Trade receivables, also known as accounts receivable, represent the money your business is owed by customers to whom you’ve sold products or provided services. Trade receivables are considered a current asset and are listed as such on your balance sheet, as they’re expected to be paid in less than a year.

Overview: What are trade receivables?

Whether you sell flower pots or provide consulting services, if you sell to your clients on credit, you will have trade receivables. Trade receivables, more commonly known as accounts receivable, represents the money that you have billed a customer for goods sold or services provided during the normal course of business.

Trade receivables vs. nontrade receivables: What’s the difference?

Trade receivables are the amount owed to your business for goods sold or services provided. Once a customer has been invoiced but has not yet paid the invoice, the amount becomes a trade receivable.

Trade receivables are always part of the normal course of doing business. On the other hand, nontrade receivables represent money owed to your business that is not related to selling products or providing services. Nontrade receivables include:

- Salary advances made to employees

- Tax refunds

- Insurance claims

- Interest receivable

While these amounts are owed to your business, they are not part of the course of doing business.

How to reduce trade receivables

Should you worry about an accounts receivable increase? Probably. Your accounts receivable balance should remain fairly consistent as new invoices are created and current balances due are paid.

However, if your average or net trade receivables are increasing, you need to look at several different things including who you’re extending credit to and the credit processes that are currently in place.

Remember that offering credit terms to your customers is important. Unfortunately, even with careful planning, some of those accounts will end up delinquent no matter how careful you are.

But you can do things to reduce the number of delinquent accounts as well as ways to be more proactive in collecting past due balances.

1. Create a credit approval process

It’s easy to brush this important step aside, particularly if it’s someone you’ve done business with. But, make no exceptions. Every customer extended credit needs to complete a credit application that should be thoroughly examined. This process can help determine:

- How much credit to extend: The best option when extending credit to a new individual or business is to start with a lower credit limit, limiting your losses should the customer default on payment. If they pay regularly, you can increase the limit later.

- If a deposit is required: Many small businesses require a deposit upfront, not necessarily because the customer has poor credit, but because they operate on a very tight cash flow and can’t extend a great deal of credit upfront. If you’re hesitant to extend too much credit, the deposit option can be a good compromise.

- What payment terms should be: Anytime you extend credit, you should have credit terms assigned as well. Be as conservative as you can at the beginning, reserving net 30 or longer for your most reliable customers.

2. Prompt invoicing

Do you immediately invoice your customers or does it normally take at least a few days to prepare an invoice? One of the best ways to facilitate prompt payment from your customers is to invoice them immediately and accurately.

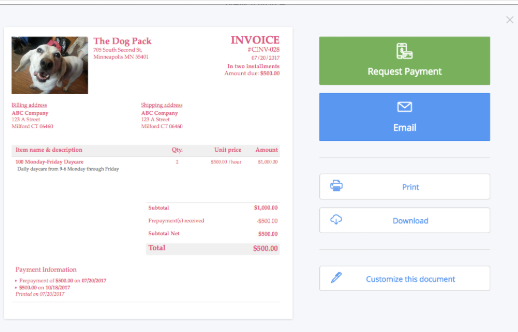

This sample invoice from OneUp allows you to request payment when emailing the invoice. Image source: Author

The most efficient way to prepare an invoice is to use accounting software, but even if you’re invoicing manually, you need to send the invoice promptly.

When invoicing, ensure that customer information such as mailing address and email address are correct and that the billing terms (see #1 above) are visible. If at all possible, invoice your customers electronically with a link to pay online.

3. Make it easy for customers to pay

The more payment options you provide your customers, the more likely they’ll pay their outstanding invoices sooner rather than later. Yes, some customers will only pay by check, but there are a lot more that would be happy to pay electronically.

