If you’ve never heard of a pro forma invoice, you’re not alone. Pro forma is a Latin term meaning “as a matter of form,” and it’s provided to your customers as a courtesy rather than as a binding document. In most cases, a pro forma invoice falls somewhere between a quote and a completed invoice and is used to advise customers of the final cost of goods and services.

Overview: What is a pro forma invoice?

A pro forma invoice is not an invoice at all, but rather a precursor to writing an invoice. Businesses use pro forma invoices when providing their customers with an estimate or quote for goods or services, and they serve to advise your customers of the final costs of a sales transaction.

Pro forma invoices, when used, are always sent to your customers before goods and services are delivered. They can be particularly useful for businesses that ship products globally because they provide customs personnel with the details they need regarding the type of goods included in the shipment, the quantity, price, weight, and any other specifications.

Most accounting software applications can create a pro forma invoice, but like in manual accounting, the information provided on a pro forma invoice is never recorded in the general ledger until it becomes a regular invoice for services rendered or goods supplied.

Pro forma invoice vs. regular invoice: What's the difference?

There are plenty of similarities between a pro forma invoice and a regular invoice. Both provide details such as the number of items sold, the unit cost, and the final cost, as well as shipping information.

But there are just as many differences between a pro forma invoice and a regular invoice as there are similarities, starting with its legal standing. A pro forma invoice can be sent as a courtesy but does not constitute a binding agreement between the buyer and seller, whereas a regular invoice does.

| Pro forma Invoice: | Standard Invoice: |

|---|---|

| Is a non-binding document sent for informational purposes only | Is a binding document that the buyer is obligated to pay |

| Is always sent before goods and services being received | Is sent after the goods and services that are purchased have been received |

| Final terms and pricing are negotiable | Is non-negotiable |

| Is not recorded in an accounting system | Is entered into an accounting system when it’s issued |

| Is valid for a limited amount of time | Remains valid until the terms have been satisfied |

3 benefits to using a pro forma invoice

While some business owners may find creating and sending a pro forma invoice unnecessary, there are some benefits to using this type of invoice.

1. They provide relevant details before delivery

A pro forma invoice provides your customers with many of the details that will be found on the final invoice, including a breakdown of all of the items ordered and their cost. All relevant sales terms should be included as well.

You won’t need to add final terms such as the due date or an invoice number until the final invoice is created. In addition, pro forma invoices can be used to notify customers about expected delivery dates.

2. Provides a level of commitment from both the buyer and the seller

Though non-binding, a pro forma invoice indicates an informal level of commitment from both the buyer and the seller. A pro forma invoice can also double as a quote or purchase order for your customer, which in many cases may be a necessity for them to get the sale approved and the final invoice paid.

3. Can serve as a negotiating tool

Since a pro forma invoice provides all relevant sales information, it also provides the opportunity for both buyer and seller to make any changes. While this may prove more beneficial to your customer, it can also help build customer loyalty in the long run.

An example of a pro forma invoice

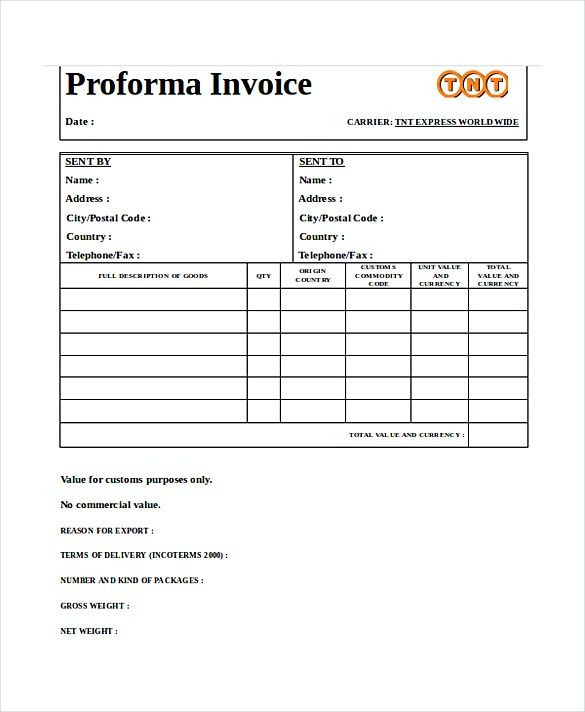

A pro forma invoice will have almost all the same details that a regular invoice will have except for an invoice number. Pro forma invoices can also display shipping information to make sure that the shipment can smoothly clear customs (invoice software can help with this).

A pro forma invoice is useful for overseas shipments because it provides details on the items and the reason for the export. Image source: Author

Note that the pro forma invoice is not considered a pro forma bill, nor does it offer pro forma terms or a pro forma payment option because it’s designed to be used for informational purposes only. Only a regular invoice should include these items.

Another occasion when a pro forma invoice may come in handy is when you sell goods to your customers on consignment. The example below illustrates how a pro forma invoice can be used for consignment sales.

A pro forma invoice is often used when goods are sent on consignment. Image source: Author

Once the consignment numbers are finalized, a regular invoice would be sent for payment of any items that were sold.

When you should use a pro forma invoice over a regular invoice

A pro forma invoice never takes the place of a regular invoice but is used in addition to a regular invoice. A pro forma invoice is not required for all sales but can be helpful under certain circumstances.

If a provisional bill of sale is required

A pro forma invoice provides your customers with a detailed account of the sale before its finalization. This information can be valuable -- or sometimes even necessary -- for your customers.

For example, if you’re selling to any government agency, a pro forma invoice will provide them with the details of the sale they need to get the final sale approved. A pro forma invoice also gives your customer a final look at the terms of the sale, including pricing and payment terms, providing an opportunity to make any last-minute changes or adjustments to an order.

For international shipping purposes

One of the most beneficial uses of a pro forma invoice is for international shipping. Since the pro forma invoice contains all the details needed to expedite clearing customs, many businesses use these invoices with international shipments. This provides their customers with a standard invoice once the product has cleared customers and has been received.

When selling items on consignment

Selling on consignment is always a tricky business since you can only invoice for items that have been sold. That’s when a pro forma invoice comes in handy. The pro forma invoice allows you to send a preliminary invoice of sorts to your customer detailing the items shipped, allowing you to then provide them with a regular invoice once items have been sold.

Pro forma invoices can be useful

Not all businesses need to use pro forma invoices. For example, if you provide cleaning services to your customers, it’s likely neither you nor your bookkeeper will ever need to prepare a pro forma invoice for your customers.

However, for those who sell overseas, on consignment, or to businesses that require a more formal agreement before finalizing a sale, knowing how to create a pro forma invoice is a must.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.