Margin, or profit margin, is a percentage that’s used to measure the profitability of your business after expenses have been deducted from revenues. While revenue provides a good preliminary indicator of how well your business is performing, to determine actual business profit, you must consider your expenses as well.

Before you can calculate any accounting margin, you need to obtain the following information.

- Total Revenue: Total revenue is the income earned from selling goods and services. Revenue is calculated using the following total revenue formula: Total Revenue = (Average Price per Unit/Service Sold) x (Number of Units Sold). Be sure not to confuse revenue with profit.

- Cost of Goods Sold: The cost of goods sold is the cost of producing or purchasing inventory for resale.

- Operating Expenses: Your operating expenses such as overhead and administrative expenses will need to be calculated if you’re calculating the net profit margin or operating margin.

All this information is easily tracked in accounting software applications and can be obtained directly from your income statement. If you’re using a manual accounting system, you can access the information directly from your accounting ledgers.

Overview: What are margins in business accounting?

Margin refers to three different types of profit margins, which we’ll explore next. A margin always measures the difference between business revenue and varying business expenses. It should always be presented as a percentage. Depending on the type of margin you’re calculating, various expenses may be included or excluded from the calculation.

3 types of profit margin

There are three common profit margins that business owners calculate regularly. Each profit margin has advantages and disadvantages and can provide small business owners with basic product profitability to a more comprehensive view of company performance.

1. Gross profit margin

Gross profit margin measures revenue against the cost of goods sold. The object of the gross profit margin is to give you an idea of how profitable business operations are without including any other expenses. To calculate your gross profit margin, you’ll first have to calculate your gross revenue along with your cost of goods sold for the period which you’re calculating.

Gross profit margin is a key metric for investors and financial institutions as it only includes information about business operations, and not operating expenses. Gross profit margin is most helpful if calculated as a percentage.

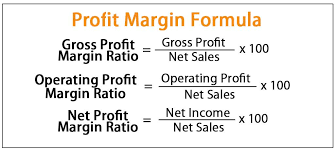

The gross profit margin formula is:

(Revenue - Cost of Goods Sold) ÷ Revenue x 100 = Gross Profit Margin %

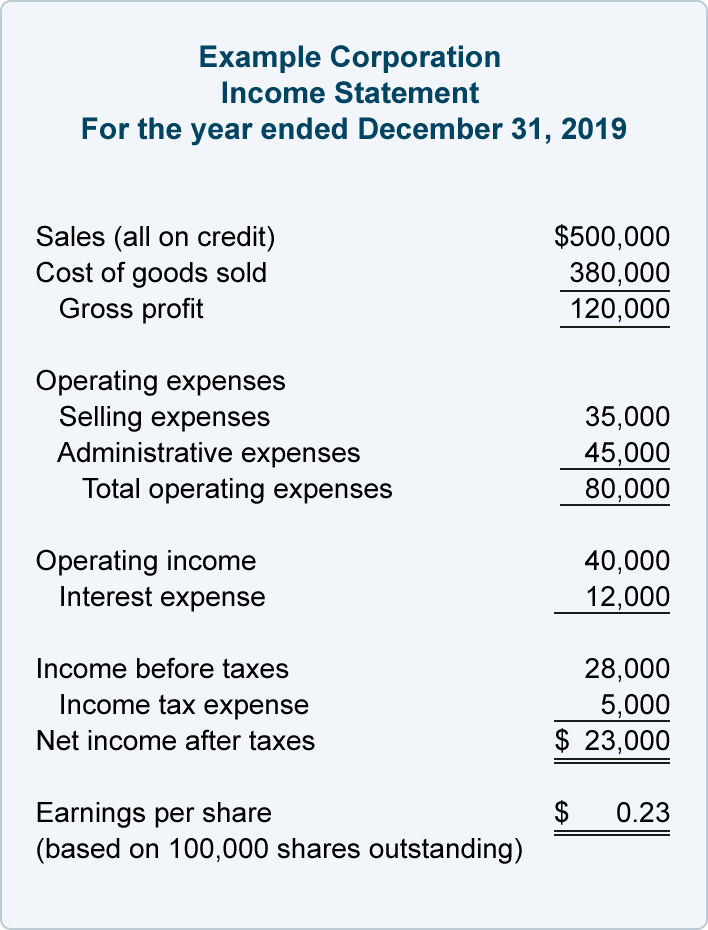

Using the income statement below, the gross profit margin would be:

