Whether you’re a sole proprietor or own a thriving small business, preparing a business budget is sound financial management. While static budgets, or budgets that don’t change, can be helpful, preparing and using a working budget can be much more useful for small business owners, allowing them to make adjustments as they go along.

Learn why writing a budget, particularly a working budget, is important for your small business, and pick up a few tips on how to make a working budget plan for your business.

Overview: What is a working budget?

A working budget is one you prepare and consult daily, weekly, or even monthly. For example, if you prepare a static budget, you have a set amount in your budget for revenue and expenses. Using a working budget, you can adjust those totals as you see fit, increasing revenue when you land a new customer or increasing expenses when your rent is unexpectedly raised.

Usually, you'll create working budgets using spreadsheet software since many accounting software applications designed for small businesses cannot create a working budget.

A working budget doesn’t have to be changed. However, when circumstances change in your business, as they most likely will, a working budget will allow you to reflect those changes in your budget.

Why is it important for your business to have a working budget?

A working budget doesn't replace a static budget. The point of having a flexible or working budget is to adjust your budget as circumstances change. For example, you’ve budgeted $10,000 in supplier costs for the year, but your supplier recently raised their price to $1,500 monthly, which comes out to $18,000 annually.

Using a working budget, designed for flexibility, you can adjust your budget each month to reflect the new total. If you find another supplier, you can then change your budgeted total to reflect the cost of the new supplier.

How to write a working budget for your business

Creating a working budget or flexible budget requires knowledge about prior year revenues and expenses, which is easily obtained from your financial statements. The best way to start is to create a budgeting outline, detailing what information you need to get started and where you can obtain it.

If you have no prior year information, just estimate your monthly budget totals based on your business plan.

For example, if your plan says you will be providing bookkeeping services for 25 clients, with each client paying you $5,000 annually, and that is your only source of revenue projected for your first year in business, you would estimate your revenue at $125,000. If you’re not sure how many clients you will have, you can enter a lower estimate. Then adjust your totals up or down based on actual numbers, as they occur, in your working budget.

Just follow these easy steps to create a working business budget for your business.

1. Review your revenue

Revenue is the number one driver for the rest of your budget. If you don’t have income flowing into your business, you won’t have the money to pay any expenses.

You need to examine business operations closely to determine revenue for the upcoming year. Do you plan on selling the same products and services you did last year, or are you adding or eliminating a product or service from your offerings?

If you’ve been operational for several years, you can examine past trends to determine what your expected revenue for the upcoming year should be budgeted at. If your business is relatively new, you’ll need to estimate your revenue based on realistic estimates of customers, products, and services you expect to sell.

2. Look at operating expenses

Before you look at your production costs and cost of goods sold, examine your operating expenses. These are expenses you will incur regardless of the products or services your business offers for the upcoming year. Because these business expenses will not vary, it’s much easier to estimate them based on prior-year costs, or even actual costs.

For example, if you’ve been paying $1,600 a month for rent, but you know that every year you have a rent increase of 10%, it’s easy to add the increase into your budget. You can always adjust later in the year based on actuals.

3. Estimate variable costs

While it may be easy to estimate fixed costs, it’s more difficult to estimate variable costs, or costs that will fluctuate with production. If you have variable costs from a prior year, you can use them to get started.

However, if you’re just starting, you’ll have to base variable costs on projected sales for the upcoming year, which is something you should do when completing your business plan or strategic plan. Either way, with a working budget, these numbers can be adjusted as needed, so a change in production will not negatively affect your budget.

4. One-time and emergency funding

Are you planning on replacing any machinery or equipment? Are you considering buying or selling a building? Consider these things when creating your working budget. The same goes for budgeting for emergency expenditures.

We all like to think computers will last forever, equipment will never stop working, and hurricanes and tornadoes won’t ever affect our business, but planning for such events allows you to be more financially prepared should disaster strike.

5. Create your budget

The final step is to take all your calculations and estimates and place them in a budget format that you can update monthly. This allows you to make adjustments regularly, rather than to operate your business off a budget that is no longer accurate.

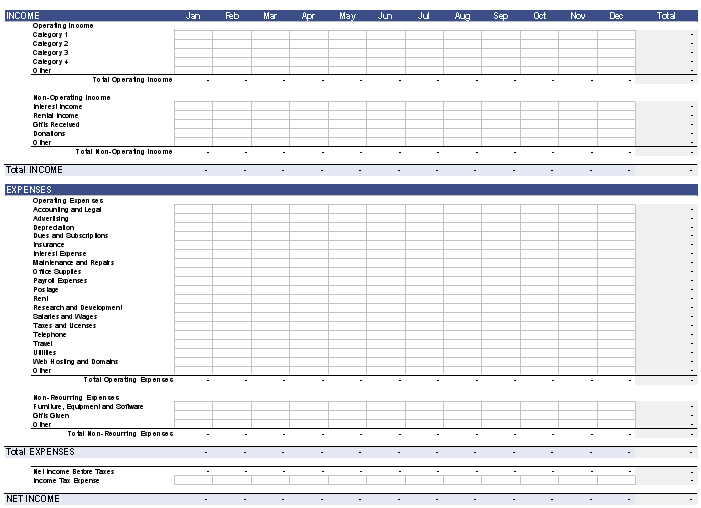

This budget template, or one similar, can be used to create budget totals each month. Image source: Author

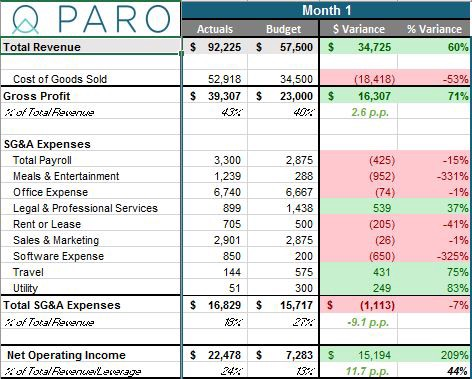

Using this budget plan example, you can review totals each month, and enter a more accurate estimate for the upcoming month. You may also find having a column with monthly actuals, as in the spreadsheet below, can help you better plan your budget each month.

Creating a working or flexible budget allows you to examine budget vs. actuals monthly and make changes for the upcoming month. Image source: Author

3 best practices for writing a working budget

Creating a working budget is similar to creating any budget. While some small businesses may want to review their working budget daily, reviewing budget vs. actuals monthly will usually suffice. You can do the following to ensure your working budget remains a useful resource.

1. Use your annual budget as a starting point

Using a working budget doesn’t mean you should forego your annual operating budget. Instead, use the totals on your annual budget to fill in the gaps on your working budget. At the end of the year, you’ll have a much better idea of how your business performed financially.

2. Update your working budget regularly

Using a working budget allows you to make proactive adjustments regularly. It’s pointless to create a working budget and then not update it regularly. You can only make needed adjustments going forward by updating budgeted totals with actual totals. For example, if you see travel expenses are too high, you can cut back on travel for the upcoming months, rather than waiting until the end of the year to address the issue.

3. Find the method that works best for you

Some small businesses like to look at their budget daily, while others may find it best to review income and expenses monthly or even quarterly. A working budget will make you more proactive in tracking your finances, so find the method that works best for you and stick to it.

Are you ready to write a budget?

Budgets are an important part of small business accounting. While an organizational budget is a necessity, you may find that using a working budget provides you with greater insight into your business finances, allowing you to make adjustments regularly.

With its flexible nature and ability to make adjustments in real time, the working budget would benefit even the smallest business.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.