculate gross profit, subtract sales revenue from the cost of goods sold. Gotta Lick It Up’s gross profit is $170,000 ($200,000 sales revenue - $30,000 COGS).

Net profit, which includes all expenses, totals $55,000 ($200,000 - $30,000 - $50,000 - $50,000 - $5,000 - $15,000 - $30,000 - $15,000).

When should you use gross profit instead of net profit?

Whether you use gross profit or net profit to communicate your business’s financial health depends on the question.

The next time someone asks you whether your business is profitable, you should respond with your company’s net profit or net loss. Profitability usually refers to your entire business's health, not just how much you’re earning on your products.

A question about your products’ profitability is about your gross profit. Investors often ask about your gross profit to understand whether you’ve priced your product appropriately.

When I say "profit," you say...

“Gross or net?”

Gross profit and net profit both provide valuable insights into the health of your small business. Use these figures to articulate your company’s profitability.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.