You may use a variety of methods to track business expenses, but in order to manage your business adequately, keep track of expenditures, and ensure that expenses are accurately accounted for, you will need to create an expense tracking system that works for you.

Here's how you can track your business expenses:

- Open a business bank account

- Choose an appropriate accounting system

- Choose cash or accrual accounting

- Connect financial institutions

- Begin managing receipts properly

- Record all expenses promptly

- Consider using an expense app

Overview: What are business expenses?

Part of the bookkeeping process is tracking business expenses properly. Any expenditure that is related to your business is considered a business expense.

Here are some common business expenses you are likely to encounter:

- Advertising

- Bank fees

- Commissions

- Consulting fees

- Contract labor

- Dues and subscriptions

- Mileage

- Office supplies

- Postage and delivery

- Printing and copying

- Salaries

- Software

- Travel

- Utilities

While these are the more common business expense categories, any purchase that is associated with your business can be categorized as a legitimate business expense.

How to track your small business expenses

The best way to track your business expenses is to use small business accounting software, which makes it much easier to track your expenses, classify them correctly, and have access to up-to-date financial information. This is especially important at tax time, since you’ll want to be sure to take all of the expense deductions that you can.

There are ways to track expenses manually, though this is only recommended if you have few business expenses to track.

Step 1: Open a business bank account

As a new business owner, you will need to open a business bank account. Once that account is operational, it should be used exclusively for business transactions.

While there may be an instance when you use your personal bank account for business purposes, having a separate business account will make it much easier to track and record your expenses properly.

Step 2: Choose an appropriate accounting system

You have a choice about what kind of accounting system to use for your business. While the best option is to choose an accounting software application that will work for your business, you can also use spreadsheet software, such as Microsoft Excel to record income and expenses for your business.

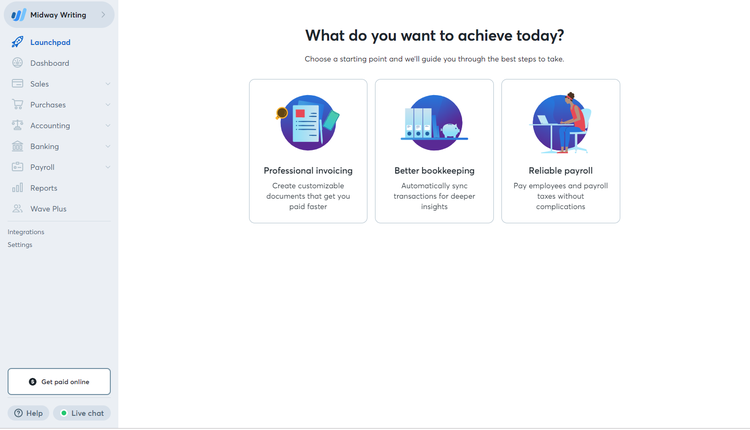

The Wave Accounting user interface allows you to easily set up both income and expenses. Image source: Author

If your heart is set on using accounting software, but it’s just not in your business's budget, opt for a free application such as GnuCash or Wave Accounting.

Step 3: Choose cash or accrual accounting

When setting up your accounting system, you’ll also need to choose either cash accounting or accrual accounting.

Most very small businesses, sole proprietors and freelancers use cash accounting as it’s very simple. When you use cash accounting, you simply record transactions when they occur. For instance, you record income when it’s received, and you record payments when they’re made.

Accrual accounting is more in-depth, and it’s a necessity for growing businesses, businesses with employees, or larger businesses. With accrual accounting, you record income when a product is sold, not when you receive payment for that product. The same goes for expenses, which are recorded when you receive the bill, not when you pay the bill.

Step 4: Connect your financial institutions

Small business expense tracking can be simplified by connecting your financial institutions with your accounting software. While some may be uncomfortable with this option, it’s actually very safe, with safeguards built in to protect your data.

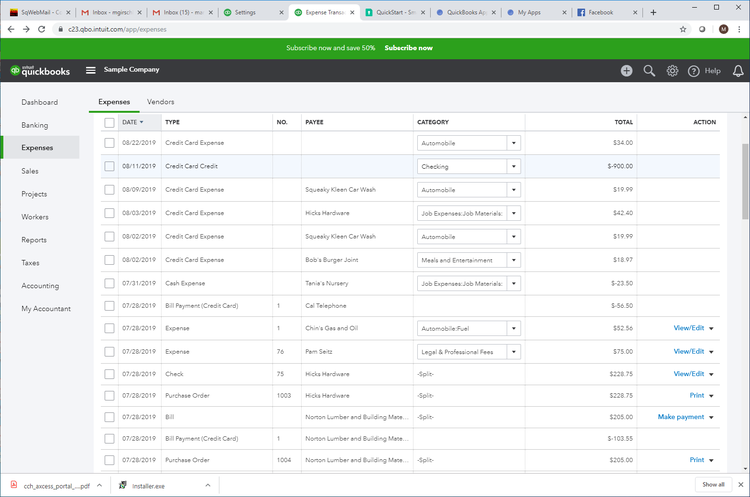

If you do connect your bank, you’ll be able to automatically download all banking transactions directly to your accounting software, and in many cases, have it automatically posted to the appropriate account.

