Reimbursing expenses may seem fairly straightforward, but the process can quickly get into a lot of grey areas, resulting in late reimbursements and angry employees.

The best way to avoid disagreements is to establish an expense reimbursement policy that spells out exactly which business expenses are reimbursable and what employee and employer responsibilities are with regard to reimbursing expenses.

Of course, the easiest way to track business expenses is by using expense management software, which is useful for managing expenses and processing reimbursements. But even if your employees are still submitting bulky expense reports, creating a reimbursement policy can help standardize the entire process.

Overview: What are reimbursable expenses?

Reimbursable expenses are items or costs paid by an employee that are eligible for reimbursement. Not all expenses incurred by employees are reimbursable, which is why it’s helpful to clearly indicate in your policy which expenses are reimbursable and which are not.

When creating an expense reimbursement policy, it’s best to create what the IRS calls an accountable plan. An accountable plan must meet the following three conditions:

- There is a business connection: This condition means that the expense that is reimbursed has a direct connection to the performance of services. For example, if an employee purchases pens for the office, the expense is reimbursable, but if they purchase pens for their personal use, the expense should not be reimbursed.

- Substantiation: Substantiation means that the employee has evidence of the expense, whether in the form of time spent, a receipt for expenses, or other proof. Substantiation also requires that the employee present their documentation within a reasonable period of time.

- Return of excess amounts: For example, if you give your employee an advance payment of $200 for travel expenses and they do not spend the entire amount, they are required to return the excess to you in a reasonable amount of time.

If these three conditions are not met, any reimbursements given to your employees may be considered taxable income and will need to be tracked and reported accordingly.

Examples of reimbursable expenses

There is an unlimited number of employee business expenses that can be considered reimbursable in the course of business, but the following are examples that represent the most typical reimbursed expenses.

1. Travel and transportation expenses

Under IRS rules, the cost of work-related travel is considered a reimbursable expense. This can include flying anywhere for business purposes, driving to a nearby conference, renting a car, as well as other travel-related expenses, including the cost of a hotel room. Travel and transportation can also include the cost of traveling between a temporary location and a place of business.

A travel expense log can help your employees track all travel-related expenses. Image source: Author

For example, if you’re in Chicago for business, and your hotel is 12 miles from your temporary place of business, the cost of commuting between these two locations is considered reimbursable if you’re using your personal vehicle.

Remember when you’re creating a policy that you’ll need to specify that you’re using IRS mileage reimbursement rules and rates when reimbursing employees. You should also note that commuting costs are not reimbursable for everyday commuting, nor is mileage reimbursable if an employee is using a rental car paid for by the company.

If you’re using expense management software, you can easily enter all travel-related expenses into the application, or use a template like the one above.

2. Meals and entertainment

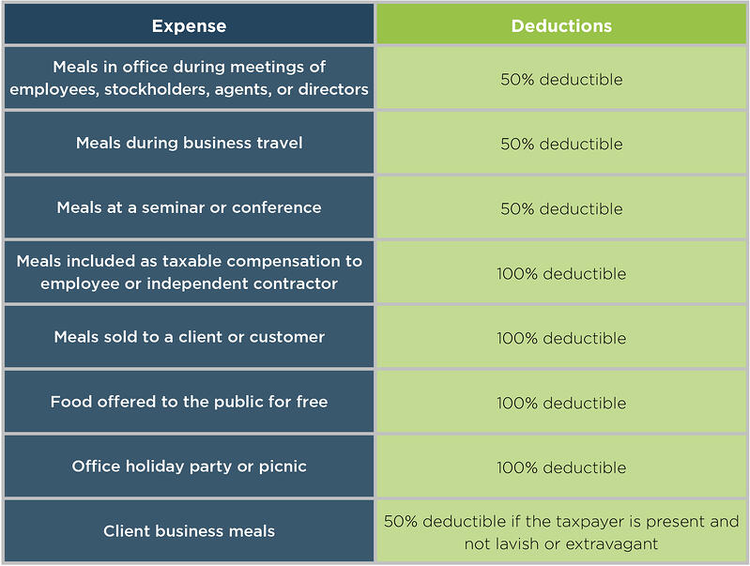

Meals and entertainment are 100% reimbursable to your employees, but they’re only 50% deductible as a business expense. Meals and entertainment can include per-diem amounts for meals while traveling, or the cost of having lunch or dinner with a client.