($500,000 - $380,000) ÷ $500,000 x 100 = 24% Gross Profit Margin

2. Net profit margin

Net profit margin takes the calculation one step further than gross profit margin by including other expenses besides the cost of goods sold in the calculation. To calculate your net profit margin, you’ll first need to determine your total sales. Next, you’ll need to add together the following expenses:

- cost of goods sold

- operating expenses

- interest expense

- income tax expense

You can find all of these totals on an income statement, such as the one below.

Your income statement provides all the information you need to calculate your net profit margin. Image source: Author

Once you add these together, the total will need to be deducted from your total sales. This number will produce your net income, which is used to calculate your net profit margin.

Net Profit ÷ Revenue x 100 = Net Profit Margin

Using the numbers from the income statement, we’ll calculate net profit margin:

$23,000 ÷ $500,000 x 100 = 4.6% Net Profit Margin

3. Operating profit margin

Operating margin or operating profit margin measures the ratio of your business’s operating income to its return on sales. Unlike gross profit margin and net profit margin, which focus on business operations, operating profit margin focuses on indirect operating expenses such as administrative costs, salaries, and depreciation.

Operating income is calculated by taking the operating income found on your income statement and dividing it by your total revenue.

Operating Income ÷ Total Revenue = Operating Margin

Using the numbers from the income statement, we’ll calculate operating margin:

$40,000 ÷ $500,000 x 100 = 8% Operating Margin

In addition to these three frequently used margins, some businesses also calculate contribution margin, which measures the effect of variable expenses against sales totals.

3 benefits of understanding your margins

While the calculations are simple, the information they provide is not. There are several benefits that small business owners can derive from knowing their margins.

1. You’ll be able to pinpoint areas where your business is struggling

By running the three margin calculations discussed, you’ll be able to get a much better idea of where your business is thriving and where it may be struggling.

For example, if your gross margin ratio for one product is 50%, but only 21% on a second product, you may want to spend some time determining why one product is performing so much better than another. The same principle applies to net profit margin. If your net profit margin is too low, that can be a sign that you need to reduce expenses.

2. You’ll be able to set better pricing levels

It’s not always easy to set pricing levels. Sometimes, your price may be too high, resulting in slower sales. Other times, if you set your prices too low, you’ll end up losing money. Knowing your margins can help you when calculating markup, which in turn allows you to set more accurate pricing that will keep your business competitive.

3. You’ll know the overall health of your business

Margins can tell you and your investors a lot, such as whether your cost of goods sold is too high for your revenue totals, whether your operating expenses are eating into your profits, or whether business operations are successful overall. It can also be beneficial to compare your profit margins to similar businesses to see if you’re on target or struggling to remain profitable.

The profit margin formula is similar for each of the three most common profit margins that small businesses should calculate. Image source: Author

Limitations of the profit margin formula

Calculating profit margins is an important part of determining company performance, but it has limitations, including the following:

- Comparison limitations: If you’re looking to compare results across multiple companies, profit margin ratios are not the best tool, since the results should only be compared to like businesses. For example, if you own a software company, you should be comparing your results to other software companies, not to those of a big-box retailer.

- Data accuracy: The profit margin calculation is only as good as the numbers used to calculate it. This is particularly important if manual calculations are used to arrive at your profit margin. This issue can be resolved by using accounting software. While accounting software doesn’t eliminate the possibility of inaccurate data entry, it does eliminate issues such as transposed entries, erroneous calculation of totals, and even missed entries.

- Lack of details: While the results of your profit margin calculations can point to potential problems in your business, it’s up to you to determine exactly where the problem lies, and take the appropriate steps to address it.

Small business owners should always know their margin

Calculating your margins is an easy task, and you should calculate them regularly. Knowing what your margins are is essential if you’re looking for investors or are interested in obtaining a loan.

Knowing your margins can also help you pinpoint trouble areas in your business operations, let you know you need to get expenses under control, and can even help you set more accurate pricing for your products or services. With all of those advantages, why not start calculating your margins today?

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.