This process makes it easy to account for every expense incurred by your business.

QuickBooks Online allows you to easily import all expenses from your bank account. Image source: Author

Many popular accounting software applications including QuickBooks Online, Xero, and FreshBooks, along with many others, allow you to easily connect your bank accounts for easy business expense tracking.

Step 5: Begin managing receipts properly

Another way to ensure that you’re tracking your business expenses properly is to use the mobile app that is available with your accounting software application. If your software doesn’t offer such an app, you can choose to use an expense management application that will integrate with your software.

These apps typically allow on-the-go expense management, allowing you to take a picture of a receipt and upload the image to your software, where it will be stored and later attached to the appropriate expense. If it’s a reimbursable expense, the receipt can be used for creating an expense report.

Step 6: Record all expenses promptly

You learned in Accounting 101 that all income and expenses need to be accounted for. This can be done in many ways. If you choose to connect your financial institutions to your software application, this process becomes fairly automated, though you will have to set up your accounts properly to insure proper allocation of the uploaded transactions.

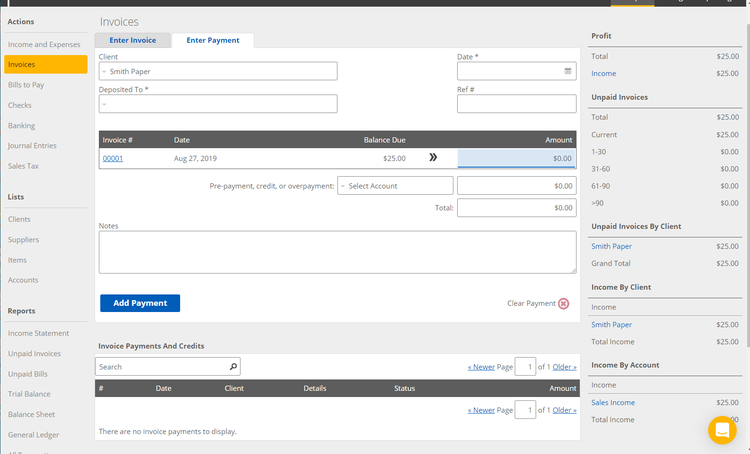

Kashoo allows you to enter your expenses manually rather than connecting with your bank. Image source: Author

Some applications offer the option to enter expenses manually. This is a good alternative for those who choose not to import transactions automatically. In most cases, you can also choose to import your bank statement at the end of the month and record your expenses at that time.

Finally, completing your bank reconciliation on a monthly basis helps to ensure that all transactions have been properly accounted for.

Step 7: Consider using an expense app

While not necessary for everyone, if you travel a lot for business, it may be worth investigating some of the expense apps on the market. These apps are designed to track travel expenses such as mileage, flight expenses, meals and entertainment expenses, and any other related business expenses.

Should you use an accounting software for tracking business expenses?

As you can see, you have many ways to keep track of your business expenses, both manually, and by using accounting software.

When an accounting software is best:

While using accounting software is always best for any type of business tracking, including both income and expenses, there are times when it is a must.

If any of the following situations apply to you or your business, it’s highly recommended that you use accounting software if you’re not already doing so:

- You travel for business frequently: Let’s face it, everyone loses receipts. If you’re tired of carrying a stack of receipts in your wallet or your purse, accounting software is your best bet. This is especially important if your business requires you to travel frequently.

- You have multiple employees that need to track expenses: If you have multiple employees that need to track business expenses, it’s imperative that you use accounting software. While a spreadsheet may be adequate for a single-person operation, it simply will not work if you’re tracking expenses for multiple employees.

- Your business is undergoing a growth phase: You may be small now, but if you’re planning on, or currently undergoing a growth phase, you’ll want to invest in accounting software and begin tracking your expenses properly.

- You have multiple business bank accounts: Tracking expenses from one institution can be time-consuming if done manually. It’s next to impossible if you have more than one business bank account. So do yourself a favor and use accounting software.

When to seek other methods:

While accounting software is the best business expense tracking solution, there are occasions when you can get by using spreadsheet software.

If any of the following situations apply to you, manually tracking your business expenses may be the right choice.

- You incur few expenses: If you’re just starting out and only need to track the occasional expense, using a spreadsheet may be adequate. But if business expenses start to increase, you should consider making the switch to a software application.

- You’re an Excel whiz: It’s no secret that Excel can perform a lot of calculations. If you’re an Excel whiz, it’s likely you can set up a spreadsheet that works for your business. However, since most of us aren’t an Excel whiz, accounting software may still be your best bet.

- Your business is more of a hobby: If you’re a dabbler and haven’t fully committed to your business just yet, tracking expenses manually may be just fine. But for everyone else, accounting software should be at the top of your list.

Tracking business expenses is a big part of your business

Whether you’re just starting out, are in the process of building your business, or are a well-established business, you need to track your business expenses.

So take a few minutes and put a plan in place that will allow you to track your business expenses easily and accurately.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.