Even though meals are only 50% deductible for your business, their expense is still 100% reimbursable for employees. Image source: Author

3. Gifts

Any gift given as part of doing business can be considered reimbursable if paid for by an employee, but it’s important to remember that, as a business, you can only deduct up to $25 for each gift given.

4. Miscellaneous expenses

Miscellaneous expenses include anything your employee may purchase that is used exclusively in the business. For example, if you run out of copy paper and your employee stops at the office supply store to purchase some, they can be reimbursed for the cost of the paper since it’s used exclusively in the course of business.

If they purchased a bottle of water at the same time, the cost of the water would not be reimbursable.

How to create an expense reimbursement plan for your business

The best way to keep expenses in check and still make sure that your employees are promptly reimbursed is to create an expense reimbursement plan for your business. The plan serves as a guide for employees, letting them know what steps they need to take in order to be reimbursed for any eligible expenses.

But creating an expense reimbursement plan also helps you by establishing rules, setting boundaries, and potentially reducing employee disputes, while also ensuring that expenses are categorized properly. If you’re ready to create an expense reimbursement plan but aren’t sure where to start, check out the suggestions below.

1. Create an expense management policy

Before you create a reimbursement policy, consider creating an expense management policy first. Establishing expense management best practices for your business can provide clarity for your employees and prevent future disagreements about what is and isn’t reimbursable.

Your expense management policy should also provide instructions on how employees should process expense reports, detailing what needs to be included and when a report should be submitted.

2. Make sure it’s accountable

Before creating your expense reimbursement plan, make sure it’s accountable according to IRS rules. This means that all reimbursable expenses have a direct connection to the business, that the employee can substantiate the expense properly in the appropriate amount of time, and that any excess funds advanced to an employee are promptly returned.

Creating an accountable reimbursement plan keeps you in compliance with IRS guidelines and also helps employees know from the start which expenses are reimbursable.

3. Determine which expenses are reimbursable

Create a list of which expenses are reimbursable and which ones aren’t. Employees can then refer to the list when deciding whether to submit a reimbursement request. For example, airfare, rental car costs, or any public transportation that is used for business purposes is usually reimbursable.

| Reimbursable Expenses | Non-Reimbursable Expenses |

|---|---|

| Airfare | Personal entertainment |

| Rental car | Alcoholic beverages |

| Mileage | Lost items |

| Meals and entertainment | Parking tickets or other fines |

| Gifts | Family/spouse travel |

| Hotel | Non-business related purchases |

| Other business expenses | Local commuting |

4. Specify needed documentation

Any time that your employees submit expenses, whether reimbursable or not, they need to provide substantiation of the expense. As the business owner, it’s up to you to determine what type of documentation is needed.

For example, some businesses do not require a receipt or other documentation for expenses of less than $25, while other businesses require documentation for any expense, regardless of the cost. It’s up to you to decide what works for your company and then put it in writing to eliminate any future issues.

5. Provide submission deadlines

Setting a deadline for submitting expenses is also one of the parameters you should establish in your expense reimbursement plan. Again, when setting a deadline, whether it’s 30 days after the expense occurs or later, it needs to be in writing.

6. Determine the mode of reimbursement

Your expense reimbursement policy should also detail how your employees will be reimbursed. Will reimbursements be paid through payroll, submitted to accounts payable, or deposited immediately into your employee’s bank account via ACH or direct deposit? Decide which option works best for your business, and specify the reimbursement mode in your policy.

Reimbursing expenses doesn’t have to be complicated

Taking a few hours to create an expense reimbursement policy for your business can be extremely helpful for you and your employees. Having a policy in place can eliminate unnecessary reimbursement requests and make sure that employees submit their requests with the proper documentation included.

Your policy can be as simple or as complex as you desire, so why not get started creating your expense reimbursement policy today?

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.