In one of the classic episodes of the hit sitcom "The Office," the following exchange takes place:

David Wallace: Got your per diem?

Michael: I have my per diem. I already know what I am going to spend this on. I am going to buy a sweater.

David Wallace: Michael, that’s for your food.

Michael: Well I’ll just, I’ll use different money for that.

Michael’s gaffe is forgivable -- per diem isn’t even an English phrase. In this article, we’ll go over what per diem means, when to issue it to your employees, and how to expense it for the IRS.

Overview: What does per diem mean?

Per diem is a Latin phrase that translates to per day in English. In the business sense, per diem is how a business reimburses employees for operating expenses related to travel.

Unlike most expenses, the IRS sets a limit for the per diem amount you can expense on your business’s tax return. That amount varies by geographical location.

How does per diem reimbursement work?

There are two ways to calculate per diem costs: the first is to simply add a travel day per diem line onto the employee’s paycheck and the second (the option that Dunder Mifflin employed in "The Office") is to give the employee cash to be used when traveling.

Note that per diem cannot be paid to anyone who owns greater than 10% of the business.

If you choose the first option, employees will spend their own cash and then be reimbursed on their next paycheck. Your payroll software should have an option to input per diem amounts during the payroll process.

How does per diem work for travel rates?

Each year the government determines an amount for travel day per diem in two categories: lodging and meals.

These amounts vary by geographical location and take the local cost of living into account. You can search by state on this website, which is maintained by the U.S. General Services Administration (GSA).

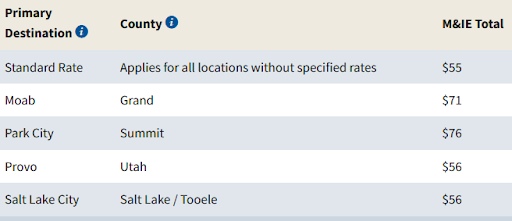

See the below graphic for an example of what you will find on the website for the meals and incidental expense (M&IE) per diem in my state, Utah.

The meals and incidental total allowed per day varies by local cost of living. Image source: Author

If one of your employees was traveling to Park City for a conference and you planned to give them per diem during their stay, you would search Utah on the GSA website and multiply the federal per diem rates by the number of days.

The graphic above shows the meals per diem. You can also find the per diem rates for lodging on the GSA website.

You can also only provide one of the two. If your employee is attending a conference that provides all meals, you can provide lodging only. You could also pay for lodging separately and provide only the M&IE per diem.

Per diem vs. business credit cards

An alternative to per diem is to simply issue a business credit card to the employee for travel expenses. Each method has pros and cons.

With a business credit card, you must trust the employee to use it properly. You could have them use their own card and reimburse them based on receipts.

To expense credit card costs, the employee must save all receipts and even then only 50% of the amount spent on meals and entertainment can be written off on taxes. The IRS is intense in its travel expenses audits. The benefit is you only pay for the amount spent -- per diem rates are often higher than what is spent.

Per diem laws allow you to simply issue cash to employees and let them decide how to spend it.

Some employees prefer per diem because there are no payroll deductions or taxes taken out of it. The IRS per diem rules require any amount over the ceiling rate to be taxed and employees must track the expenses that per diem is used for.

While the GSA sets a ceiling for per diem rates, no such floor amount regulations exist. You can choose to offer employees less than the normal per diem rate if you’re concerned about keeping travel costs low.

What is the per diem high-low method?

You can use the IRS’s high-low method for per diem instead of looking up rates for each area your employees go to. The high-low method has two rates, one for locations on its list of high cost areas and a lower rate for anywhere else.

If you use this method, you must use it for the full calendar year, and there is no easy way to find the current rates and locations other than searching the IRS Website each year for the most recent per diem notice.

Carpe per diem

Now that you know the pros and cons of using per diem, you’re one step closer to learning all the intricacies of how to do payroll. Don’t be afraid to use different methods for different employees and know that no matter what, you can account for travel expenses effectively if your business needs to.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.