In a world where we’ve sent people to the moon and self-driving cars exist, I wonder why I’ve never had a printer that consistently works. They disconnect from their networks, run out of cyan before black, or chew up my paper.

If you’re ready to ditch paper in the payroll process, we’ll show you how.

Overview: What is paperless payroll?

Paperless payroll implies that your payroll system, from collecting and processing tax documents to running payroll, requires no paper documents. All payroll records live in the digital ether, whether in your payroll software or electronic document management system.

Businesses that implement paperless payroll don’t cut physical payroll checks. Employees receive their wages and variable payments by electronic funds transfer (EFT), moving money from your company’s accounts to employees’ accounts without writing a physical check. Direct deposit is a popular type of EFT for payroll.

The only tool you need to implement paperless payroll is payroll software. Aside from delivering employee paperless paychecks, this software automatically generates and stores digital payroll records.

Paperless payroll doesn’t preclude you from printing documents when necessary; instead, all payroll documents are generated, tracked, and stored electronically.

Sometimes, paper is unavoidable in the payroll process. For example, an employee without a bank account can’t collect wages by direct deposit, so a paper check is the next best option. Another employee may prefer to receive a printed Form W-2 to hand to her tax preparer.

Types of paperless payroll

Taking paper out of payroll means digitizing paychecks, employee pay stubs, and payroll records.

Paychecks: Electronic funds transfer (EFT)

On the 15th and last day of each month, money magically arrives in my bank account. The specific strain of magic is called direct deposit, a type of EFT. Paperless payroll implies that employees are paid without a physical check, necessitating an EFT.

Direct deposit is a transaction where a network -- called an automated clearing house (ACH) -- pulls money from your business bank account and places it into your employees’ accounts. All digital payroll solutions use direct deposit.

Few states allow business owners to require direct deposit for employees with bank accounts. Check your state’s labor department website to see if that’s an option for your business. Other states must provide paper checks to employees.

You’re required to provide another means to pay employees without bank accounts, no matter the state. It’s best to keep a stack of pre-printed paycheck stock at your office in case you need to pay an employee by paper check, even if you live in a state where you’re allowed to require direct deposit.

Pay stubs and timesheets: Employee self-service (ESS) software

If you do payroll manually, you start by collecting employees’ paper timesheets. Employees then receive physical payroll checks with pay stubs that show the taxes and other deductions from the paycheck. Without a physical check, where’s a lonely pay stub to go? To an online portal.

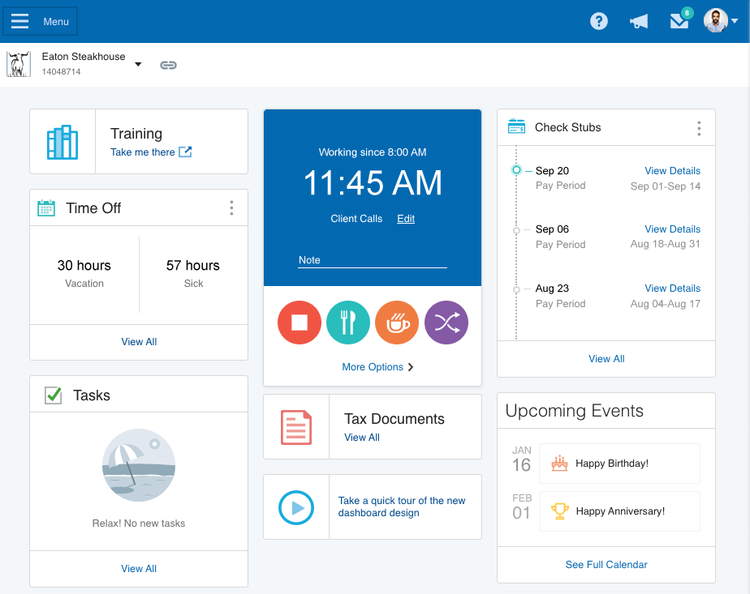

You’re likely familiar with the employer side of payroll software. To go 100% paperless, you need an employee payroll portal, formally called an employee self-service (ESS) model, where employees can submit timesheets and view paperless paycheck stubs and tax forms.

Employee self-service (ESS) portals are home to digital timesheets and pay stubs. Image source: Author

Depending on the software and features you enable, the site can operate more like a one-stop-shop human resources hub that allows employees to request time off and update their personal information. Most payroll solutions come with employee portals, some better than others.

State law might require you to make paper pay stubs available to employees. Again, your state labor department website can tell you more.

Payroll records

Paperless payroll systems make file cabinets obsolete. For most small businesses, all payroll records are generated and stored in your payroll software’s secure document management system. Government agencies dictate how long to keep payroll records.

As a backup, you’ll want to save your payroll records periodically within your company’s electronic document management system. If you’re the only one who needs access to the files, you can get away with storing payroll records in Dropbox or Google Drive, provided you have the strictest security settings enabled.

Payroll records contain sensitive personal information, such as Social Security numbers (SSNs), and should be closely guarded. Develop an incident response plan to help you respond quickly if your records are compromised.

The 3 benefits of paperless payroll

You’ll be happy you switched to a paperless payroll system for these three reasons.

1. You can get rid of your file cabinets

Maybe your file cabinets can hold your coat or a plant, but whatever you do with them, they won’t be needed anymore when you move to paperless payroll.

You’re required to retain payroll records for years after they’re produced, and that once meant guarding years of paper payroll registers under lock and key. No longer. Years’ worth of digital documents can fit in a hard drive the size of a fingernail, or you can use a cloud storage solution.

Paper documents are prone to getting misplaced and lost. Your payroll software can securely hold your payroll records, organizing them in a way you and your tax preparer can easily navigate.

2. It streamlines accounting for payroll

Taking payroll digital will lighten your bookkeeping workload.

Payroll software can integrate with your accounting software to automatically record payroll journal entries. The more automation you can bring into your bookkeeping, the better. Automated journal entries make it less likely you'll make a transposition error that causes discrepancies between your bank statement and accounting records.

3. It’s green

Mother Nature and the forests will thank you for not printing dozens of documents every time you do payroll. You're not only saving money by printing less, but you’re also protecting the environment.

4. Employees get paid faster with direct deposit

Direct deposit transactions usually post to employees’ bank accounts faster than paper checks, meaning employees’ wages are available earlier.

Direct deposit is a win-win for employees and employers since it reduces the number of checks outstanding at the end of the month. Having fewer outstanding checks simplifies monthly bank reconciliations, saving you time and headaches.

Next stop: Fully paperless

Once you’ve gotten your paperless payroll set up, you’re ready for the next step: taking your whole business paperless. If paperless payroll can save you time and money, think about what an entirely paperless company looks like. Check out our small business guide to going paperless.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.