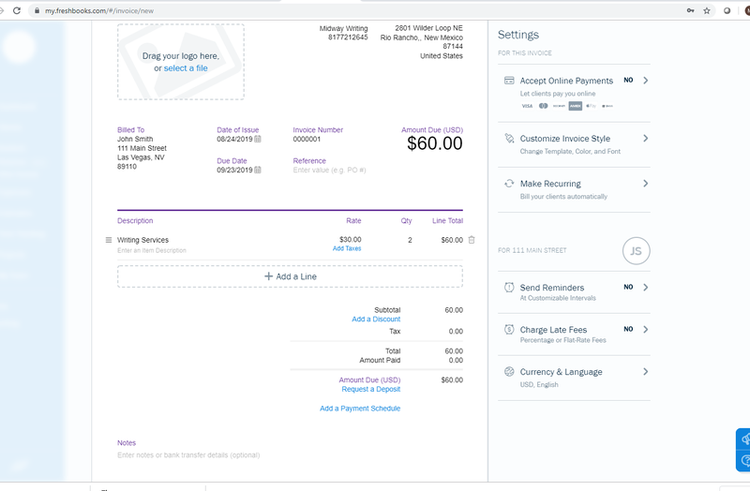

FreshBooks invoicing lets you accept online payments, send reminders, and charge late fees. Image source: Author

Providing a link to online payment options and accepting multiple credit cards will go a long way toward getting payment faster.

4. Be proactive with collections

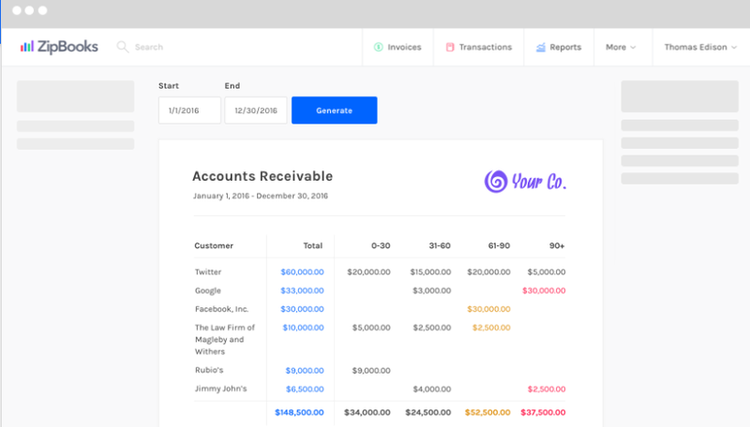

Establish a collections process and use it regularly. This includes running an accounts receivable aging report that provides detailed information on both current receivables and your total receivables, which includes any overdue accounts.

A good accounts receivable aging report provides details on all outstanding invoices. (Photo courtesy of ZipBooks) Image source: Author

Start the collection process early with a friendly reminder, which may be all that someone needs. However, you also need to establish a collection plan that can include follow-up invoicing, past due notices, or phone calls for those that don’t respond to your gentle reminder.

Whatever you plan, make sure that it’s implemented as soon as an invoice goes past due.

FAQs

-

Yes, they are. Both accounts receivable and trade receivables represent the amount of money for goods sold or services provided that have been invoiced but not yet paid. Both accounts receivable and trade receivables are considered current assets, as they are expected to be paid within one year.

-

The most important thing you can do should be done before you invoice your first customer: Create a credit approval process. This process starts with a proper screening of any customer that wishes to purchase something on credit. The credit approval process, if done properly, can accomplish the following:

- Ensure that you have the proper contact information

- Eliminate customers that are a credit risk

- Help assign the appropriate credit terms for each customer

Even careful screening will not eliminate bad debt entirely, but it should reduce your outstanding receivables balance considerably.

-

In a perfect world, your customers would all pay on time. In reality, it’s likely that you’ll have a few customers that need some additional coaxing.

Many accounting software applications offer reminders that are automatically emailed to any customers once their account becomes past due. However you contact them, it’s best to do so immediately after an invoice becomes delinquent.

-

No. Nontrade receivables, such as employee loans and advances, income tax refunds, and insurance claims are not invoiced.

Trade receivables are part of doing business

You have the choice to extend credit to select customers. While you can certainly run an all-cash business, it will be difficult to increase your customer base and your sales numbers if you don’t extend credit to customers.

If you extend credit terms, exercise due diligence before offering credit terms.

If you’re struggling with managing your customers and your trade receivables manually, consider upgrading to accounting software. Even the most basic applications on the market today offer easy invoicing and accounts receivable reporting.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.